Bitcoin Price Analysis: Will BTC Price Able To Add More Gains Above $24,000?

The Bitcoin price analysis shows a positive outlook for the day. The largest cryptocurrency by the market cap started the new series on a lower note as it remained pressured below the highs of July 30 at $$24,672.87. The price tested the reliable support around $22,650 multiple times. Even, in today’s session, the BTC price tested the same support level. But recovered sharply above $23,500.

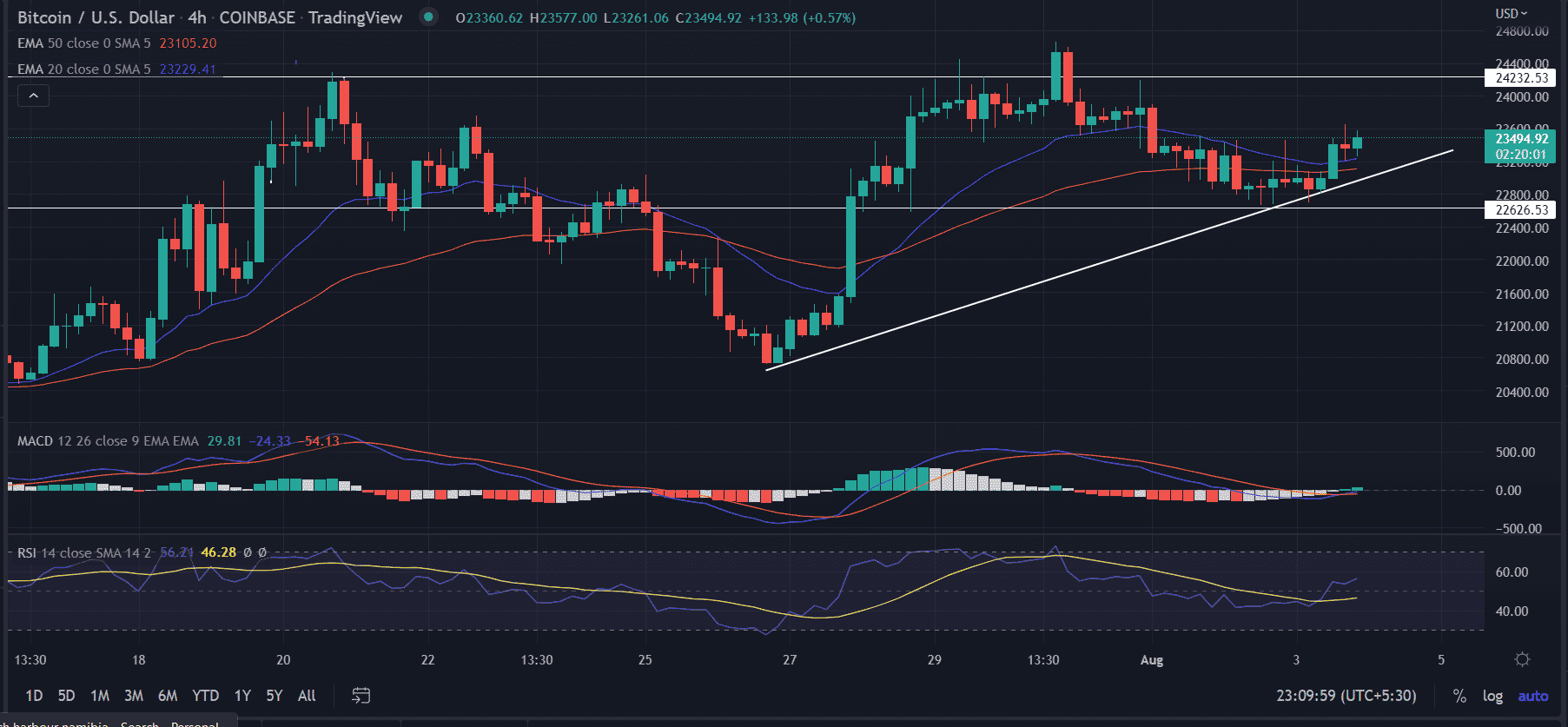

On the four chart, the BTC price is displaying some bullish moves. But, the upside is capped near the $24,190 level. Hence, in the short-term BTC consolidate in the price range of $22,600 to $24,200.

It would be interesting to find out the directional bet of the breakout of the trading range.

As of writing, BTC/USD is exchanging hands at $23,509, up 2.36% for the day. According to the CoinMarketCap data, the largest cryptocurrency by the market cap holds the 24-hour trading volume at $26,881,814,757 with a loss of 8%.

BTC price extends consolidation

BTC price is trading along the ascending trend line from the lows of $20,730. After retracing from the swing highs of $24,666, the price takes well to support the critical 20-day and 50-day EMA crossover. As a result, the price manages to trade above the $23,500 level.

We expect BTC to hit the upper range of the defined trade range of $22,600 and $24,200 on the four-hour chart. More upside gains are possible if fresh buying emerges near the upper trading level. In that case, the next upside target for BTC buyers would be $26,000.

On the other hand, a break below $22,950 would mark the breach of the bullish trend line. Next, the stoppage would be $22,600 for the bears.

The RSI (14) holds above the average line with a bullish bias. Currently, it reads at 53.

