Can Bitcoin Price Reach $120K in the Next 7 Days of January?

Highlights

- Bitcoin price trades above $100K, primed for a bounce, with potential targets at $120K before January 2025 ends.

- Technicals indicate clear skies, with RSI bouncing off 50 and AO showing reduced bullish momentum.

- BTC Open Interest recovers to ATH levels, currently sitting at $67.52 billion.

Bitcoin’s price trades at $104,734.0 on 11 PM as of February 27. But will BTC reach $120,000 in the next seven days of January 2025 as US President Donald Trump signs an executive order to stockpile Bitcoin and other crypto assets?

Bitcoin Price Today

Bitcoin price today hit a daily high of $107,006.0 and is up 0.54%. This development comes after President Donald Trump announced via executive order to create a national digital asset stockpile. Hence, the chances of BTC hitting $120K before January 2025 ends are high. While many expected a Bitcoin reserve, the president took a generalist route, hinting that the US could accumulate Bitcoin and other cryptocurrencies as well.

*TRUMP ORDER ON CRYPTO TO DEVELOP NATIONAL DIGITAL ASSET STOCKPILE: FOX

— db (@tier10k) January 23, 2025

*bitcoin price updated as of 11 PM.

Despite this bullish announcement, the crypto markets remain unchanged except for the short-term volatility. However, technicals suggest that BTC hovers above the $100K psychological level and is primed for a bounce. Many analysts speculate that the news of a national crypto stockpile is not priced in and expect a massive rally. As noted above, the chances are high, but will Bitcoin price rise to $120K in the next seven days? Let’s find out.

Will Bitcoin Price Hit $120K in Next 7 Days?

From a technical standpoint, BTC price firmly stands above the $100K psychological level, despite recent market volatility. This signals strength and hints buyers could be defending this key support, hinting at a bounce.

The key support levels include $100K, $98,638 and $96,800. Even if BTC slides below $100K, the $99K to $96K is a buy zone, as noted in a previous article. The 50-day Simple Moving Average (SMA) hovers inside this buy zone at $98,638, making it a good place to accumulate BTC.

On the contrary, the ATH at $110K, $115K and $120K are key resistance levels that could cause friction for the uptrend and where investors should consider booking profits.

Technicals Indicate Clear Skies

The Relative Strength Index (RSI) has been bouncing off 50 for the past few days, adding credence to the idea that buyers are defending $100K support. A rebound off the mean level will signal a bullish momentum comeback and support Bitcoin revisiting its $110K ATH.

The Awesome Oscillator (AO) shows no clear signal due to the recent chop. However, the recent descent in histogram bars coupled with consolidation reveals reduced bullish momentum.

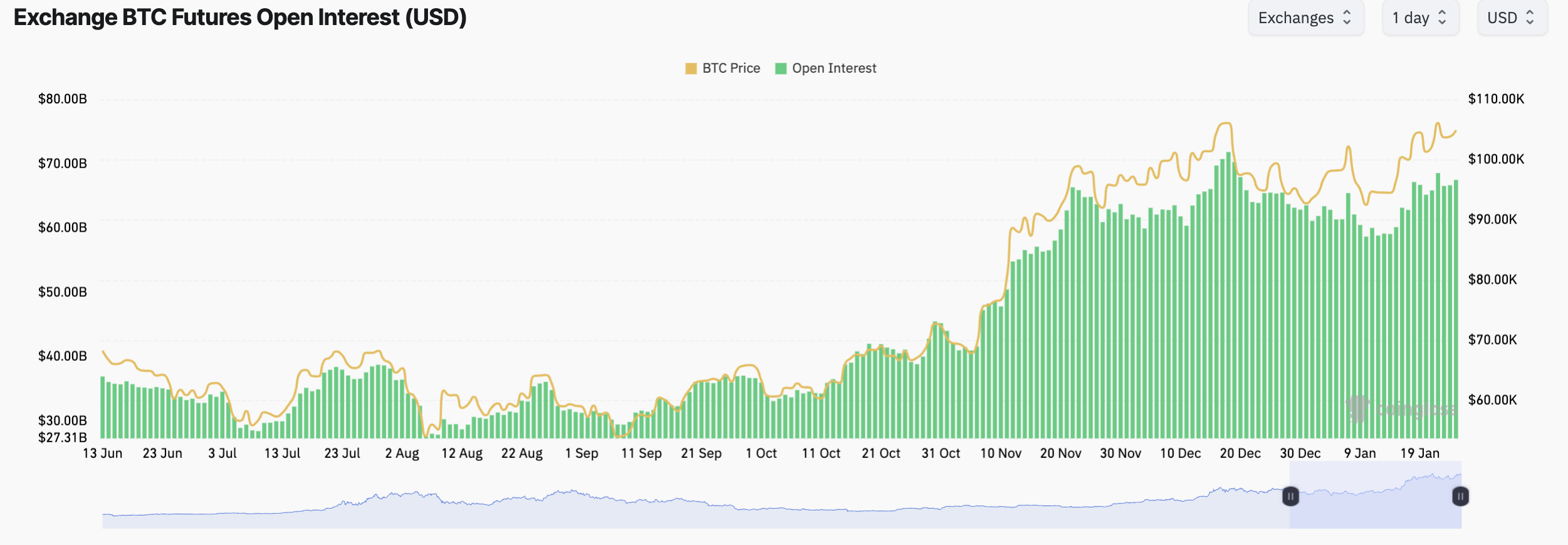

BTC Open Interest Recovers to ATH Levels

On December 18, 2024, Bitcoin price hit an all-time high of $106K. Interestingly, the Open Interest (OI) also hit a new high of $71.85 billion. As a result of market uncertainty and profit-taking, the OI dropped to a low of $58.87 billion on January 12. The recent optimism surrounding the US President’s inauguration and approval of the national crypto stockpile has caught investors’ attention, which also explains the surge in OI back to the ATH levels. Currently, the OI sits at $67.52 billion.

To summarize, Bitcoin price prediction is bullish. Technicals and other data points suggest that a bounce from $100K is likely. The next logical take-profit level for BTC is $120K. With only seven days left for the first month of 2025 to end, it is likely the month-end dynamics could trigger a volatile move to $120K.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

Frequently Asked Questions (FAQs)

1. What is Bitcoin's current price?

2. Will Bitcoin price reach $120,000 in the next seven days?

3. What is the significance of the US President's executive order on Bitcoin?

- $2T Barclays Explores Blockchain For Stablecoin Payments and Tokenized Deposits

- Breaking: U.S. PPI Inflation Rises To 2.9%, BTC Price Falls

- XRP News: Ripple-Backed Ctrl Alt Completes $280M in Diamond Tokenization on XRPL

- Bitwise CIO Calls Bitcoin Selloff ‘Classic Cycle,’ Dismisses Manipulation Rumors

- Cardone Capital Takes Real Estate On-Chain With $5B Tokenization Plan

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs