Bitcoin, Ethereum Price Prediction- Bullish Reversal In Market Leaders Pushed Altcoins Higher

Bitcoin, Ethereum price prediction: the BTC and ETH price bullish reversal climbs higher, keeping an early bullish sentiment in the crypto market. Moreover, the global crypto market at 10:55 am EST Tuesday stands at 850.04B, with a hike of 1.77% since yesterday.

However, the total crypto market volume has depreciated 20.32% to $65.87 Billion in the last 24 hours. Currently, the total volume in DeFi stands at $3.94 Billion, which adds up to 5.98%3 of the total crypto market 24-hour volume.

Top Gainers and Losers

The largest gainer among the top 100 cryptocurrencies is Stacks(STX) at $0.298, up 37.90% in the last 24 hours, followed by Quant(QNT) at $121.39, up 11.77%. On the other hand, Trust Wallet Token and Helium are the top losers, with TWT price dropping 20.51% to $2.08 and HNT price dropping 4.78% to $2.54.

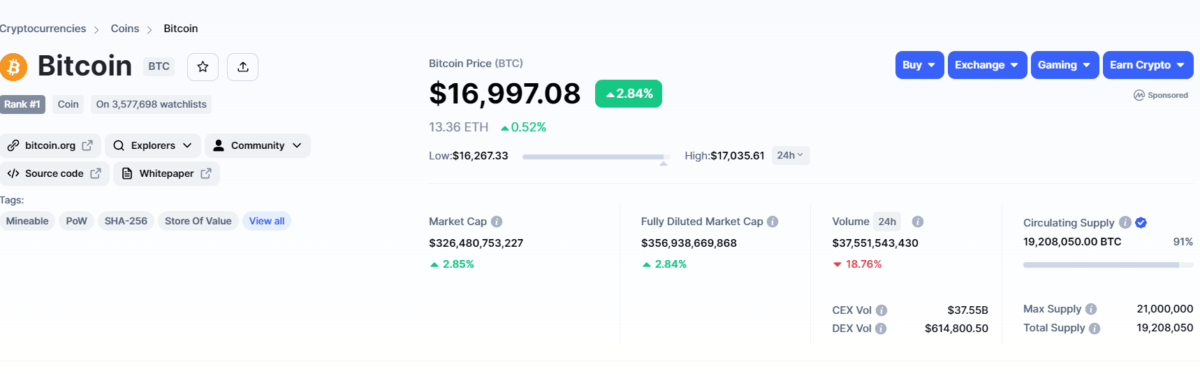

Bitcoin Price

Within a week, the Bitcoin price has rebounded twice from the $15800 support, indicating that buyers are actively defending this level. So far, the bullish reversal has raised the prices by 6.2% and pushed it to its current level of $16855.

A bullish divergence in the daily RSI slope indicates replenishing bullish momentum, which may encourage considerable recovery. With sustained buying, the Bitcoin price should rise 8% higher to hit the $18250-$18400 resistance zone.

The aforementioned resistance aligned with the 20-day EMA resistance offers a high possibility for the price to revert lower and resumption the prior correction.

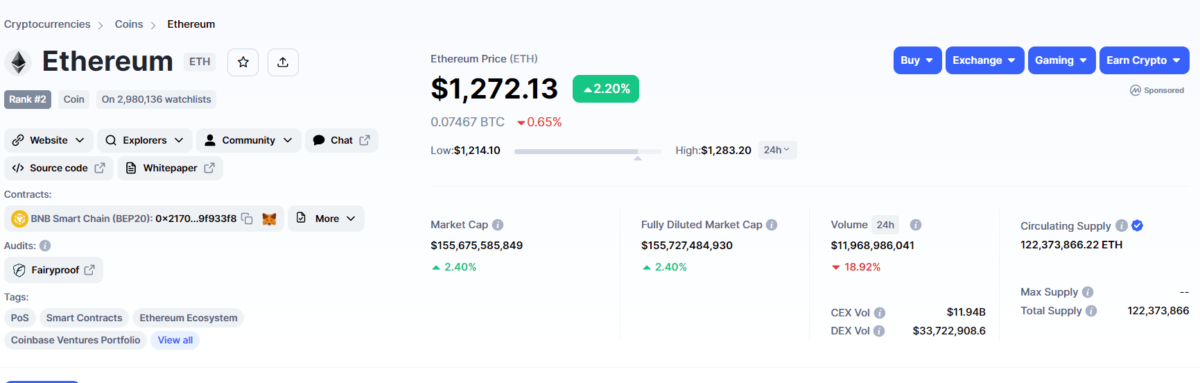

Ethereum price

The Ethereum daily time frame chart shows multiple short-body candles with higher and lower price rejections hovering above the $1222 support. Thus, this candle structure indicates uncertainty in market participants and struggles for buyers to resume price recovery.

However, the buyers could continue to sustain above the aforementioned support; the buyers should manage to prolong this relief rally 12% higher to hit the $1400 supply zone.

Nevertheless, with the overall market sentiment still bearish, the altcoin could resume the prevailing correction if hit by strong resistance. Anyhow, the 20-and-50-day gathered at $1400 resistance creates formidable barriers against buyers.

- US Senator Launches Probe Into Binance After Fortune Report on Sanctions Violations

- CLARITY Act Odds, Bitcoin Drop as Trump Skips Crypto in State of the Union Speech

- Tokenized Stock Market Gains Boost as Kraken and Binance Launches New Products

- Peter Schiff Casts Doubt on Bitcoin Rally Ahead of Trump’s SOTU Speech

- Putin Signs Law to Confiscate Bitcoin Amid Russia’s Crypto Crackdown, Pavel Durov Probe

- Cardano Price Signals Rebound as Whales Accumulate 819M ADA

- Sui Price Eyes Recovery as Third Spot SUI ETF Debuts on Nasdaq

- Pi Network Price Eyes a 30% Jump as Migrations Jumps to 16M

- Will Ethereum Price Dip to $1,500 as Vitalik Buterin Continues Selling ETH?

- XRP Price Outlook as Clarity Act Passage Odds Plunge to 53%

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

Claim Card

Claim Card