Another momentum oscillator, the Moving Average Convergence (MACD) hovers just below the midline but in a good attempt to cross. An increasing bullish momentum as indicated by the histogram signaling a favorable situation for the bulls.

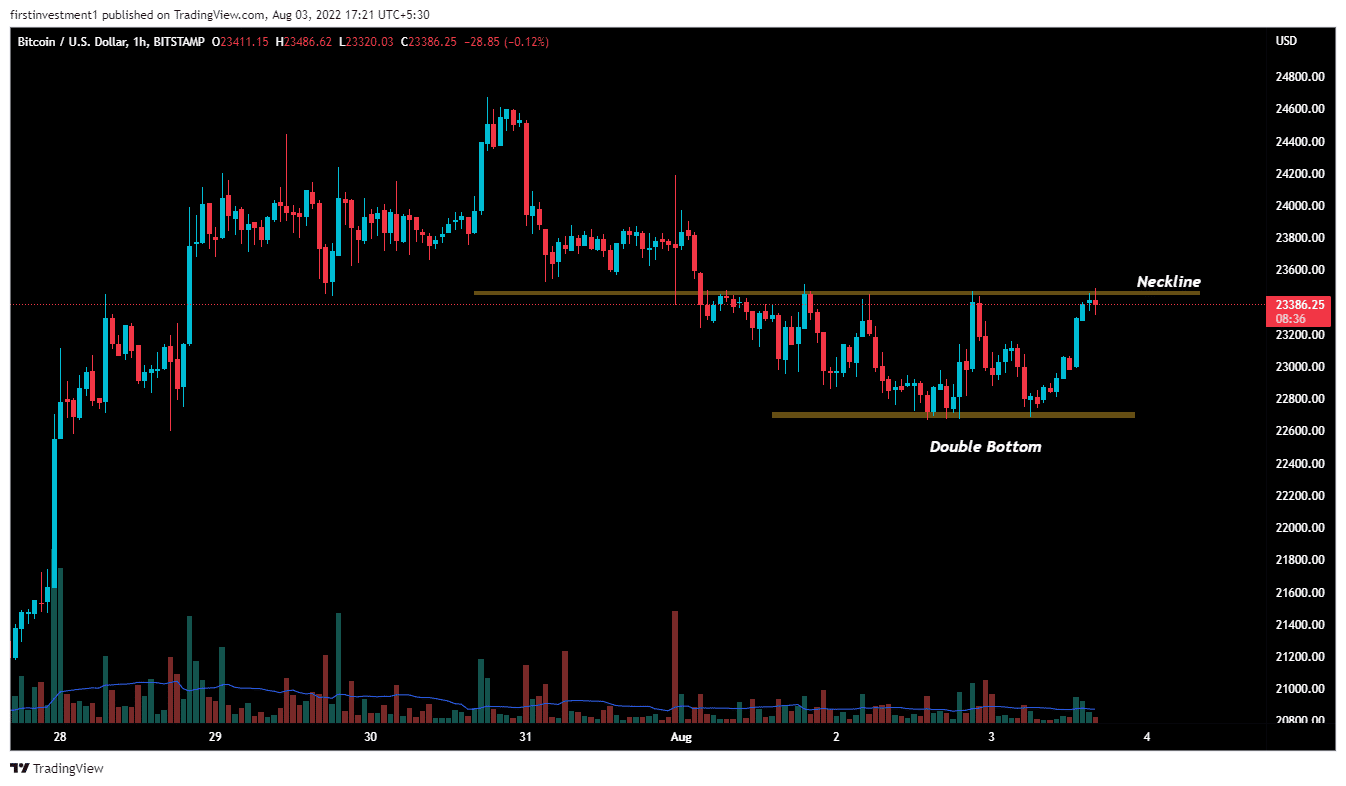

On the hourly time frame, the price formed a “Double Bottom pattern” indicating strong support near the lower levels. According to this pattern, if the price breaches the neckline above the $23,520 mark with good volumes, then the BTC price might test the $23,900 to $24,100 resistance zone.

On the other hand, a break below the $22,650 level could invalidate the bullish outlook. And the price can slide up to $22,100.

BTC/USD has often witnessed large price swings, gaining meaningful follow-through action once a clear direction has formed.

- Why is XRP Price Dropping Today?

- Breaking: FTX’s Sam Bankman-Fried (SBF) Seeks New Trial Amid Push For Trump’s Pardon

- Fed’s Hammack Says Rate Cuts May Stay on Hold Ahead of Jobs, CPI Data Release

- $800B Interactive Brokers Launches Bitcoin, Ethereum Futures via Coinbase Derivatives

- Michael Saylor Says Strategy Won’t Sell Bitcoin Despite Unrealized Loss, Will Keep Buying Every Quarter

- Bitcoin Price Analysis Ahead of US NFP Data, Inflation Report, White House Crypto Summit

- Ethereum Price Outlook As Vitalik Dumps ETH While Wall Street Accumulates

- XRP Price Prediction Ahead of White House Meeting That Could Fuel Clarity Act Hopes

- Cardano Price Prediction as Bitcoin Stuggles Around $70k

- Bitcoin Price at Risk of Falling to $60k as Goldman Sachs Issues Major Warning on US Stocks

- Pi Network Price Outlook Ahead of This Week’s 82M Token Unlock: What’s Next for Pi?