Bitcoin, Ethereum Price Prediction- Market Leaders Falling Puts Altcoins On Red Alert

Bitcoin, Ethereum price prediction: the BTC and ETH price’s failure to sustain higher levels indicate uncertainty among market participants. A sideways trend in market leaders prompts the majority of major currencies to stall their recovery. As of 7.50 EST Wednesday, the global crypto market stands at $833.58 billion, down 1.56 % from yesterday.

However, the total crypto market volume has dropped 11.03% to $62.65 Billion over the last 24 hours. Currently, the total volume in DeFi comes in at $3.82 Billion, which adds up to 6.1% of the total crypto market 24-hour volume.

Top Gainers and Losers

In the last 24 hours, the highest gainer among the top 100 cryptocurrencies is Chiliz(CHZ) at$0.2281 with a price jump of 13.45%, followed by Stacks (STX) at $0.2383 and a 6.24% rise. Conversely, Trust Wallet Token and GMX are the top losers, with TWT price falling 13.04% to $1.97 and GMX price down 11.60%% to $39.73.

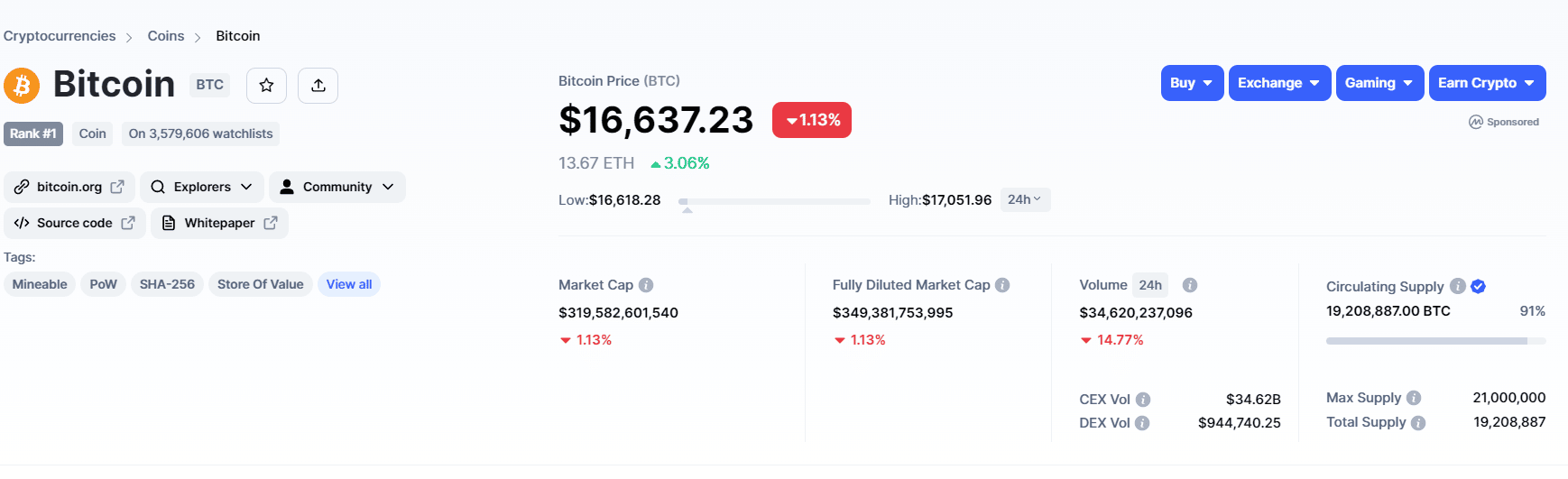

Bitcoin Price

On November 14th, the Bitcoin price rebounded from $15825 with a Doji candle and significant volume. This bullish reversal rosed the prices 6% higher in the last three days, as it currently trades at $16700.

However, the higher price rejection in the last three days candle indicated that Bitcoin traders face high supply pressure from above. As a result, the coin is 1.17% down on intraday triggering a side price movement.

If the selling pressure persists, the Bitcoin prices may restest the weekly support of $15825.

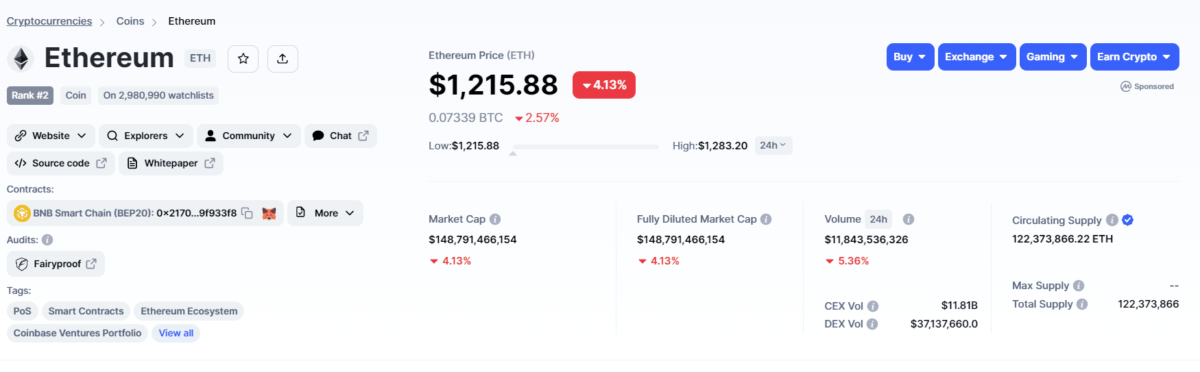

Ethereum price

The Ethereum price continues to hover above the $1220 support as buyers struggle to follow up for a bullish recovery. By the press time, the altcoin trades at the $1211 mark with an intraday loss of 2.54%.

The bearish candle shows a reattempt to break the $1220 support. A daily candle closing below the aforementioned support will indicate the sellers regain trend control and may prolong the prevailing downtrend.

Thus, the post-breakdown fall could tumble the prices 9.6% down to $1100, followed by a $1000 psychological level.

On a contrary note, if the buyers reverted the price higher to defend the $1220 support, the price will continue the consolidation phase.

- CLARITY Act: Banks and Crypto Make Progress Following “Constructive” Dialogue at White House Meeting

- Expert Warns Bitcoin Bear Market Just In ‘Phase 1’ as Glassnode Flags BTC Demand Exhaustion

- SEC Chair Reveals Regulatory Roadmap for Crypto Securities Amid Wait for CLARITY Act

- ProShares Launches First GENIUS Act Focused Money Market ETF, Targeting Ripple, Tether, Circle

- BTC Price Falls as Initial Jobless Claims Come In Below Expectations

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?

- Dogecoin Price Eyes Recovery Above $0.15 as Coinbase Expands Crypto-Backed Loans

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying

- Why Shiba Inu Price Is Not Rising?