Bitcoin Price Rally Could Hit $107K, Legendary Trader Predicts Ahead of US Jobs Data

Highlights

- Bitcoin price could jump to $107,000, according to John Bollinger.

- Bollinger developed the popular Bollinger Bands indicator.

- Focus will be on the upcoming US jobs data, which will come out on Wednesday and Friday.

Bitcoin price rally stalled at a crucial resistance level as the recent bull run lost momentum. It was trading at $93,468, a few points below the key resistance at $94,645. Still, one legendary trader believes that the coin may rally to $107,000 as traders focus on the upcoming non-farm payrolls (NFP) data.

Bitcoin Price Could Surge to $107,000

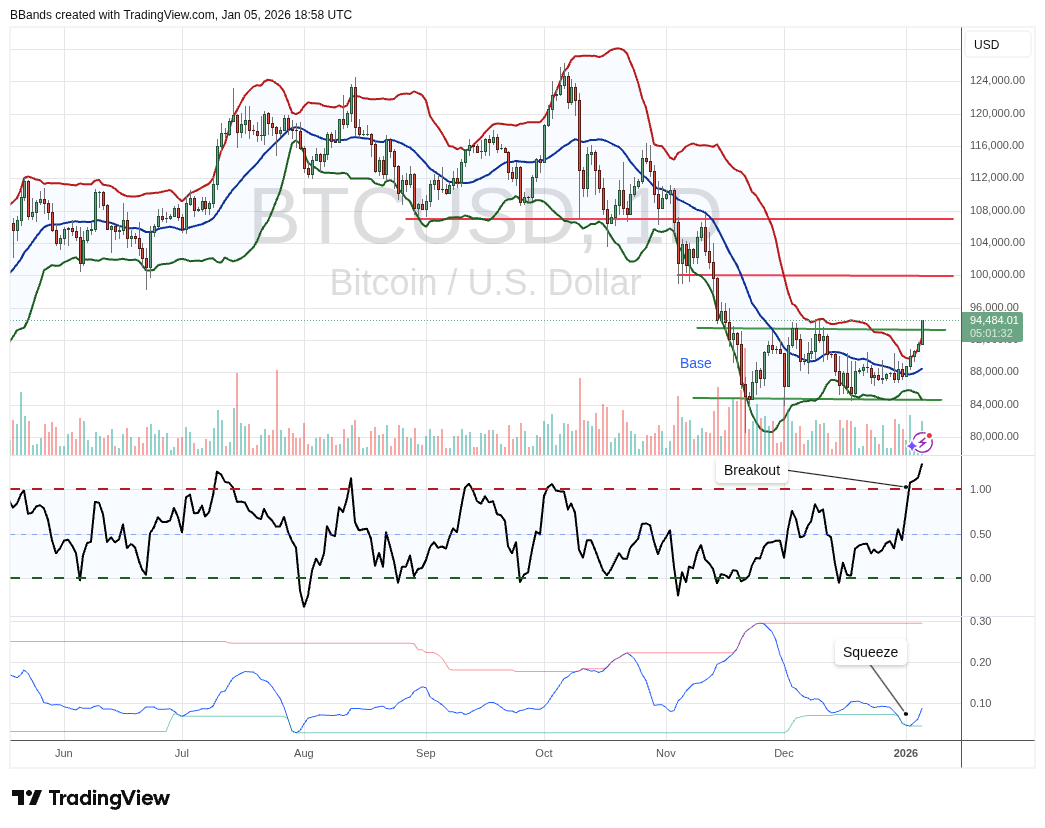

In an X post, John Bollinger, a well-known trader and chartist noted that the coin may surge to $100,000. A move above that level may then see it rising to the important resistance at $107,000. This final target is about 14% above the current level.

Bollinger is popular for developing Bollinger Bands, one of the most common trend indicators. It is made up of three lines, with the middle one being the simple moving average and the two outer ones being the positive and negative standard deviations.

