Bitcoin and XRP Price At Risk As US Govt. Shutdown Odds Reach 73%

Highlights

- Bitcoin and XRP prices are at risk as US government shutdown odds rise on Polymarket.

- Democrats have threatened not to provide votes for the upcoming Federal government funding bill.

- The two coins have formed several bearish chart patterns on the weekly chart.

Bitcoin and XRP prices remained under pressure today, January 25, as investors anticipated a busy week ahead, with the Federal Reserve expect to deliver its interest rate decision, the odds of a government shutdown rising, and trade war risks remaining at an elevated level. Bitcoin price was trading at $88,600 on Sunday, while XRP was at $1.89.

Government Shutdown Odds Rises as Trade Risks Rise Ahead of Federal Reserve Interest Rate Decision

Bitcoin and XRP prices wavered as investors remained concerned about multiple risks, which explains why the Crypto Fear and Greed Index has moved to the fear zone.

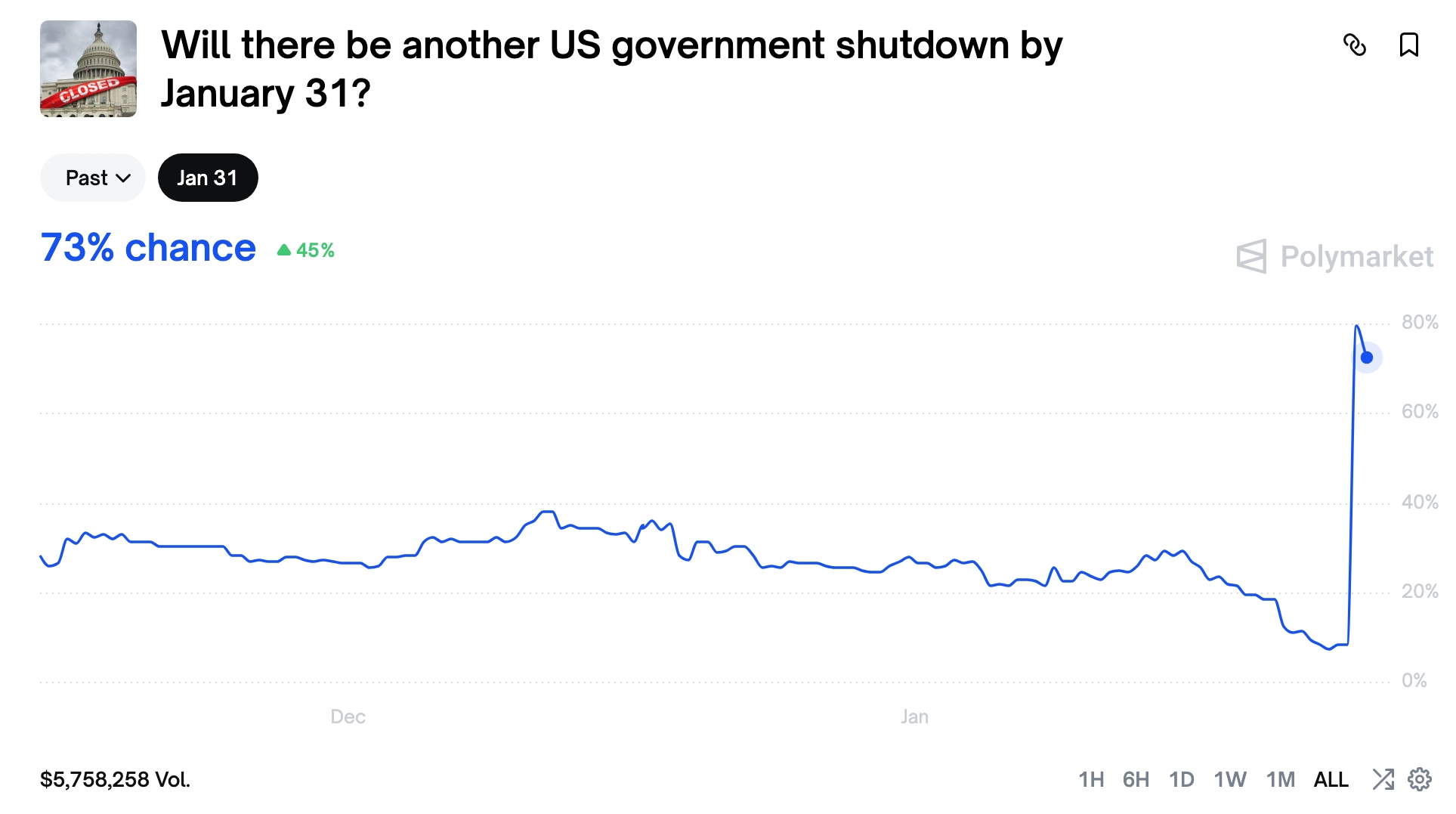

Data compiled by Polymarket shows that the odds of a government shutdown happening soon have jumped to 73% from a low of 8% this month. These odds jumped after Senator Chuck Schumer warned that Democrats would oppose a government funding bill that funds Homeland Security after a fatal shooting in Minneapolis.

Such a government shutdown would be the second one in the last 52 weeks. The US experienced the longest shutdown last year as Democrats opposed the cuts in Obamacare subsidies. This shutdown lasted from late September to November.

Meanwhile, there is a renewed risk that the United States and Canada will get into a trade war that will affect goods and services worth over $600 billion. In a statement, Donald Trump warned that he would impose a 100% tariff on goods coming from Canada.

Trump was reacting to a speech that Mark Carney delivered at the World Economic Forum event in Davos last week in which he indirectly criticized Trump. This speech came after Canada reached a deal with China. Chinese EVs will now receive a 6% tariff for all vehicles sent to Canada.

The Federal Reserve will also deliver its interest rate decision on Wednesday. Economists expect that the bank will leave rates unchanged between 3.50% and 3.75%. However, there is a risk that the bank will deliver a hawkish pause after the recent strong US GDP data.

