Bitcoin Price Analysis: BTC Renewed One-Week Low Below $21,000; No Hope Of Reversal?

The Bitcoin price broke the $21,000 level briefly on Wednesday, sending jitters to the buyers. In today’s session, the BTC moves in a very tight range with limited upside potential. The analysis indicates a bearish bias unless a strong reversal sign appears on the chart.

- BTC price extends the previous session’s loss on Tuesday.

- However, the downside momentum slows down near the weekly support of $20,770.

- A daily close above $21,800 could be a last hope for the bulls.

BTC price continues south

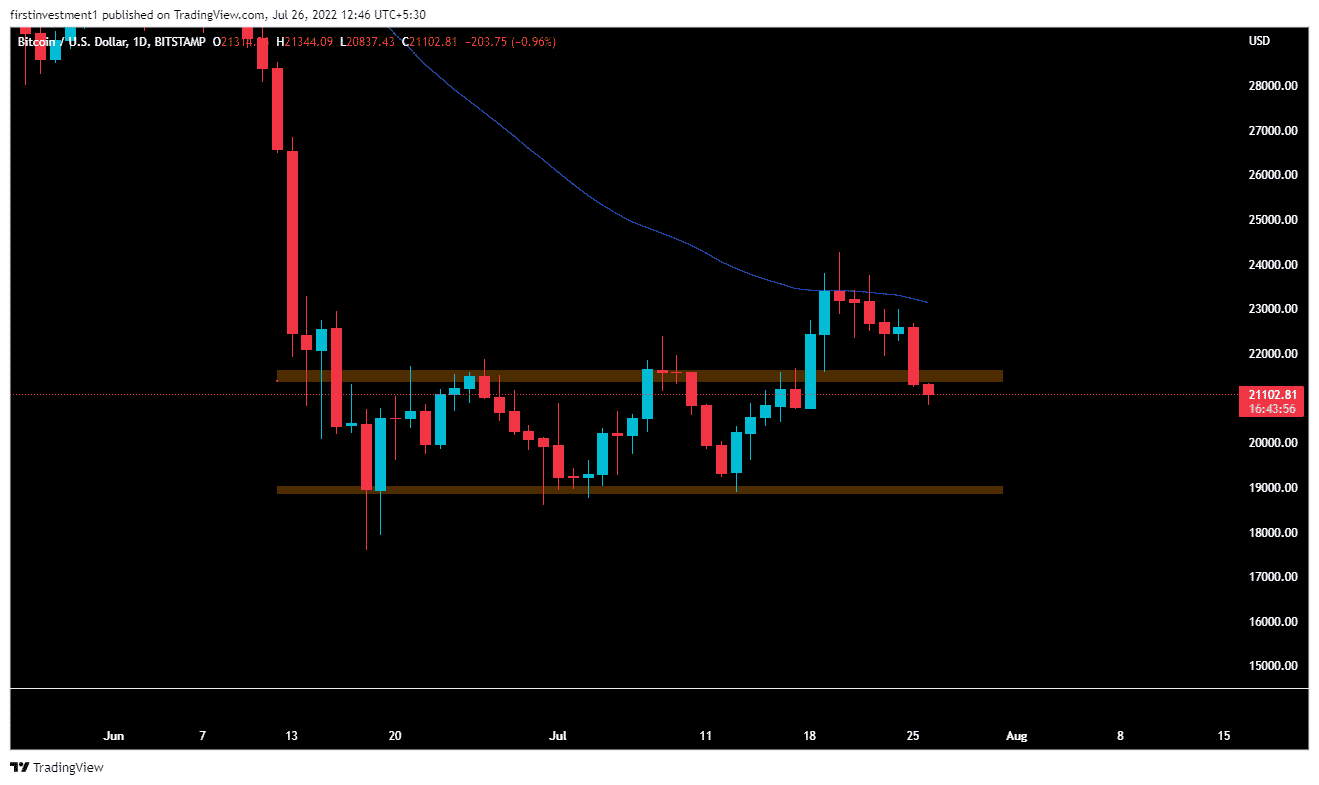

On the daily chart, the BTC price reaches a crucial level, a weekly support structure near $20,800 to $21,000. A make or break point for BTC investors.

After the much-awaited breakout, the bulls failed to sustain above the critical 50-day exponential moving average (EMA).

A daily close below the $20,700 level would intensify toward $20,200 followed by $19,000.

BTC after giving an impulse move from the extended consolidation between $18,900 to 22,300, the upside momentum is exhausted or waiting for further confirmation. However, the formation of multiple Doji candlesticks indicates rejection near $24,400.Thus, inducing a distribution phase.