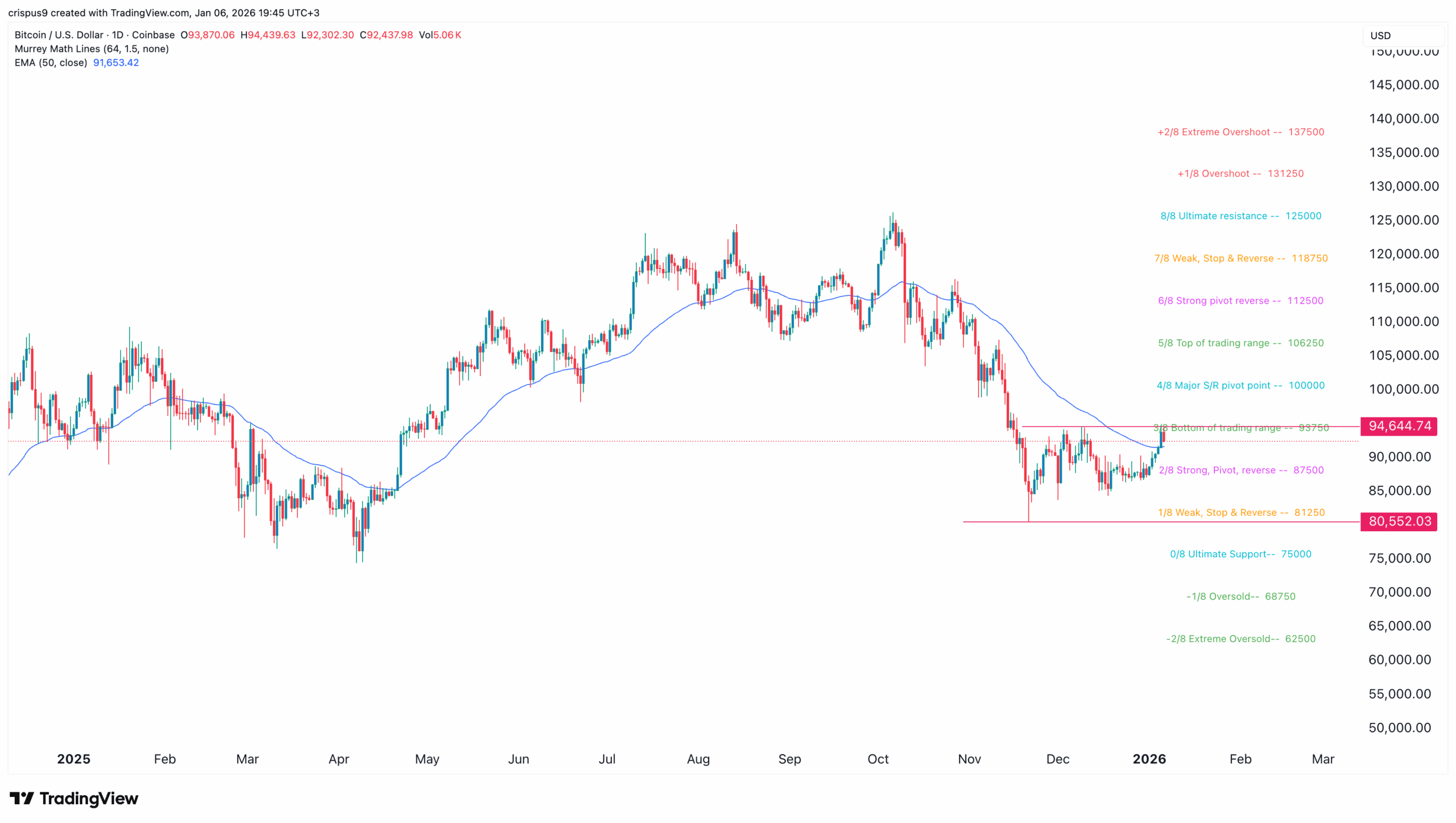

Other technicals support a more BTC price rally if it moves above the key resistance at $94,645. This is an important level where it failed to move above twice in December last year.

The coin has already moved above the 50-day moving average and is attempting to flip the Bottom of the Trading Range of the Murrey Math Line tool.

Therefore, a move above that resistance will point to more gains, initially to the Major S/R pivot point of the Murrey Math Lines at $100,000. A drop below the support at $87,500 will invalidate the bullish outlook. This support is the Strong, Pivot, Reverse point. Such a move will point to more downside, potentially to $80,000.

US NFP Data and Rising Open Interest

Bitcoin price has some important catalysts ahead. One of them is the rising futures open interest, which are a sign that investors are adding leverage to their positions. The figure rose to $63 billion on Tuesday, much higher than where it was in December.

American retail and institutional investors are also boosting their Bitcoin ETF holdings as inflows jumped by $697 million on Monday, higher than the Friday level of $471 million. These funds have now added over $57.7 billion in cumulative inflows, a trend that may continue in the coming weeks.

Meanwhile, Michael Saylor’s Strategy continued its accumulation last week, adding over 1,200 coins into its balance sheet. It now holds over 673k coins worth $62 billion and is not showing signs of slowing down. It has over $11 billion in shares that it can sell to buy more coins. American Bitcoin also bought more Bitcoin recently.

Looking ahead, the next key catalyst for the Bitcoin price will be the upcoming US jobs data. ADP will publish its estimate for the US jobs data on Wednesday, while the Bureau of Labor Statistics will release its estimate on Friday. These numbers will help the Federal Reserve when making its interest rate decision, with officials like Stephen Miran supporting more aggressive cuts.

Frequently Asked Questions (FAQs)

1. What is the most likely Bitcoin price forecast?

2. What are the most likely Bitcoin catalysts?

3. Why is the BTC price rising?

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- Crypto Market Rises as U.S. and Iran Reach Key Agreement On Nuclear Talks

- Trump Tariffs: U.S. Raises Global Tariff Rate To 15% Following Supreme Court Ruling

- Bitwise CIO Names BTC, ETH, SOL, and LINK as ‘Mount Rushmore’ of Crypto Amid Market Weakness

- Prediction Market News: Kalshi Faces New Lawsuit Amid State Regulatory Crackdown

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise