Bitcoin and Gold Outlook 2026: Warsh, Rieder Gain Traction in Trump’s Fed Pick

Highlights

- Polymarket traders are betting on Kevin Warsh or Rick Rieder becoming Federal Reserve Chair

- Bitcoin price has formed a bearish flag pattern, pointing to a retreat

- Gold price has become highly overbought, pointing to a reversal.

Bitcoin and gold prices have diverged this year as demand for the latter has soared. BTC erased all the gains made earlier this year, while gold hit the key resistance level at $5,000. This article explores what to expect now that the prediction market is favoring Kevin Warsh and Rick Rieder as the next Federal Reserve pick.

Kevin Warsh Takes the Lead as Rick Rieder Surges

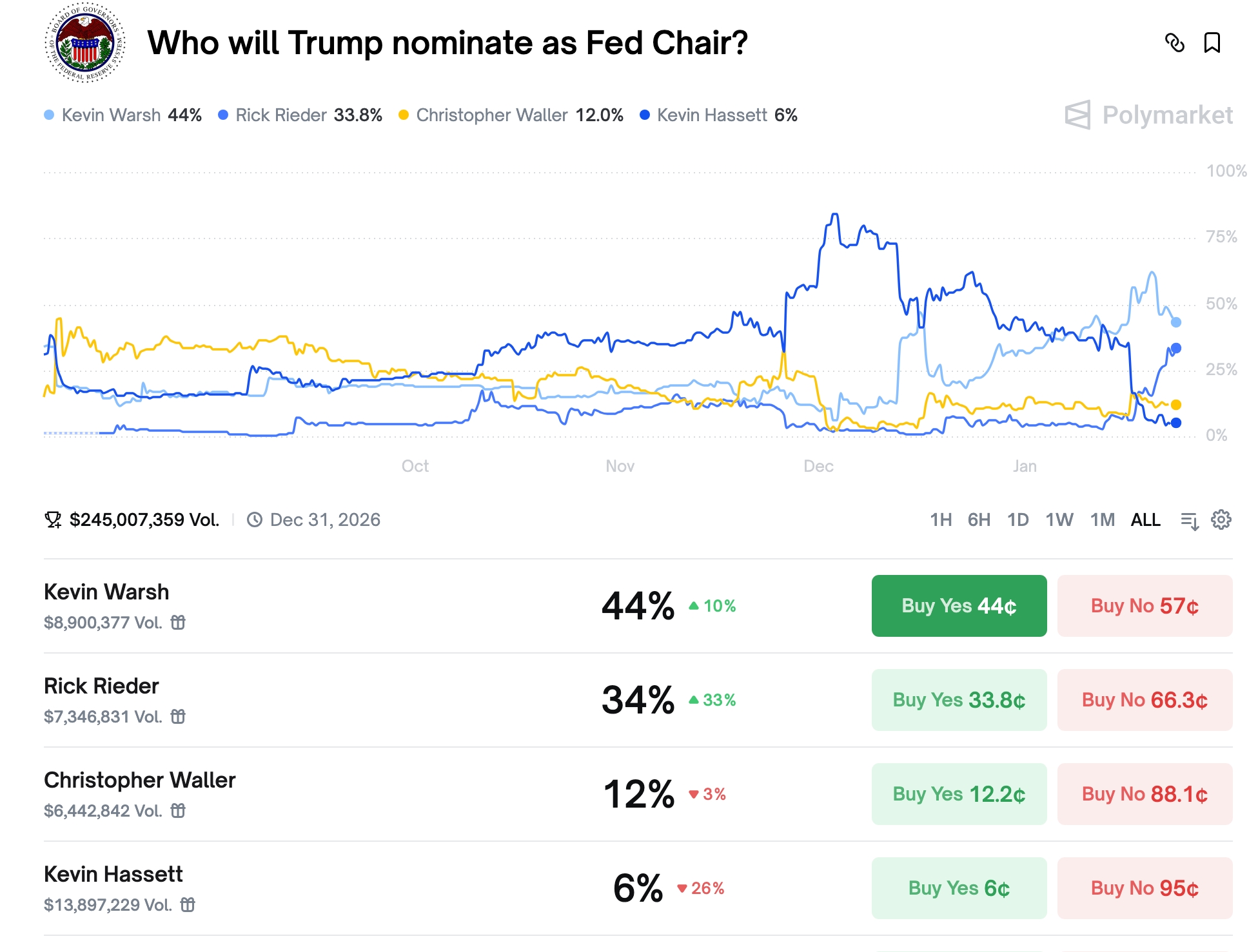

The prediction market is betting that Kevin Warsh will become the next Federal Reserve Chairman. Polymarket data shows that Warsh is the favorite among traders with a 44% share. His odds rose by 10 points in the last 24 hours.

On the other hand, Rick Rieder, a senior BlackRock official, has a 34% chance, a figure that has jumped by 33%. According to CNN, Donald Trump and the officials interviewing him were impressed with his performance.

Kevin Hassett, who was the leading contender a few weeks ago, has a 6% chance of becoming Federal Reserve Chair. His odds dropped because Trump wants him to stay at the White House.

The new developments come as the Federal Reserve prepares to deliver its first interest rate decision of the year on Wednesday next week. Economists polled by Reuters expect the bank will leave interest rates unchanged between 3.50% and 3.75%. This meeting will set the tone for what to expect later this year.

However, the upcoming guidance may change because of the upcoming Fed changes. For example, the Supreme Court may rule in favor of Trump’s decision to fire Lisa Cook, a move that would open a new position for Trump to fill. Also, there is a likelihood that Jerome Powell will exit the Fed after his term as the chairman ends, opening another position for Trump to fill.

