BTC Price Analysis: Falling Volumes Hints Extended Consolidation Near $22,000

The Bitcoin price remained offered amid a lukewarm trading session on Monday. The price opened higher but fell quickly to test the intraday low of $21,702. However, as influenced by the previous week’s price action, it moved back to reclaim the $22,000 mark.

- BTC price started the fresh trading weak on a lower note.

- Bulls were not able to withstand higher opening in the early trading hours.

- However, an impressive bounce back from $21,700 points at the range bound movement.

Why 22,000 is crucial?

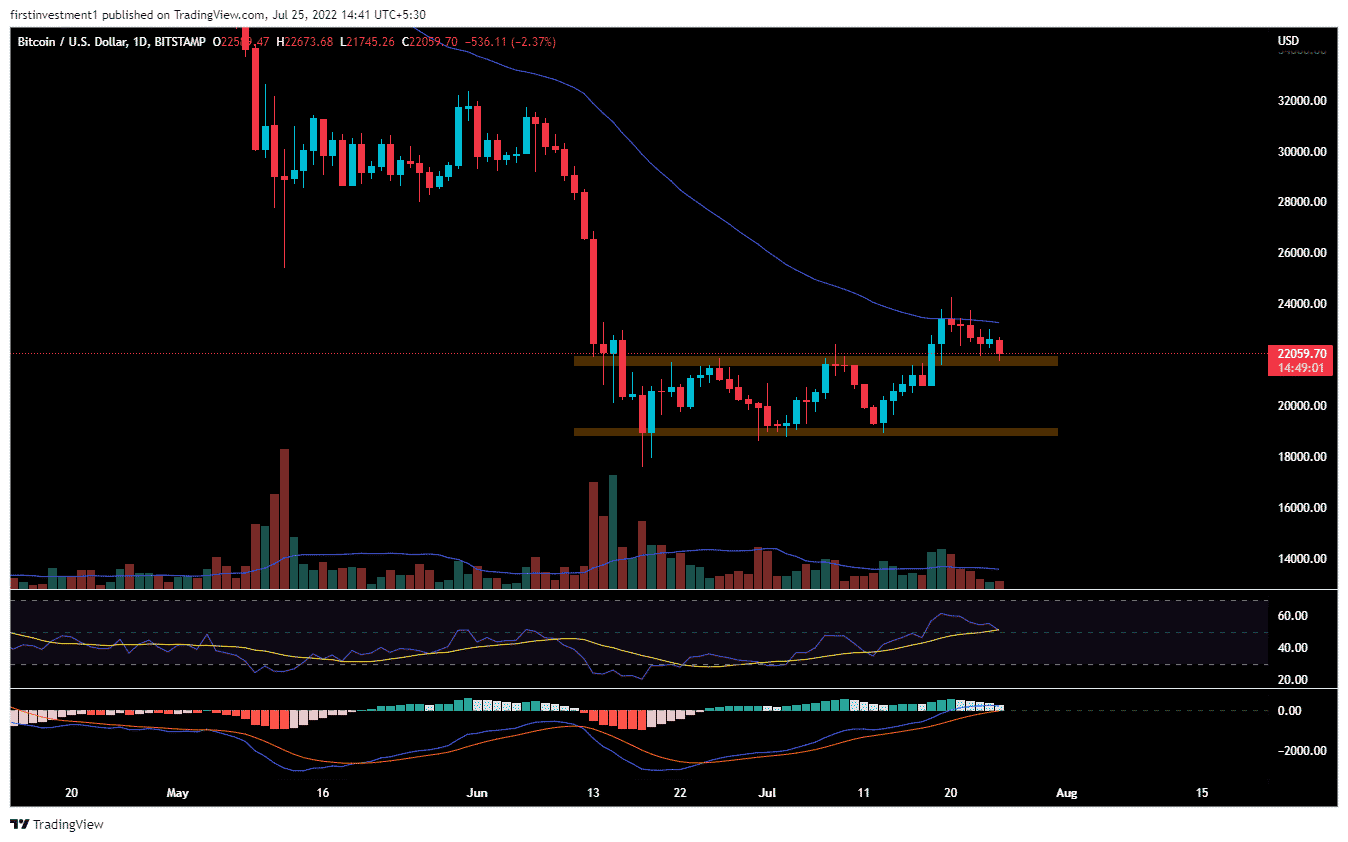

BTC remained in a short-term consolidation that extends from $18,000 to $21,000 since June 16. The price breached the resistance zone on July 18, and testify one month near $22,780 with impressive volumes. In an earlier attempt, the asset was rejected near $22,490. Thus, the support-turned-resistance level is a make or break point for BTC investors. For today, the BTC price analysis remains neutral as prices are expected to move in a familiar trading range.

As of publication time, BTC/USD reads at $21,875, down 3.16% for the day. According to CoinMarketCap, the 24-hour trading volume jumped 10% at $28,700,215,128.

