Bitcoin Price Is Preparing Its Next Move Within This Chart Pattern

The Bitcoin technical chart showcased a roller coaster ride as prices took a V-top reversal during Mid August and dumped back to 2022 bottom support of $18000. Moreover, over the last weeks, the crypto market suffered due to unfavorable news such as High CPI data, Fed interest hike, and the U.S. dollar index(DXY) rise to a 20-year high. As a result, the market participants’ fear of further downfall has increased.

Key points from Bitcoin price analysis:

- Bitcoin Fear & Greed Index has dropped to 24%, signaling extreme fear among market participants.

- Interested traders should wait for the Bitcoin price to breach the triangle pattern barriers before they position their funds.

- The intraday trading volume in Bitcoin is $22.6 Billion, indicating a 35% loss.

The Bitcoin retested the bottom support zone at $$18200-18000 on September 19th. However, even a week has nearly passed, the BTC price is still wavering around this support. This consolidation indicates uncertainty in market participants.

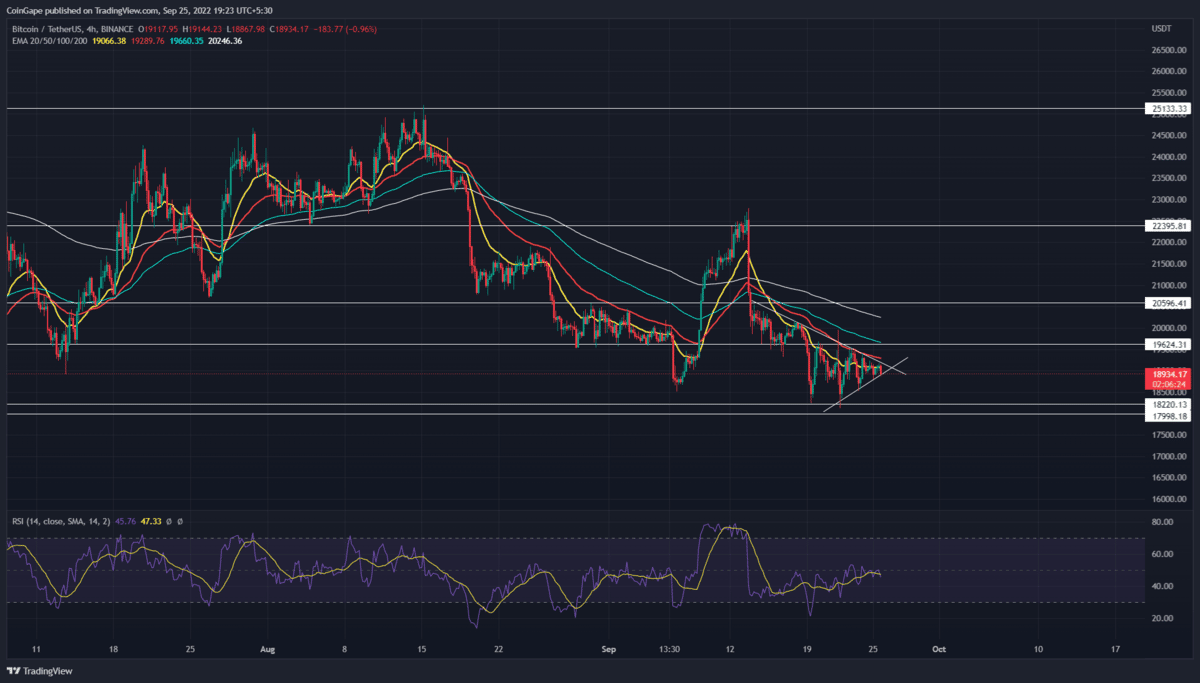

Anyhow, the 4-hour time frame chart reflects this consolidation as the formation of a symmetrical triangle pattern. In theory, this pattern usually resumes the prevailing trend after a short period of break; however, a breakout on the other side is quite possible.

Today, the Bitcoin price is trading at the $19062 mark and shows a 0.7 intraday gain. Furthermore, the two convergence trendlines have narrowed the prices enough to be considered a no-trading zone.

Therefore, a breakdown below the support trendline will intensify the ongoing bearish trend and plunge the Bitcoin price below the $18000 mark.

On a contrary note, a candle closing above the resistance trendline will signal an early sign of bullish reversal. As a result, the coin holders may witness another upswing.

Technical Indicator

RSI: Contrary to the sideways price action, the rising RSI slope indicates growth in underlying bullishness. Moreover, this positive divergence encourages a bullish breakout from the triangle pattern.

EMAs: the downsloping crucial EMAs(20, 50, 100, and 200) indicate any potential rally would face multiple resistance on its way up.

- Resistance level- $19600 and $20600

- Support level- $18000 and $16500

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Vitalik Buterin Maps Out Quantum Risks as Ethereum Foundation Unveils ‘Strawmap’

- BlackRock Adds $289M in BTC as Bitcoin ETFs Log 2-Week High Inflows Of $500M

- Glassnode Signals Bitcoin Still Faces Downside Risk Amid Massive Sell Pressure at $70K

- U.S House Introduces Bipartisan Crypto Bill To Protect Crypto Developers Amid DeFi Push Under CLARITY Act

- XRP News: Ripple Unveils Funding Hub To Support Innovation On XRPL

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

Buy $GGs

Buy $GGs