Bitcoin Price Alarming Pattern Points to a Dip to $80k as $2.7b Options Expires Today

Highlights

- Bitcoin price has formed a risky bearish flag pattern on the daily chart.

- It remains below all moving averages and the Supertrend indicator.

- Bitcoin may drop sharply as options worth over $2.7 billion expire later on Friday.

Bitcoin price rebounded by 3% today, Dec. 19, reaching a high of $87,960. This rise happened after the Bank of Japan (BoJ) delivered its first interest rate in 11 months. However, technicals suggest that the BTC price may dive to $80,000 and below ahead of a $2.7 billion options expiry and as ETF outflows continue.

Bitcoin Price is at Risk Ahead of Options Expiry

Bitcoin price is facing substantial headwinds that may trigger a major bearish breakdown in the coming days or weeks.

One of the key risks is the upcoming options expiry, which will happen on Friday. Data compiled by Deribit shows that over 31,000 contracts worth over $2.7 billion will expire.

The maximum pain, which is defined as the strike where most positions will expire worthless, is $88,000, which is slightly above the current level. The date also shows that the put/call ratio is 0.8, meaning that there are more calls than puts, which is a bullish sign.

A call is a trade that gives a trader the right, but not the obligation, to buy an asset. On the other hand, a put trade gives traders a right, but not the obligation to sell an asset. More data shows that the major open interest cluster is $100,000 for calls and $85,000 go puts.

It is common for the Bitcoin price to experience volatility ahead of and after a major options expiry like this one.

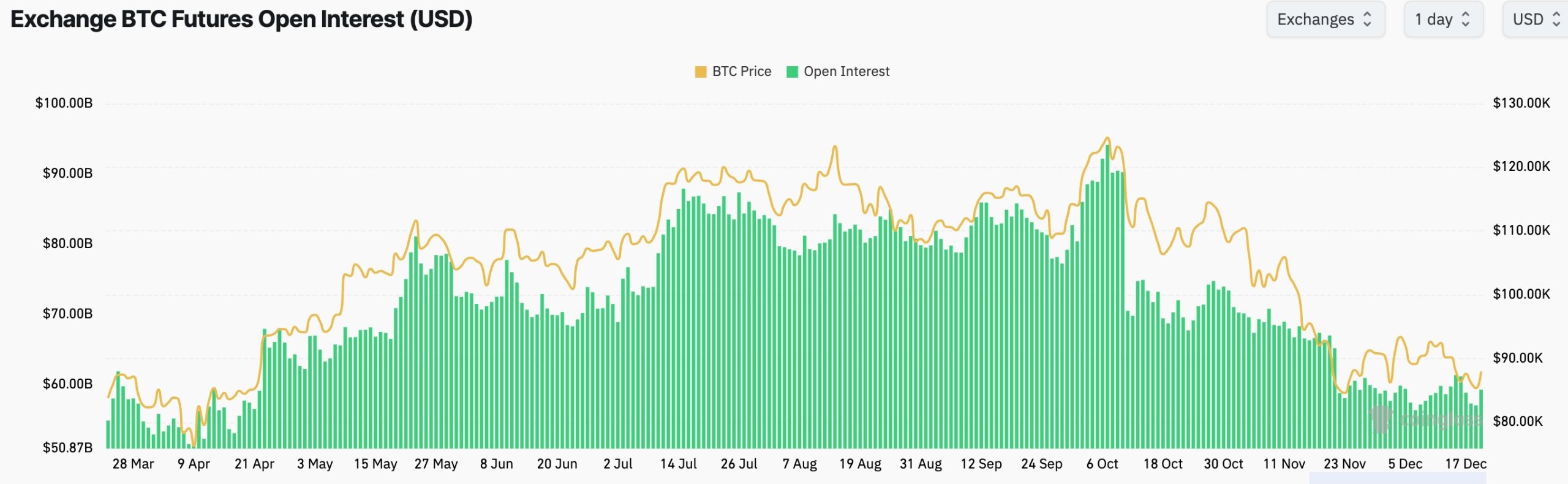

The options expiry is coming at a time when Bitcoin’s open interest has dropped to $59 billion from a high of $94 billion in October, a sign that investors have continued to reduce their leverage. Reduced leverage is a sign of weak demand.

Meanwhile, data compiled by SoSoValue shows that Bitcoin ETF inflows have remained elusive in the past few days. These funds lost over $161 million in assets, bringing the cumulative total inflows to $57 billion, down from over $60 billion earlier this year.