Bitcoin Price Outlook: A Risky Pattern Has Formed

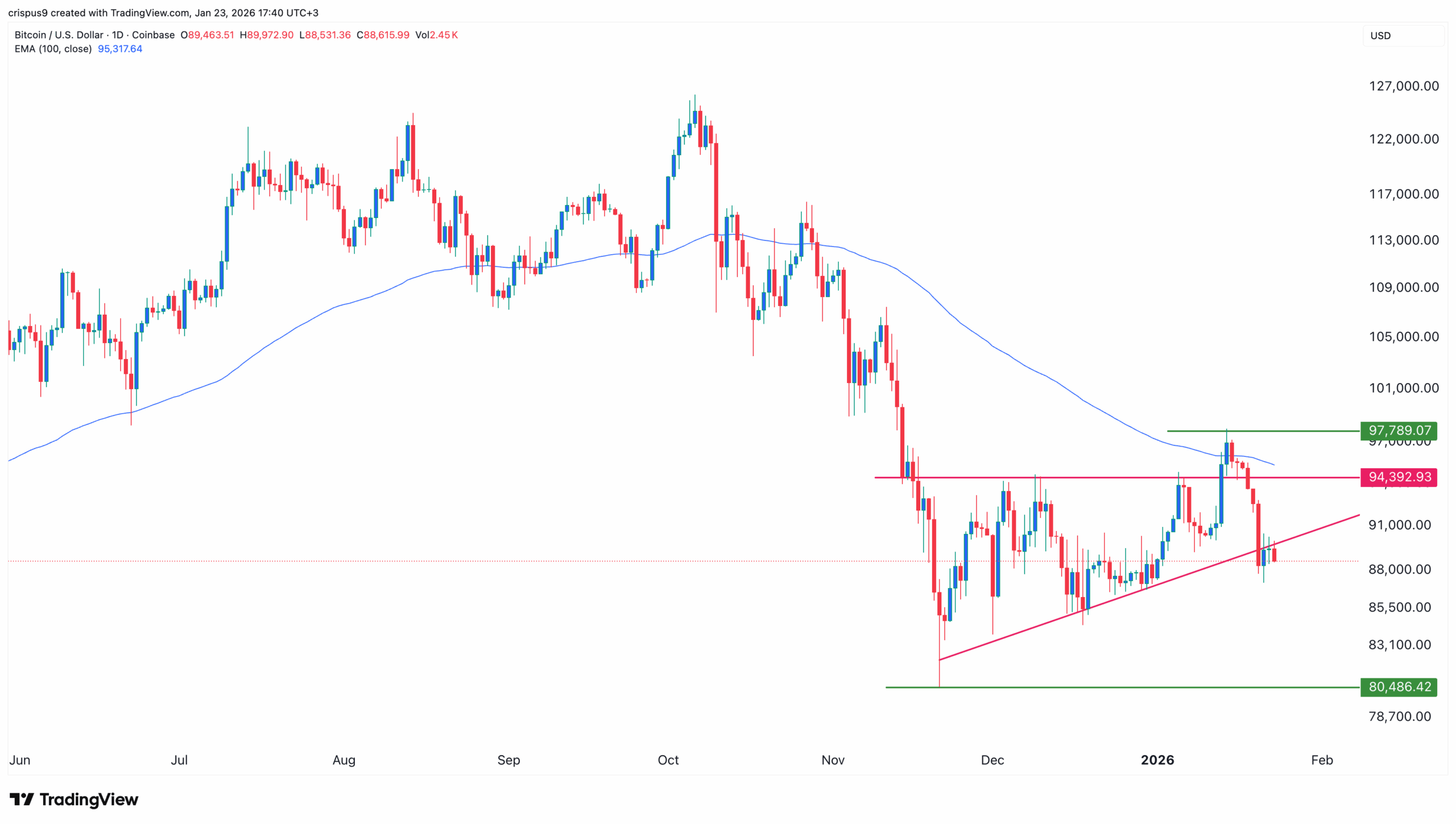

The daily timeframe chart shows that Bitcoin price may be on the verge of a strong bearish breakdown in the coming weeks. It has formed a bearish flag pattern, which is made up of a vertical line and some consolidation that resembles a hoisted flag.

Bitcoin has also remained below the 50-day and 100-day Exponential Moving Averages (EMA) and the Supertrend indicator. Therefore, the most likely BTC price long-term forecast is bearish, with the next key target level to watch being at $80,480.