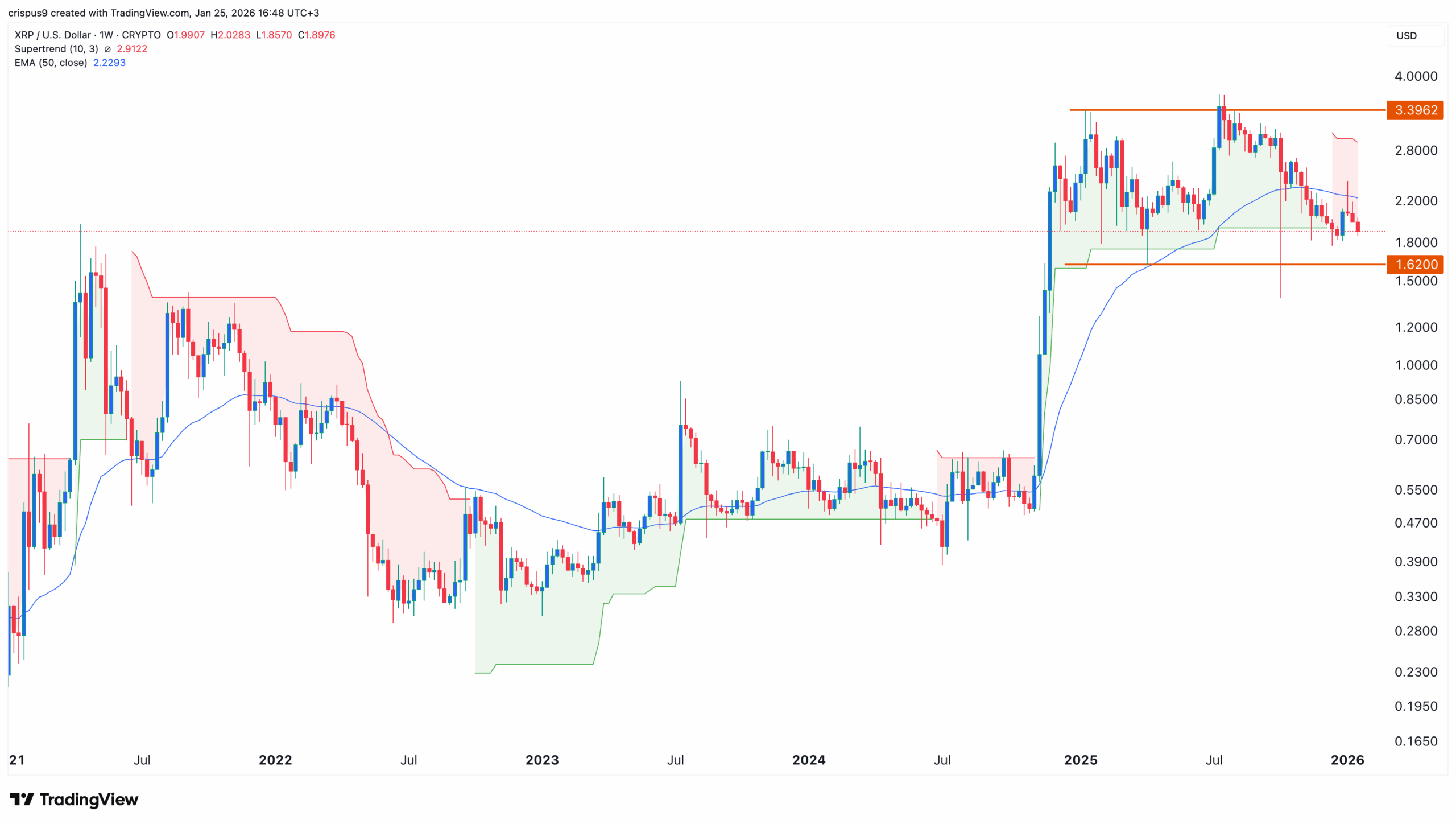

XRP Price Technical Analysis

Technical analysis suggests the XRP price could be at risk of a deep dive in the coming weeks. It formed a double-top pattern at $3.3962 and a neckline at $1.62. It has dropped below the 50-week Exponential Moving Average (EMA) and moved below the Supertrend indicator.

Most oscillators, like the Relative Strength Index (RSI) and the MACD, have continued moving downwards. Therefore, there is a risk that the token will have a bearish breakdown, potentially to the neckline at $1.62, followed by the October low of $1.355.