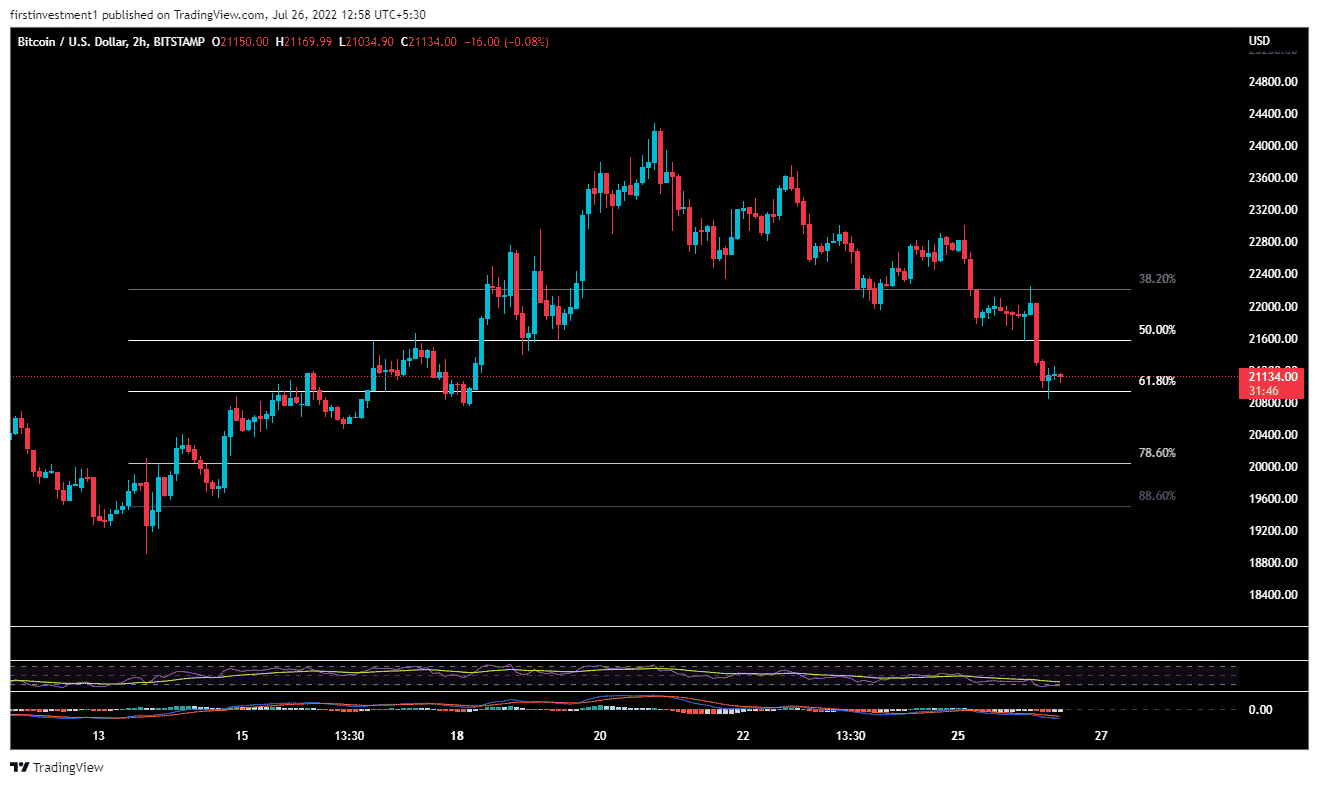

Two-hour time frame suggests consolidation

On the two hourly charts, BTC sought support near 61.8% Fibonacci retracement connecting from recent swing lows to swing high. It is also 61.8% known as a golden level. The momentum oscillator remains neutral.

As of writing, BTC/USD is exchanging hands at $21,087.20, down 1.01% in the past 24-hour. On the contrary, the trading volume rose to 31% at $38,012,601,557. A bearish sign.

Conclusion

The price faces a strong upside barricade with a technical setup in favor of bears. The higher probability of breaking the lower level is favored.

- Expert Predicts Deeper Bitcoin Decline as JPMorgan CEO Warns of Similarities to the 2008 Financial Crisis

- Trump Won’t Pardon FTX’s Sam Bankman-Fried (SBF), White House Says

- Third Spot SUI ETF Goes Live as 21Shares Fund Launches on Nasdaq

- Mark Zuckerberg’s Meta Reportedly Eyes Stablecoin Integration This Year Amid Regulatory Clarity

- Coinbase Rivals Robinhood As It Rolls Out Stocks, ETFs Trading In ‘Everything Exchange’ Push

- Cardano Price Signals Rebound as Whales Accumulate 819M ADA

- Sui Price Eyes Recovery as Third Spot SUI ETF Debuts on Nasdaq

- Pi Network Price Eyes a 30% Jump as Migrations Jumps to 16M

- Will Ethereum Price Dip to $1,500 as Vitalik Buterin Continues Selling ETH?

- XRP Price Outlook as Clarity Act Passage Odds Plunge to 53%

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

Claim Card

Claim Card