Bitcoin, Ethereum Price Prediction- Technical Chart Hints A Minor Pullback Before Next Bull Cycle

Bitcoin, Ethereum price prediction: the recently released CPI data, which is less than that expected, has created less relief in broader markets. The declining CPI data accentuates the cooling inflation and a higher chance that the US Fed will ease the interest rate hike program.

As a result, Bitcoin and numerous altcoins surged higher on December 14th and escaped their consolidation phase.

By 8:47 am EST Wednesday, the global crypto market was valued at $873.27 billion, falling 0.21% since yesterday. Moreover, the total crypto market volume fell 12.7% and reached the $40 Billion mark.

Top Gainers and Losers

Amid the recovery sentiment in the crypto market, Toncoin and Lido Dao show the highest gains today among the top 100 cryptocurrencies. In the 24-hour period, the TON price surged 17.02% to reach $2.70; the LDO price gained 8.65%% to $1.15. On the other hand, the GMX and Stacks Tokens are top losers, with GMX price down 6.99% to $54.5, while STX price at $0.2862 shows a 2.68% fall.

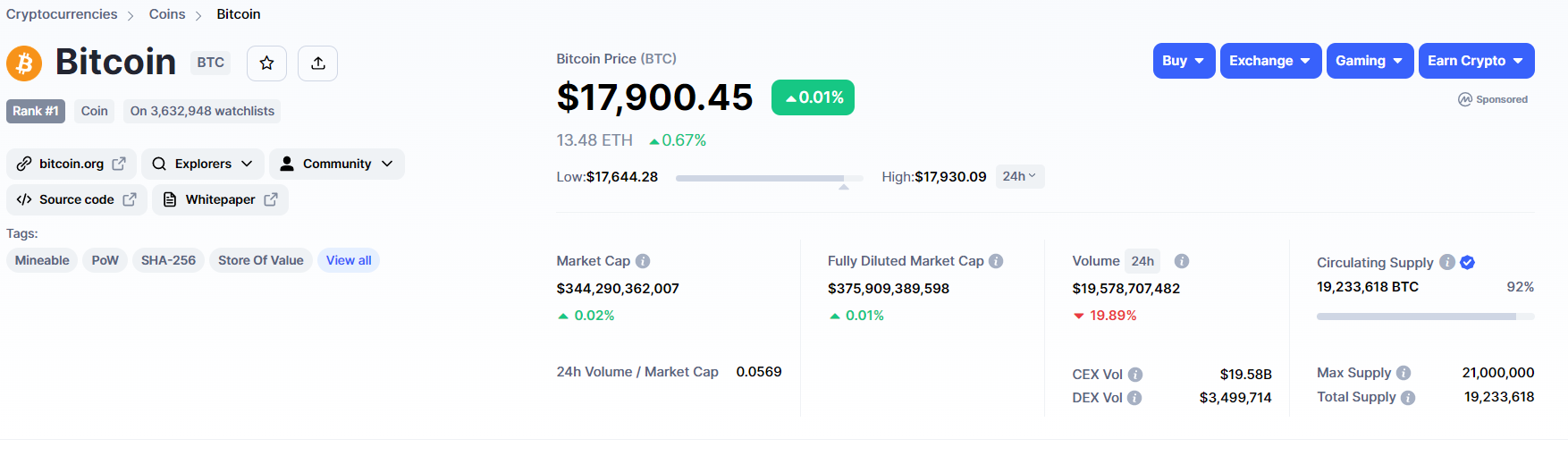

Bitcoin Price

The Bitcoin price witnessed a significant inflow just after the release of CPI data. A positive sentiment spread in the crypto market bolstered this price to give a massive bullish breakout of $17300 weekly resistance.

Moreover, the daily chart shows the coin follows a parallel channel pattern, in which the prices show a steady growth between two ascending trendlines. Thus, untill the pattern support trendline is intact, the Bitcoin price may prolong its recovery.

