Bitcoin Price Prediction: BTC Price Remains Pressured Below 48,000; Hold or Exit?

Bitcoin price extends the previous session gains on the weekends. The price consolidates in a very tight range above the 200-EMA. Investors are waiting for confirmation before taking up aggressive bids.

- Bitcoin price trades with minimal gains on Saturday.

- Some retracement is expected in BTC as the bulls remain pressured below $48,000.

- BTC price locks 4% gains on a weekly basis.

Bitcoin price consolidates

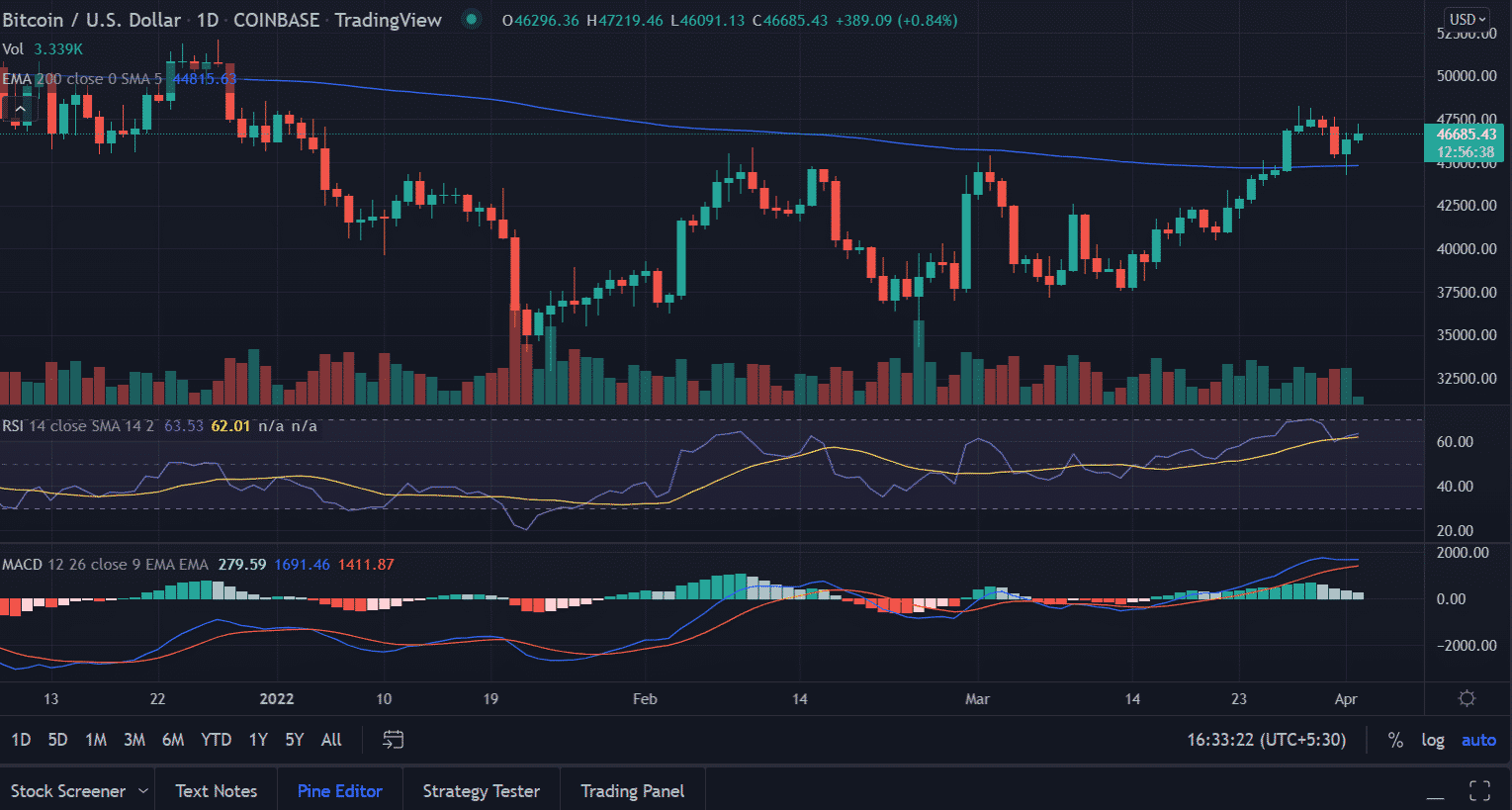

On the daily chart, the Bitcoin price surged 21% from the lows of 37,560.40 made on March 14. The asset tested 3-month highs at $48,240.0 on Thursday. However, the bulls lack the conviction or are unwilling to carry forward the gains beyond the said level. In the recent pullback, BTC price revisited the critical 200-day EMA (Exponential Moving Average) at $44,796.98.

But the downside seem limited as the price bounced back with a 5% gain in two sessions. This, suggest the bulls are not in a mood to give up easily either. So, for now, BTC slides in a trading range of $45,000 and $48,000.

An acceptance above $48,000 amid sustained buying pressure would make traders hopeful. On moving higher, the first upside target could be located at the psychological $50,000. Next, market participants would likely recapture the horizontal resistance level at $52,500.

On the contrary, if the price fails to hold the session’s low then it would invalidate the bullish outlook for BTC price in the short-term. In that case, investors will collect the liquidity at the support level found at $42,500.

As of publication time, BTC/USD is trading at $46,625.90, up 0.75% for the day. The 24-hour trading volume of the largest cryptocurrency by market cap is standing at $34,123,056,256 with a loss of 17% as reported by CoinMarketCap.

Technical indicators:

RSI: The daily Relative Strength Index oscillates near the average line with a neutral stance. It reads at 60.

MACD: The Moving Average Convergence Divergence stands above the central line but with a receding bullish momentum.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Breaking: Trump Says The U.S.-Iran War Could End Soon, Mulls Taking Over Strait Of Hormuz

- Bhutan Dumps More Bitcoin as BTC Price Climbs Amid Falling Oil Prices

- Bitget Upgrades Agent Hub to Enable OpenClaw, Claude Code to Trade Crypto in Real Time

- Why Next Two Weeks Are Do or Die for Crypto Market?

- Breaking: Tom Lee’s BitMine Acquires 60,976 ETH As BMNR Stock Eyes Recovery

- Top Analyst Explains Why Pi Network Price May Soar to $0.50 This Week

- Is MSTR Stock Going to Rally $150?

- Bitcoin And XRP Price Prediction As US Oil Prices Fall Sharply- Will This Spark a New Bull Rally?

- Is It a Good Time to Buy XRP As Price Falls 64% From All-time High

- Will Crypto Market Crash This Week? Analysts Predict Timeline for Volatility

- Gold Price Prediction Ahead of March 18 FOMC Meeting

Buy $GGs

Buy $GGs