Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

Highlights

- Clarity Act deadline may reshape crypto regulations impacting Bitcoin prices.

- XRP has key support at lower trendline to possible growth.

- Bitcoin eyes at $70,000 with the possibility of a further upward surge.

The White House indicated fresh momentum in talks over stablecoin reward rules during a private meeting with banking and crypto executives.

The hearing was held on Thursday, and it was the third hearing connected with the Senate Digital Asset Market Clarity Act.

The bill is aimed at establishing better regulatory boundaries around the fast-developing United States cryptocurrency industry.

The price of digital assets moved slightly upward because the investors responded with caution towards the indications of the potential legislative advancements. Bitcoin traded above $67K, maintaining a narrow range that has defined recent sessions.

Ether held above $1950, reflecting modest but steady demand. XRP hovered near o$1.41, sitting along the lower boundary of its trendline support. The broader crypto market gained roughly 0.33% over the past 24 hours. Traders remain alert as policymakers work against a fast approaching legislative deadline.

White House Sets March 1st Deadline

The administration has targeted March first as the date to settle disagreements surrounding stablecoin yield provisions.

The controversy revolves around the possibility of stablecoin issuers to render interest style incentives to the holders of tokens.

The banking officials claim that these payments are like the conventional deposits, and they need more federal regulation.

Digital payments are seen to drive innovation and competition; crypto industry leaders argue reward programs support them both.

The Clarity Act was passed by the House in July 2025; however, the Senate still awaits approval.

The lawmakers have found it difficult to strike a balance on the way to treat stablecoin products in the current financial regulations.

The respondents reported the most recent meeting to be a positive one, yet the discussions continue.

Coinbase Chief Legal officer Paul Grewal reported having a healthy and cooperative discussion. He indicated that stakeholders are striving to have well-balanced rules that cannot choke growth on consumers.

As time runs out, markets are keenly watching what is happening in Washington as indications of regulatory certainty.

White House officials indicated that the current battle on stablecoin rewards may have gained ground in their latest closed-door meeting with banking and crypto industry executives.

The event, which took place on Thursday, was the third among a series of discussions that are associated with the Senate Digital Asset Market Clarity Act, a significant bill that is supposed to establish more explicit regulations of the U.S. crypto market.

Bitcoin and XRP Price Prediction: Key Levels To Watch

Recently, Bitcoin and XRP prices have been recording impressive gains. BTC price rose by 0.86% to $67,732.

If the future Bitcoin outlook remains above $67,700, it could target the $70,000 resistance. However, any break below this level might lead to a retest of the $65,000 low.

Meanwhile, XRP has shown impressive performance, trading at $1.41 with a 6% surge this week, despite minor consolidation.

The cryptocurrency is now testing critical support areas and can keep its bullish run provided that the lower trendline prevails. Breakout of this trendline may move the XRP to the $1.50, but a slip may take the price down to the support of $1.30.

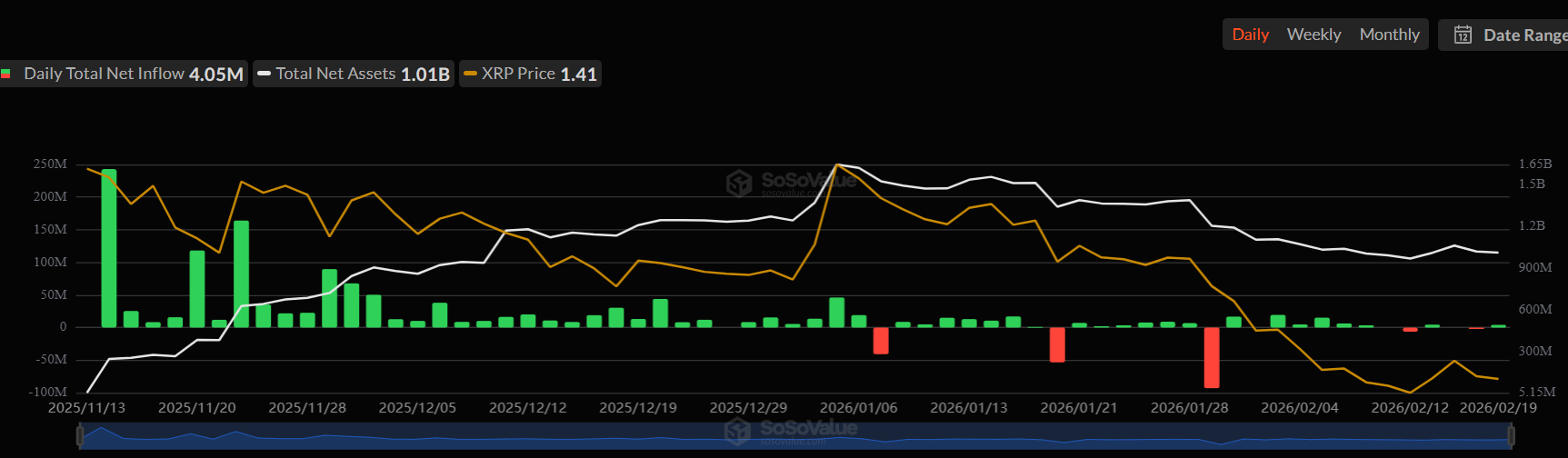

XRP is also experiencing positive inflows, with daily net inflow of totaling $4.05 million. Conversely, Bitcoin ETFs posted a net outflow of 166 million on February 19, the third consecutive day of declines.

Grok (GROK) has improved by 0.5% to a value of $0.0004734. Analysts forecast that the price will likely range between $0.00047 to $0.00048 and have a potential high of around $0.0005 if bullsh countinues. The price of Grok may increase above $0.00050 in case of the bullish momentum.

In conclusion, the March 1 date of the Clarity Act may have significant implications on Bitcoin and XRP. Investors are hoping to receive clarity regarding the regulations of stablecoins.

Frequently Asked Questions (FAQs)

1. How will the Clarity Act affect Bitcoin?

2. What is the March 1 deadline for?

- Bitcoin Price Today As Bulls Defend $65K–$66K Zone Amid Geopolitics and Tariffs Tensions

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- Crypto Market Rises as U.S. and Iran Reach Key Agreement On Nuclear Talks

- Trump Tariffs: U.S. Raises Global Tariff Rate To 15% Following Supreme Court Ruling

- Bitwise CIO Names BTC, ETH, SOL, and LINK as ‘Mount Rushmore’ of Crypto Amid Market Weakness

- Pi Network Price Prediction: How High Can Pi Coin Go?

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act