Bitcoin Price Pennant Predicament Could Sweep $40,000, Is This the Dip Before the Rip?

The crypto market is quickly erasing the gains accrued since mid-week when the Federal Open Market Committee (FOMC) kept interest rates unchanged in the range between 5.25 to 5.5%. In his remarks, Jerome Powell, the Fed Chair, announced 3 rate cuts in 2024.

This announcement, highly welcomed by investors, triggered widespread rebounds, with Bitcoin briefly rising above $43,000.

Altcoins followed in BTC’s footsteps with some majors like Solana (SOL) and Cardano (ADA) posting double-digit gains. Although Ethereum price climbed higher, it quickly retraced from resistance at $2,300 to $2,236 at the time of writing.

Recommended for you: Terra Luna Classic Price Prediction: 300% Pump, 40% Dump, Is the Worst Yet to Come?

Bitcoin Price At Crossroads, What’s Next?

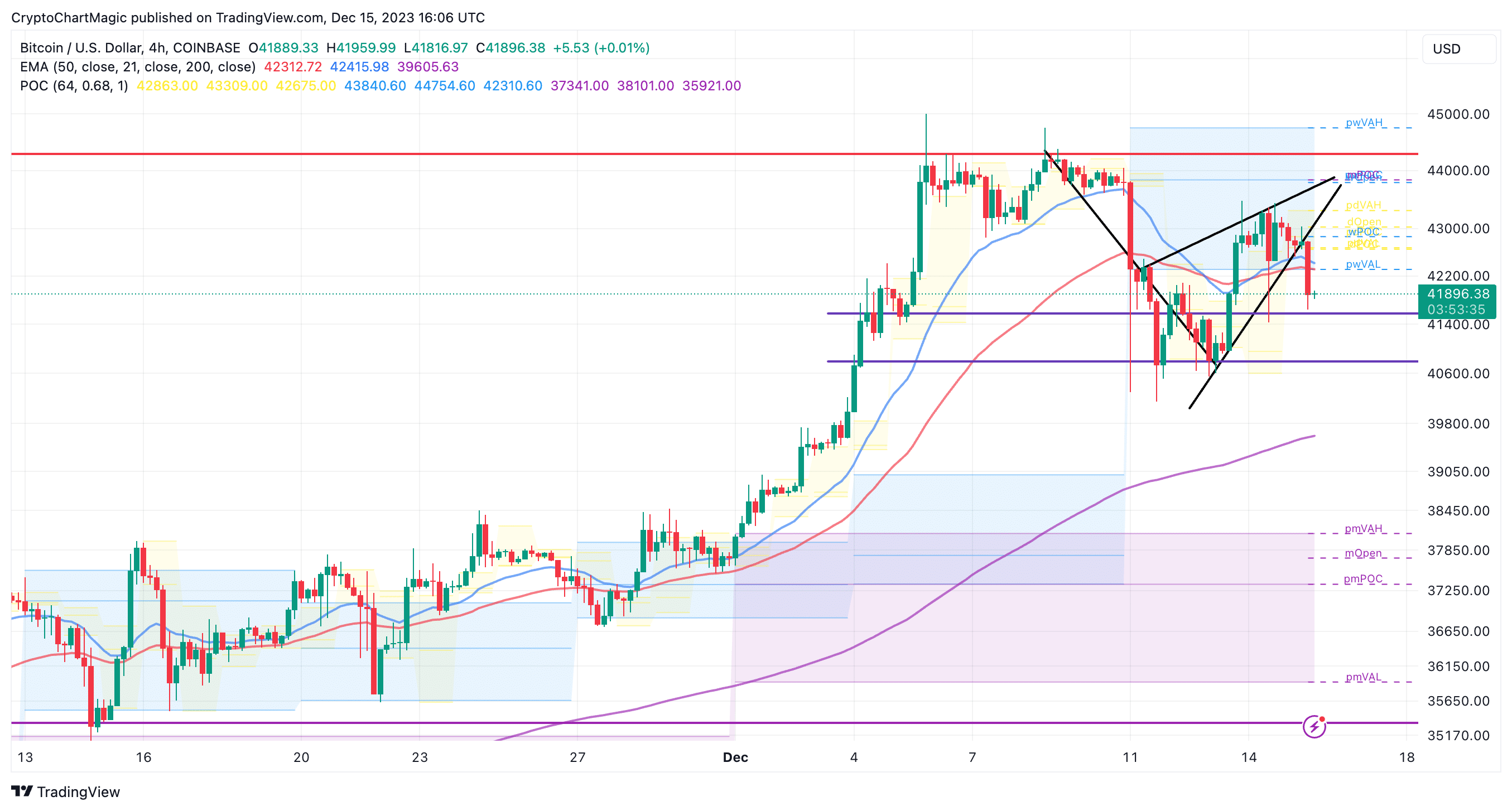

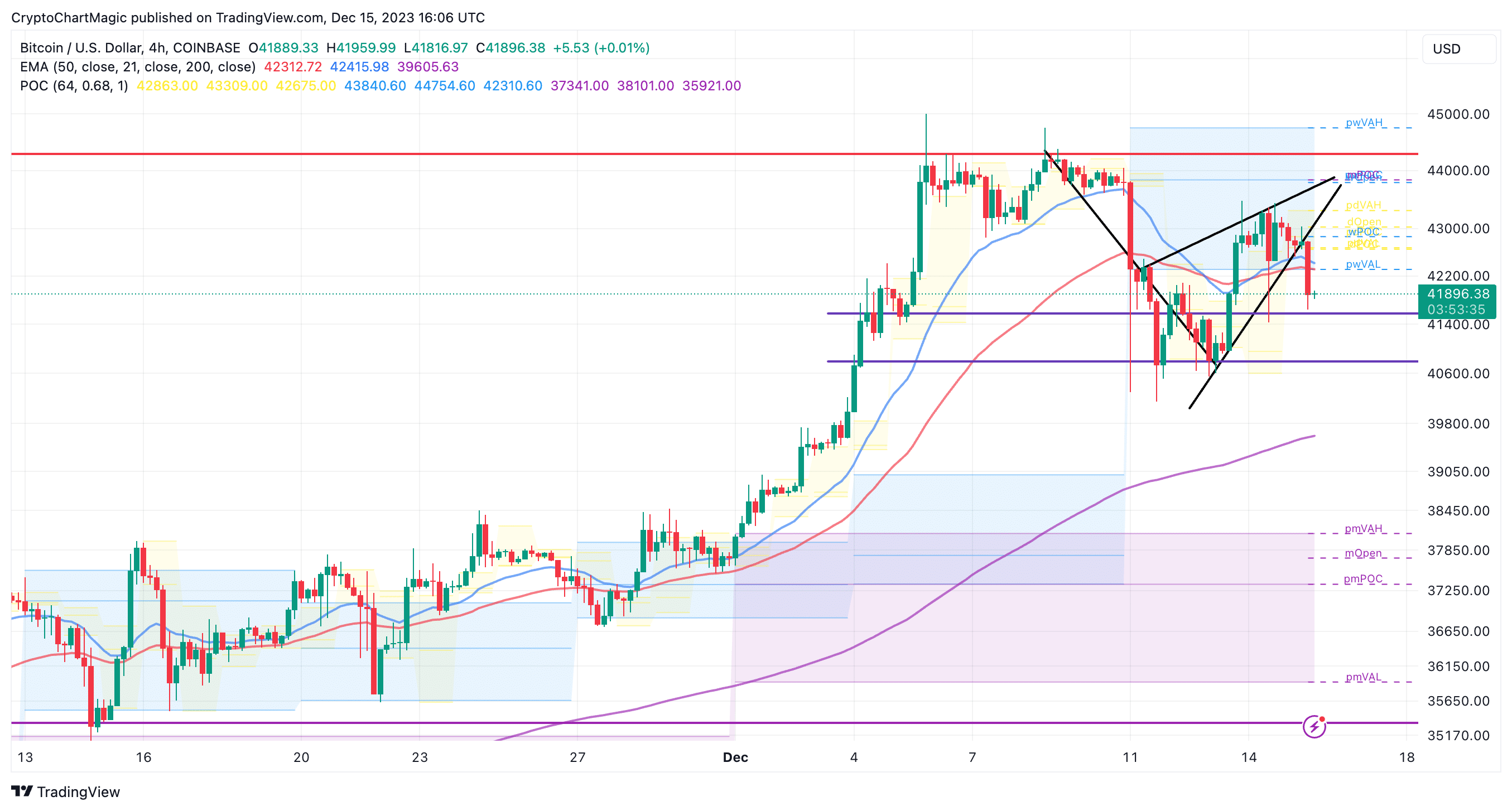

The recovery from support at $40,000 formed a pennant pattern in the process, whose validation is contributing to the current overhead pressure. A pennant can either be bullish or bearish.

In Bitcoin’s case, a bearish pennant threatens to spur a drop to $40,000. Many traders are likely to have faced liquidation on their long bets to $45,000 and possibly $50,000.

However, the fact the uptrend weakened below $44,000 resistance could have been interpreted to signal a possible swing low before the next major breakout. At the same time, Bitcoin price slid below the 20 Exponential Moving Average (EMA) (in blue), reinforcing the short-term bearish theory.