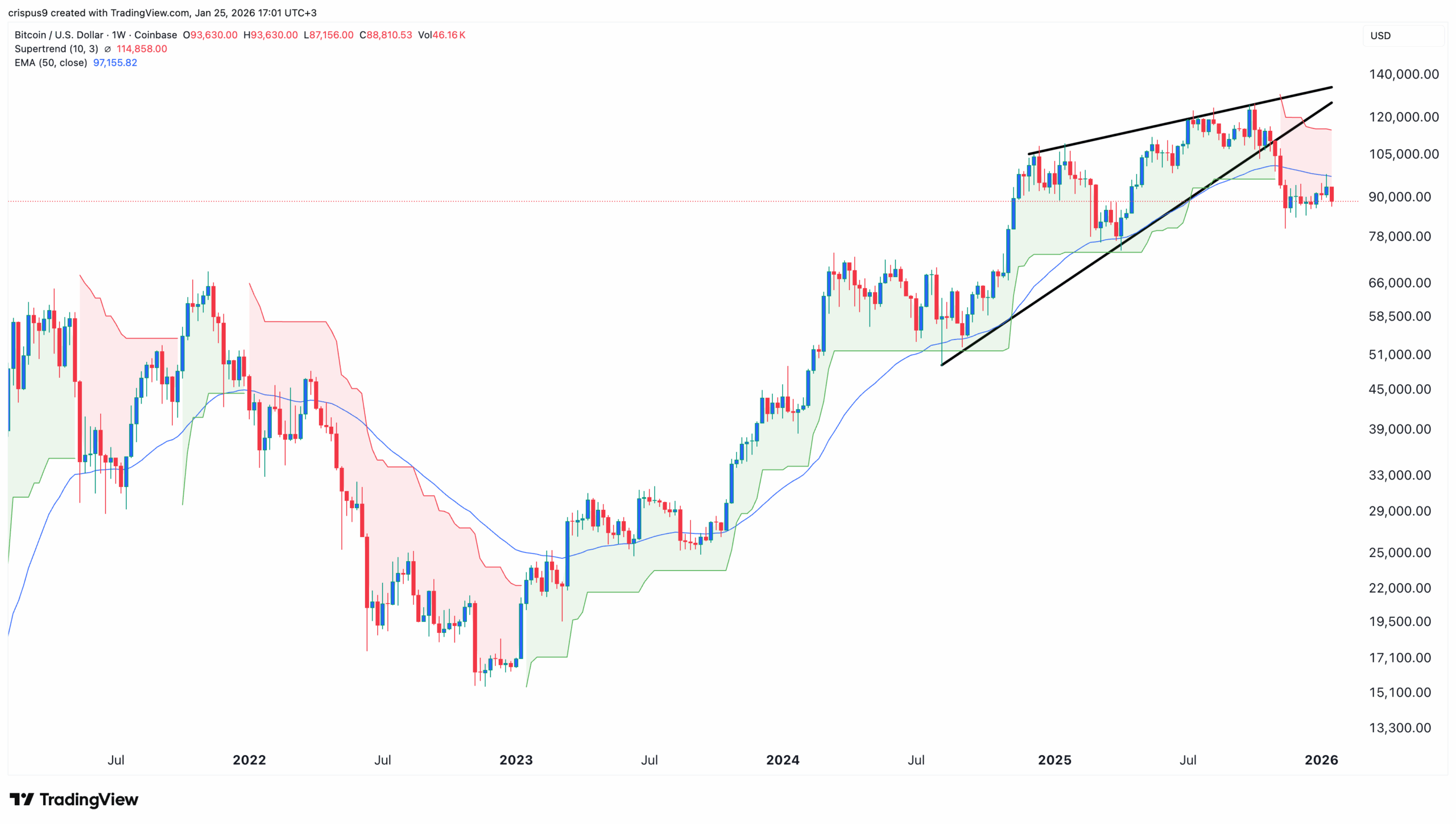

Bitcoin Price Technical Analysis as Risky Patterns Form

The most likely BTC price forecast is bearish because it has formed several risky chart patterns. It has moved below the Supertrend indicator, a sign that bears have prevailed. It also moved below the 50-week Exponential Moving Average.

The coin has also formed a rising wedge and bearish pennant patterns. These patterns mean that it will likely drop to $80,000 and below in the coming weeks.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

Frequently Asked Questions (FAQs)

1. What is the most likely XRP price prediction?

2. What is the most likely Bitcoin price forecast?

3. Why are the government shutdown risks rising?

- Analyst Predicts Bitcoin Price Dip to $55K as ETFs See Outflows Amid Middle East Tensions

- Ethereum Co-founder Sparks $157M Sell-Off Fears as ETH Struggles Below $2k

- Analyst Predicts XRP Price Could Fall to $1 as XRP ETFs Record Net Weekly Outflows

- U.S.-Iran War: Trump Threatens to Hit Iran ‘Very Hard’ Today as Bitcoin Faces New Selling Pressure

- Crypto Market Weekly Recap: US-Iran War Steer Crypto Prices, Kraken Gets Fed Master Account, Tokenization Push March 2-6

- Dogecoin, Pepe coin, and Shiba Inu Price Prediction As BTC Crashes Below $70k

- Here’s Why Cardano Price Has Not Reclaimed $0.30

- Will XRP Price Crash as U.S. Nonfarm Payrolls Fell by 92,000 in February?

- Pi Network Price Eyes a 40% Surge as Pi Day Looms on March 14

- Top Reasons Why Circle Stock Price is Surging

- Gold Price Prediction as US-Iran War Hits the Second Week

Buy $GGs

Buy $GGs