By the press time, the Bitcoin price is trading at $17900 and retesting the pattern resistance trendline. This retest indicates a higher possibility for the price to revert lower and revisit the bottom trendline.

Thus, the new traders looking for entry opportunities can enter at the support trendline for the new bull cycle that may reach to $18500 mark.

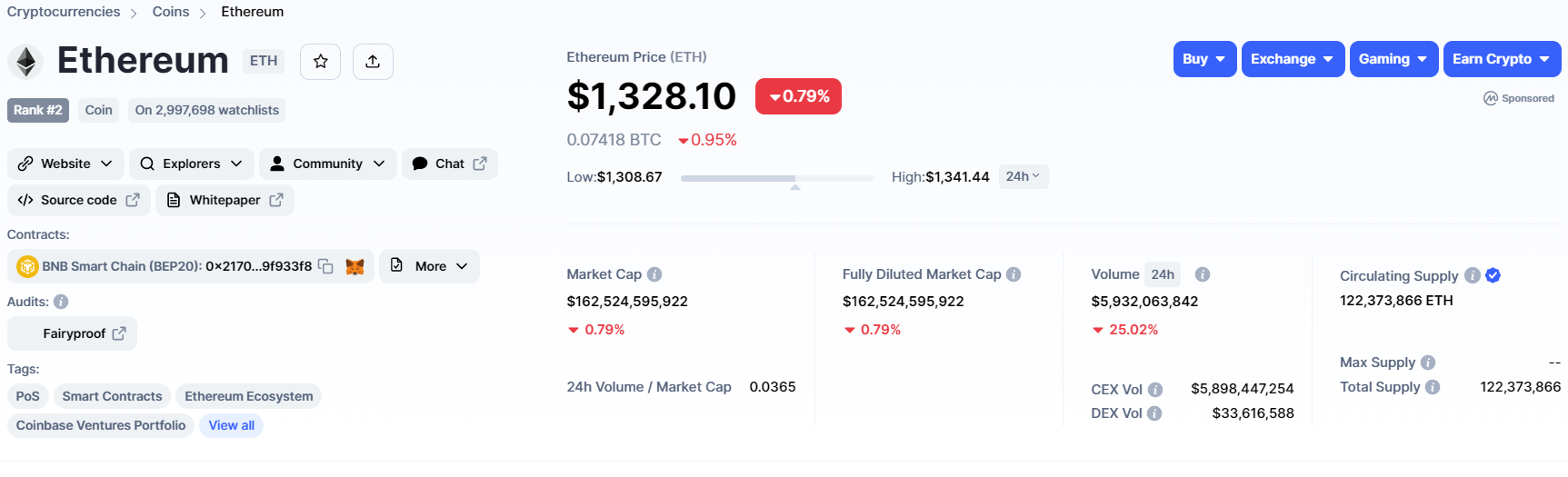

Ethereum price

Similar to Bitcoin, the Ethereum price experienced strong buying pressure on December 13th and gave a massive breakout from the $1300 monthly resistance. Today, this altcoin shows a 0.76% rise, but with low volume, the prices are likely to plunge lower and retest the $1300 mark.

If the possible retest phase shows sustaining above the $1300 mark, the buyers could drive the price $1422 barrier.

The RSI indicator, which reflects the strength of ongoing price action, indicates a bullish outlook as it reaches a four-week high of 57.8%.

Conversely, a breakdown below $1300 will undermine the bullish thesis.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitcoin & Gold Bounce as Trump Admin Brokers US-Venezuela 1000 Kg Gold Deal

- SEC Advances Major Crypto Securities Plan to White House for Approval

- Peter Brandt Flips Bullish, Predicts Bitcoin Rally As Price Holds Above $70k

- XRP News: Institutional Use Case Expands as Doppler Finance Integrates WXRP for Multi-Chain Access

- Trump Tariffs: Bitcoin Faces Fresh Headwinds as 15% Global Tariffs Begin This Week Amid Iran War

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

Buy $GGs

Buy $GGs