Bitcoin price also dropped below 50 EMA (in red) and is looking to successfully test support at $41,500. If declines overshoot this area, the next key region at $40,500 will come in handy but even so, it would be too early to rule out another retest of the $40,000 support.

Crypto analyst @CryptoBusy expects Bitcoin to create lower lows as long as it is trading in the range between $43,500 and $40,300.

#Bitcoin is still in the middle of this price range and I'm bullish if it breaks above $44,700 – I can add more long positions.

But if the price is still inside the $43,500 to $40,300 range, it could still create new lows.

Potentially, I'm seeing a mini cup and handle pattern… pic.twitter.com/UipIbsrJVa

— CryptoBusy (@CryptoBusy) December 15, 2023

Bitcoin Supply On Exchanges Dwindles

According to blockchain data shared by James Van Straten, the lead analyst at CryptoSlate, BTC left on exchanges ranges somewhere between 1.8 and 2 million.

In his opinion, BlackRock might scoop at least 1 million BTC to support its Bitcoin spot exchange-traded fund (ETF) bid.

Moreover, there are 11 more ETFs with the Securities and Exchange Commission (SEC), excluding public companies “that are now incentivized by FASB to adopt fair value accounting.”

There's 1.8M – 2M #Bitcoin left on exchanges.

My assumption is that BlackRock will acquire 1M BTC for the ETF.

Then, there are 12 other ETFs, plus public companies, that are now incentivized by FASB to adopt fair value accounting. #Bitcoin this cycle will be deemed an "ESG…

— James Van Straten (@jimmyvs24) December 15, 2023

The dwindling supply on exchanges coupled with 78% of the total supply being illiquid could further drive Bitcoin price.

The halving in April 2024 will also impact Bitcoin supply—a situation likely to trigger an unprecedented bull run.

For now, traders will look forward to BTC rebounding from support at $41,500 while speculating on the next move above $44,000.

Related Articles

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Breaking: Oil Prices Climb as Iran Set To Deploy Mines in Strait of Hormuz

- Why Is Crypto Market Up Today? 5 Key Reasons Behind the Rally

- Top U.S. Banks Weigh Lawsuit Against OCC Over Crypto Firm Charters

- CLARITY Act: Key Democrat Says Banks May Have to Compromise as Senate Eyes Crypto Bill’s Markup

- XRP News: Brad Garlinghouse Predicts ‘Defining Year’ For Ripple With XRP At The Center

- XRP Price Prediction as Goldman Sachs Becomes Biggest Holder of Ripple ETFs

- Circle (CRCL) Stock Price Prediction Ahead of CPI Data Release-Is 120 Next?

- Bitcoin Price Today: President Trump Signals Iran Conflict May End Soon As BTC Eyes $72k

- Top Analyst Explains Why Pi Network Price May Soar to $0.50 This Week

- Is MSTR Stock Going to Rally $150?

- Bitcoin And XRP Price Prediction As US Oil Prices Fall Sharply- Will This Spark a New Bull Rally?

Buy $GGs

Buy $GGs