Gold Price Outlook: It Has Become Overbought

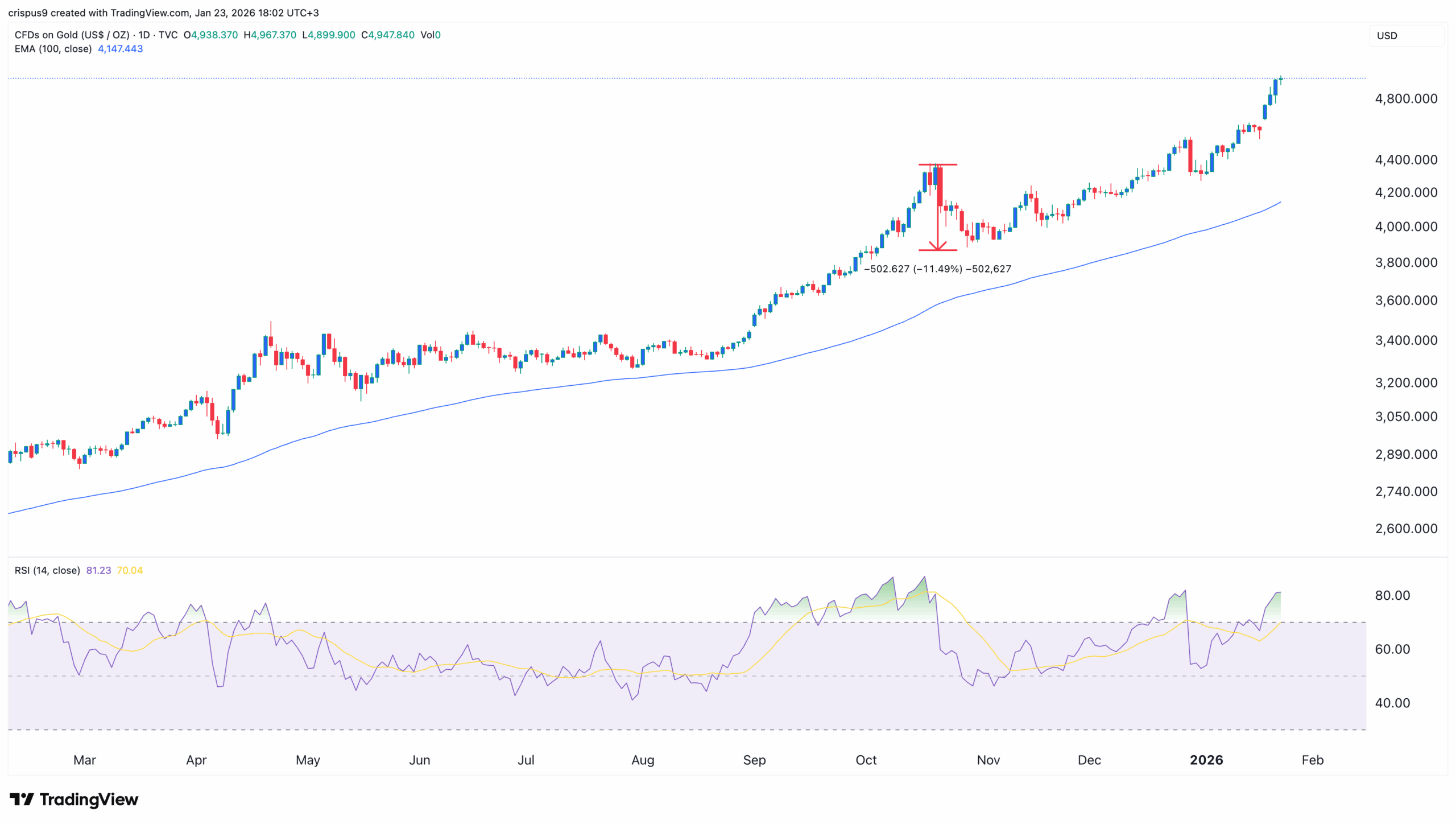

Gold price has been in a strong rally this year, and analysts at Goldman Sachs believe that it has more gains, potentially to $5,400 to go. The analysts cited the potentially dovish Federal Reserve and the accumulation from global central banks.

However, technical analysis suggests that gold may be ripe for a bearish breakdown in the near term. For one, the Relative Strength Index has moved to the extreme overbought level at 81. The last time the RSI moved to the overbought level was in October, and the metal dropped by 11% after that.

Gold also remains much higher than the 100-day and 50-day moving averages, meaning that it may experience a mean reversion, a situation where an asset drops and moves close to the historical averages.

Therefore, there is a risk that gold will drop to the key support level at $4,500 in the near term.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

Frequently Asked Questions (FAQs)

1. What is the most likely Bitcoin price forecast?

2. What is the most likely gold price prediction?

3. Who will Trump appoint to be Federal Reserve Chair?

- Bitcoin Price Still Risks Decline If Iran War Mirrors Ukraine War Market Reaction, JPMorgan Warns

- Bitget Unveils Upgrade For Stock, Gold Trading Alongside Crypto As Part Of Universal Exchange Push

- ChangeNOW Is Settling Crypto Swaps in Under a Minute.

- $3B Western Union Expands Into Crypto With USDPT Stablecoin Launch on Solana

- XRP News: Key Ripple Whale Indicator Turns Bullish After Months, Price Rally Ahead?

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

Buy $GGs

Buy $GGs