Bitcoin Price Technical Analysis Suggests that a Crash is Possible

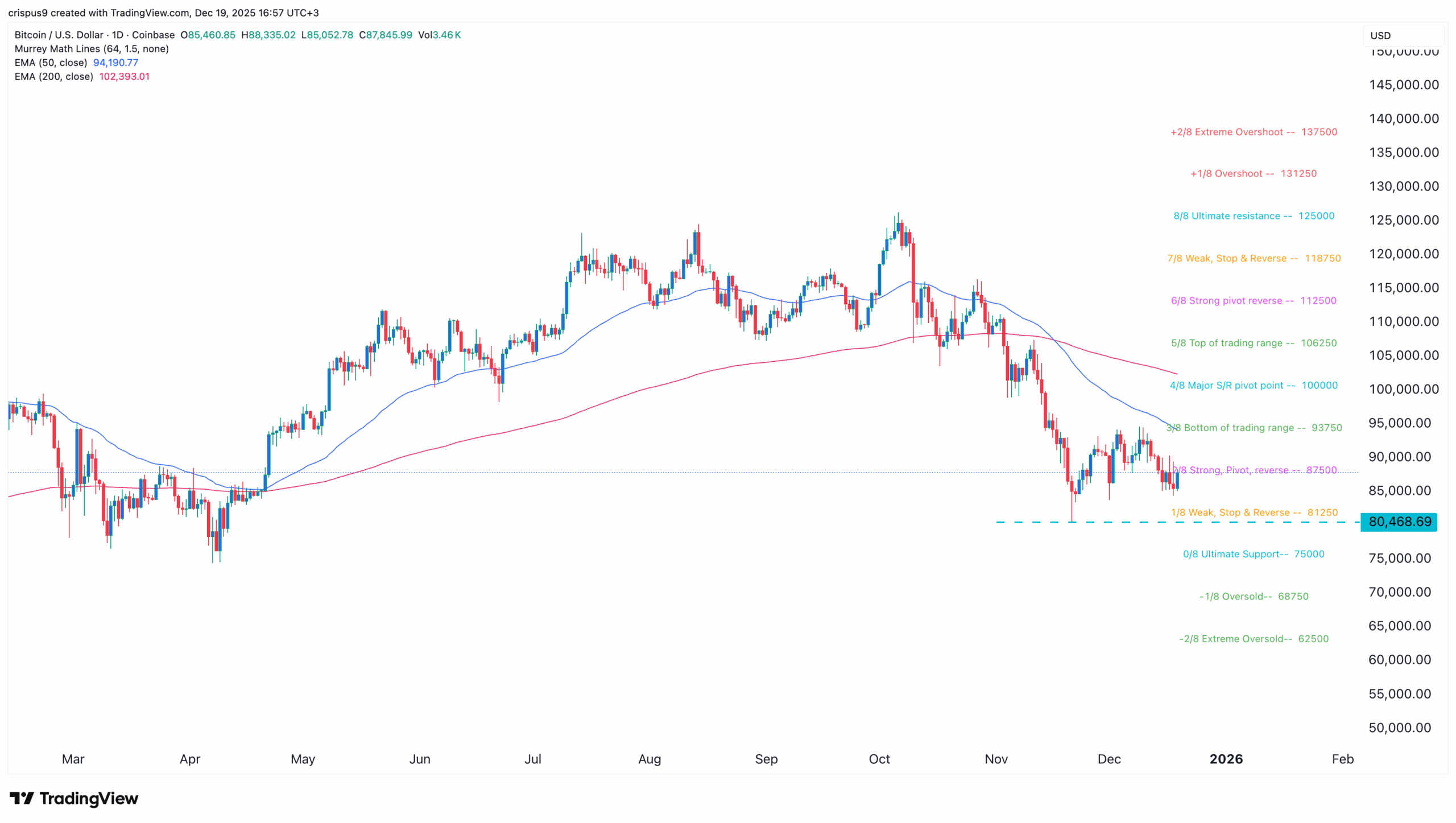

The daily timeframe chart points to more BTC price decline after the BoJ interest rate hike today. The coin has formed a giant bearish flag pattern, which is characterized by a vertical line and an ascending channel. It is now in the channel section, meaning that it may have a strong bearish breakdown in the near term.

The coin has moved below the Strong, pivot, and reverse levels of the Murrey Math Lines tool. It has dropped below the 50-day and 100-day Exponential Moving Averages (EMA) and the Supertrend indicators.

Therefore, the most likely Bitcoin price forecast is bearish, with the next major target being at $80,000, which is its lowest level in November this year.

A drop below that level means that BTC price will then drop to the ultimate support of the Murrey Math Lines tool at $75,000. On the flip side, a jump above the bottom of the trading range at $93,750 will invalidate the bearish outlook.

Frequently Asked Questions (FAQs)

1. What is the most likely Bitcoin price prediction?

2. Is Bitcoin a good investment today?

3. Are Bitcoin options expiries a bullish or bearish thing for Bitcoin?

- CLARITY Act: Trump’s Crypto Adviser Says Stablecoin Yield Deal Is “Close” as March 1 Deadline Looms

- Trump Tariffs: U.S. To Impose 10% Global Tariff Following Supreme Court Ruling

- CryptoQuant Flags $54K Bitcoin Risk As Trump Considers Limited Strike On Iran

- Why Is Bitdeer Stock Price Dropping Today?

- Breaking: U.S. Supreme Court Strikes Down Trump Tariffs, BTC Price Rises

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?