On the daily chart, the BTC after moves higher after giving a breakout out of the short-term consolidation. Next, it tagged the 50-day Exponential Moving Average (EMA) and return to a corrective pullback mode. Thus, it acted as a critical resistance level for the bulls to surpass.

The retest of $22,000 level makes it a psychological to hold. It would be marked as a make-or-break level for BTC buyers.

The RSI(14) is trading near 50 with a negative bias. The oscillator is about to break the RSI MA line, which is a sign of bearishness. If RSI goes below 49, then we can expect more downside in the asset.

Another important indicator, the trading volumes are below average, showing a lack of buying interest as the price approaches the support level.

A break below the session low would see $21,600 as the first downside target.

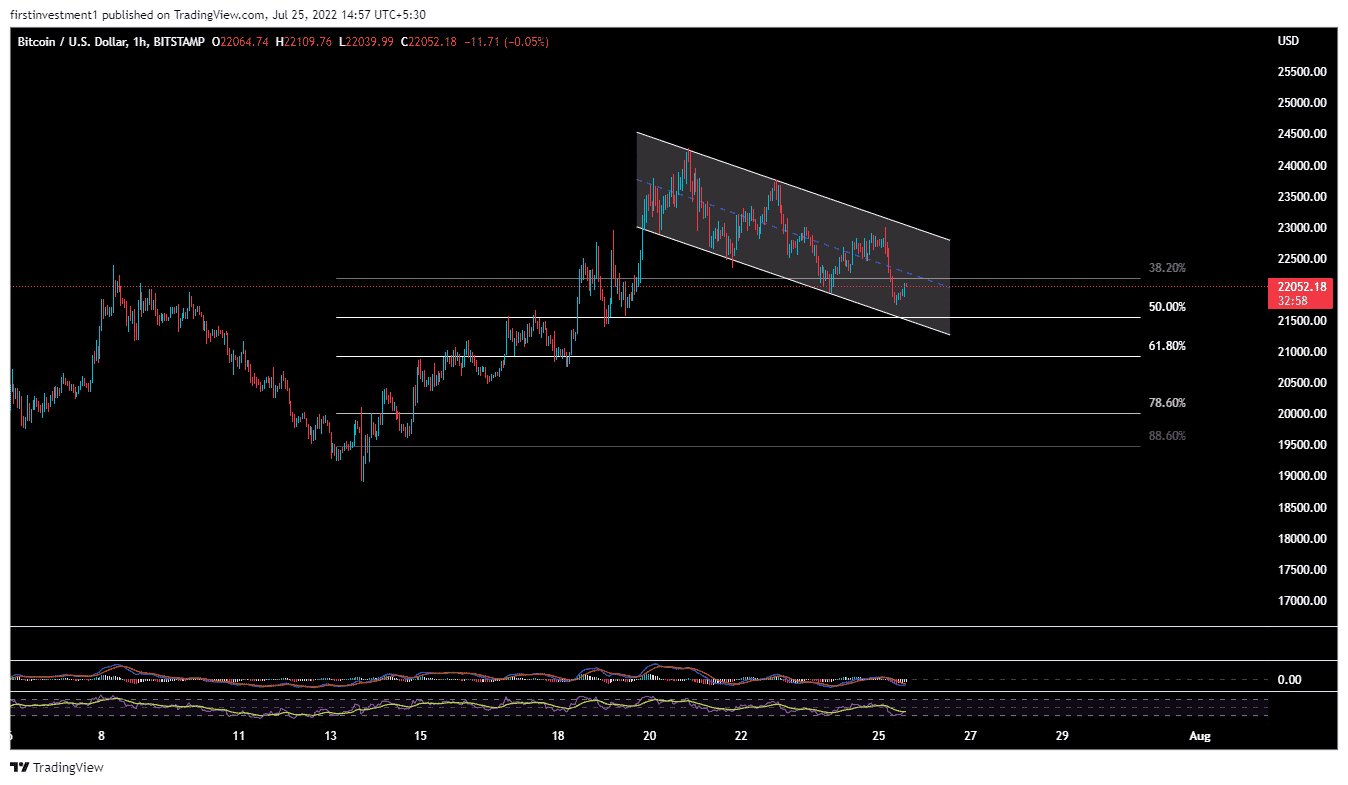

On the hourly time frame, the price is moving in a downward channel with an immediate support near 50.0% Fibo. retracement level at $21,800.

On the flip side, a buying interest could push toward the previous session high of $23,000.

Conclusion:

BTC is trading at the no-zone stage. A decisive break below $22,000 on a daily basis would open the gates for the more fall.

- Top 3 Reasons Why Crypto Market is Down Today (Feb. 22)

- Michael Saylor Hints at Another Strategy BTC Buy as Bitcoin Drops Below $68K

- Expert Says Bitcoin Now in ‘Stage 4’ Bear Market Phase, Warns BTC May Hit 35K to 45K Zone

- Bitcoin Price Today As Bulls Defend $65K–$66K Zone Amid Geopolitics and Tariffs Tensions

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?

- Pi Network Price Prediction: How High Can Pi Coin Go?

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible