Bitcoin Price Prediction Ahead of Key US Inflation and GDP Data

Highlights

- Bitcoin price rose by 1% after Donald Trump's speech at Davos.

- The US will publish the latest GDP and inflation data on Thursday.

- Technical analysis suggests that the coin may drop by 10% to $80,485.

Bitcoin price held steady on January 21, rising by over 1.45% after Donald Trump delivered his speech at the World Economic Forum in Davos. Still, technical analysis suggests that BTC may crash by 10% to its November low of $80,485. This decline may happen ahead of the upcoming US inflation and GDP reports.

Bitcoin Price at Risk Ahead of US Inflation and GDP Data

Bitcoin price has crashed and is in a technical bear market after falling by nearly 30% from its highest level on record. It stabilized on Wednesday after Donald Trump called for a peaceful resolution to the Greenland issue in his speech at the World Economic Forum in Davos.

The next important catalyst for Bitcoin will be the upcoming US GDP and inflation data, which will come out on Thursday this week.

Economists polled by Reuters expect the upcoming report to show that the economy expanded by 4.3% in the third quarter after growing by 3.8% in the second quarter. This report will come out this month because of the government shutdown.

Economists also expect that the US economy grew by 5% in the fourth quarter, a move that will bring the annual growth rate to over 2%.

The US will also publish the latest Personal Consumption Expenditure (PCE) report on Thursday. This is an important report, which measures the country’s inflation rate in the urban and rural areas and is the Federal Reserve’s favorite inflation gauge.

Economists expect the report to show that the headline PCE slowed to 2.7% in October from the previous 2.8%. Core inflation, which excludes the volatile food and energy prices, is expected to remain at 2.8%.

While this report is important, it will likely have a mild impact on Bitcoin and other assets because it is a lagging one. Also, the inflation report will not change the Federal Reserve’s outlook for interest rates this year. Economists expect the bank to deliver several interest rate cuts this year if inflation continues falling.

Bitcoin price also wavered as investors reacted to the latest Bitcoin ETF inflows and outflows data. The funds had an outflow of $483 million on Tuesday after shedding $395 million on Friday.

BTC Price Technical Analysis Points to a Plunge

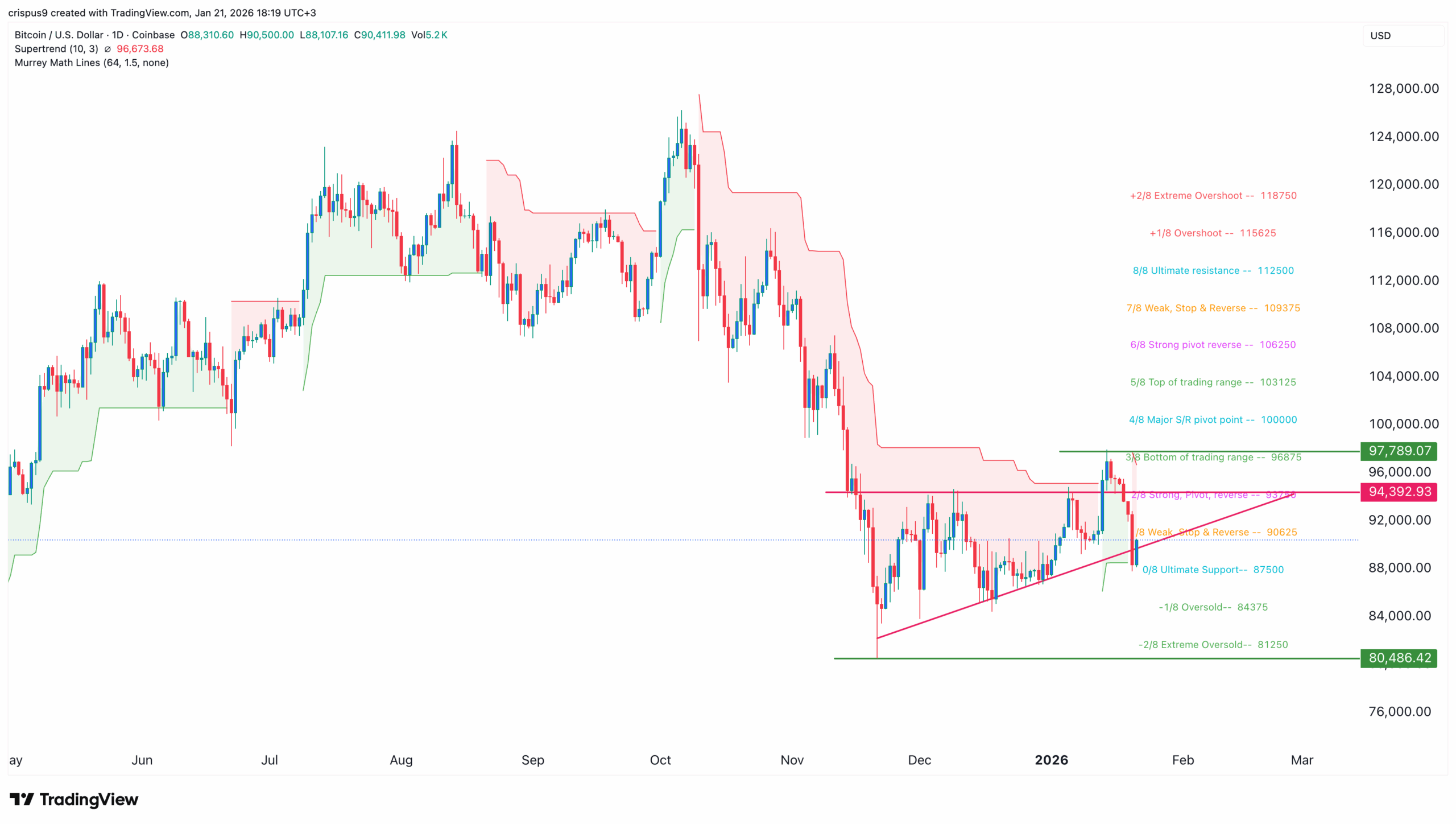

The daily timeframe chart shows that the BTC price has come under pressure in the past few weeks, moving from a high of $97,790 to the current $89,950.

It has moved below the Supertrend indicator, a sign that the bearish trend will accelerate in the near term. It moved below the lower side of the ascending trendline, which is part of the ascending triangle pattern.

Bitcoin price remains below the 50-day and 100-day Exponential Moving Averages (EMA). Therefore, the most likely long-term BTC price forecast is bearish, with the next key target being at $80,486, which is about 10% below the current level.

This view mirrors that of Michael Novogratz, the billionaire founder of Galaxy, who warned that a clear Bitcoin recovery will be confirmed if it moves above $100,000 and $103,000.

On the other hand, a move above the key resistance level at $94,392 will invalidate the bearish Bitcoin price outlook and point to more gains.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

Frequently Asked Questions (FAQs)

1. What is the most likely Bitcoin price forecast?

2. How will BTC price react to the upcoming GDP and PCE data?

3. Is Bitcoin a good coin to buy?

- ChangeNOW Is Settling Crypto Swaps in Under a Minute.

- $3B Western Union Expands Into Crypto With USDPT Stablecoin Launch on Solana

- XRP News: Key Ripple Whale Indicator Turns Bullish After Months, Price Rally Ahead?

- Crypto Market Today: BTC, ETH, XRP, SOL, and DOGE Rally as Geopolitical Tensions Ease

- Crypto Market Bill Hits New Deadlock as Banks Reject White House Deal

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

Buy $GGs

Buy $GGs