BTC Price Prediction: Where Will Bitcoin Price Head This Month; $25k or $18K?

BTC Price Prediction: The Bitcoin price showed an unclear trend for the first week of March, creating a sense of uncertainty in the market. However, the second week started on a bearish note as the coin price witnessed 4% in the last three days. As of now, this downfall halts at a strong support 0.382 Fibonacci retracement level, holding the hope of coin holders. Can BTC price resume a bullish recovery from here?

Key Points:

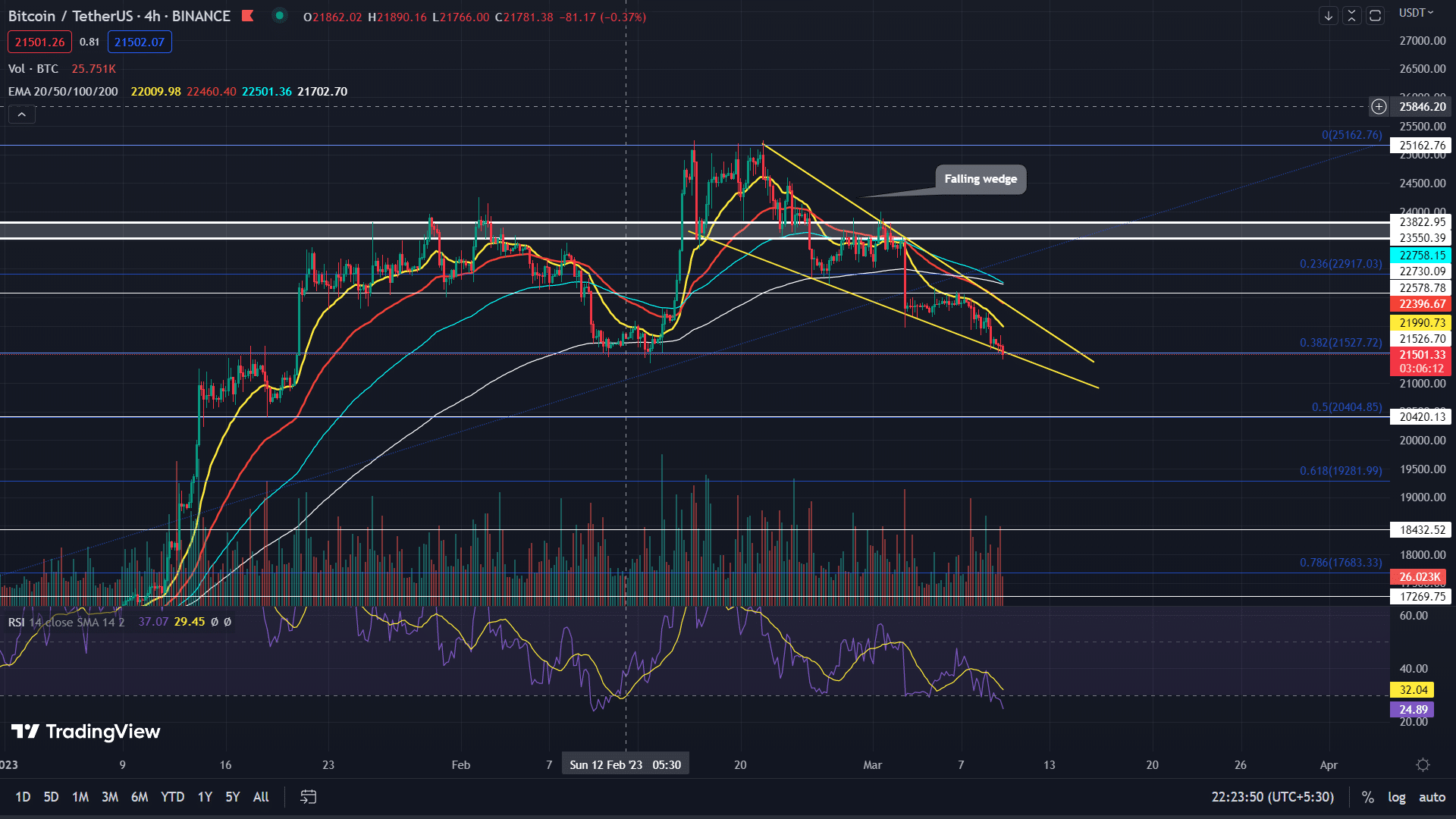

- The Bitcoin price spread narrowing within the falling wedge pattern indicates a breakout opportunity nearby.

- The ongoing correction phase in BTC price will continue until the wedge pattern is intact.

- The intraday trading volume in Bitcoin is $21 Billion, indicating a 7.2% loss.

Source-Tradingview

Source-Tradingview

The Bitcoin price has been in a correction phase for nearly three weeks now and has experienced a decline of 13.8% from the peak of $25200. This downfall has plunged the coin price to a combined support zone of 0.382 FIB and $21500 psychological level and the lower support trendline of a falling wedge pattern.

By the press time, the BTC price trades at $21636 and continues to hover above $21500 support. Usually, a retest to trendline support of the wedge pattern triggers a minor bullish pullback to hit the overhead trendline.

Also Read: Top 10 Carbon Negative Cryptos For 2023

However, the interested buyer will need a breakout above the resistance trendline to obtain a long entry opportunity in Bitcoin. This breakout will signal the end of the ongoing correction phase and a higher possibility of uptrend continuation.

The post-breakout rally may soar the BTC price to the following targets of $22400, $23800, or $25000.

On a contrary note, a breakdown below the lower support trendline will invalidate the bullish thesis.

Technical indicator

RSI: despite the declining price action, the daily RSI slope moving sideways signals the weakening of bullish momentum. Thus bullish divergence may offer additional confirmation for a wedge pattern breakout.

EMAs(4-hour chart)-: the 20-day EMA slope act as a dynamic resistance to Bitcoin price

Bitcoin Price Intraday Levels

- Spot rate: 21646

- Trend: Bearish

- Volatility: High

- Resistance levels- $22500 and $23800

- Support levels- $21500 and $20500

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs