Chainlink Price Analysis: Refreshes 4-month High Above $8.80; More Gains In Offer?

Chainlink (LINK) price analysis indicates an extension of the previous up trend. However, as the U.S trading session begins the price moved in a very range-bound manner and recovered after testing the intraday low of $8.27.

The addition of new buyers is required to continue with the bullish momentum. The price faces rejection near $8.80.

- Chainlink price retested the 4-month highs above $8.80 on Tuesday.

- The price looking for a decisive break out above $8.80 to test the psychological $10.0 level.

- The nearest support is placed at around $8.20.

Chainlink price signals upside continuation

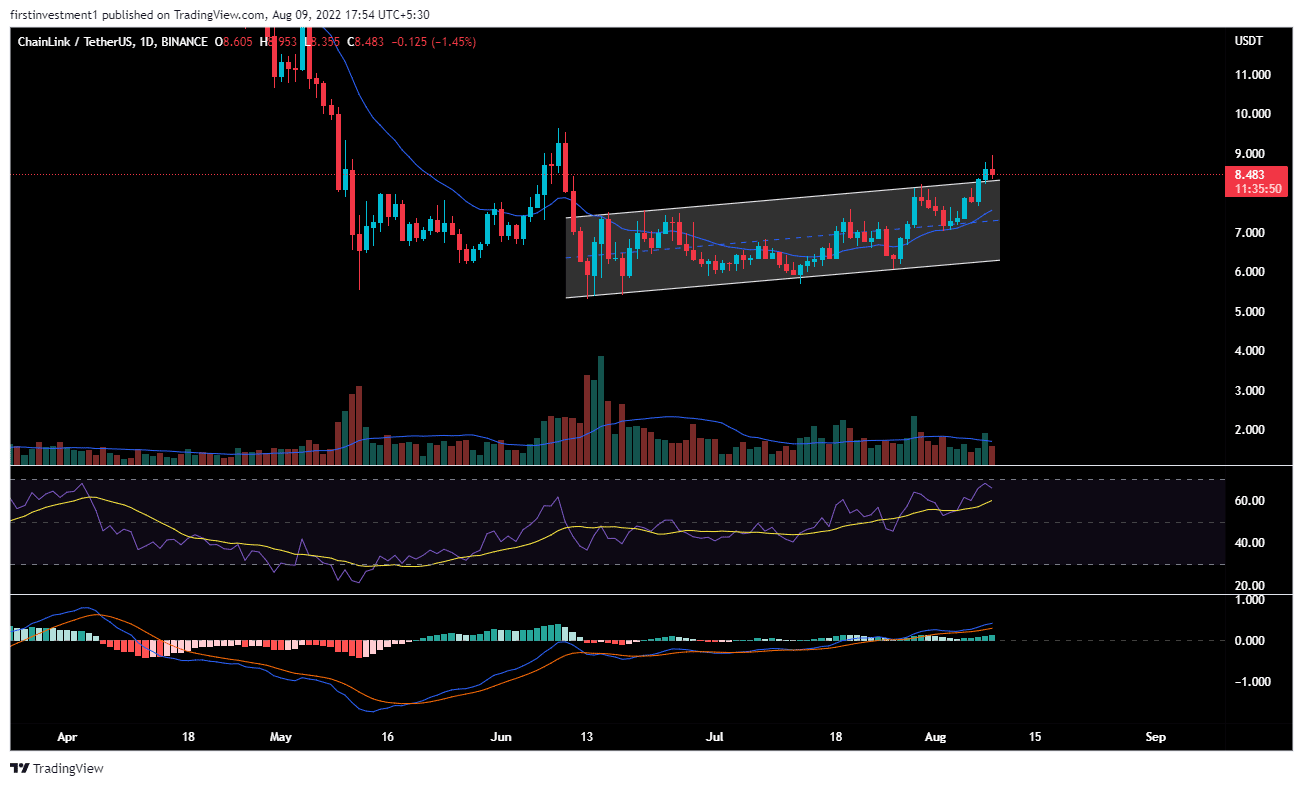

On the daily chart, the price is trading in a rising channel, making higher highs and higher lows. The price consolidated in a range of $6.20 and $7.40 since June 06.

Finally, the price breaks above the price range on July 29 with above-average volumes and surged 16%. Further, the price tagged the swing high of $8.95.

Currently, the bulls seemed to be resting near the higher levels. There is a higher probability that the price would produce a breakout on the higher side. However, the condition is that the buyers must hold $8.80 on a daily closing basis.

On moving higher, the Chainlink price would target the psychological $10.0 level.

On the other hand, the downside seems to be capped near $8.0. If broken would amplify the selling.

The RSI (14) is trading above 50, indicating that the average gain is larger than the average loss. Any uptick in the indicator would strengthen the bullish outlook.

The MACD indicator is also positive. A positive MACD value, created when the short-term average is above the longer-term average, is used to signal increasing upward momentum. This value can also be used to suggest that traders may want to refrain from taking short positions until a signal suggests it is appropriate.

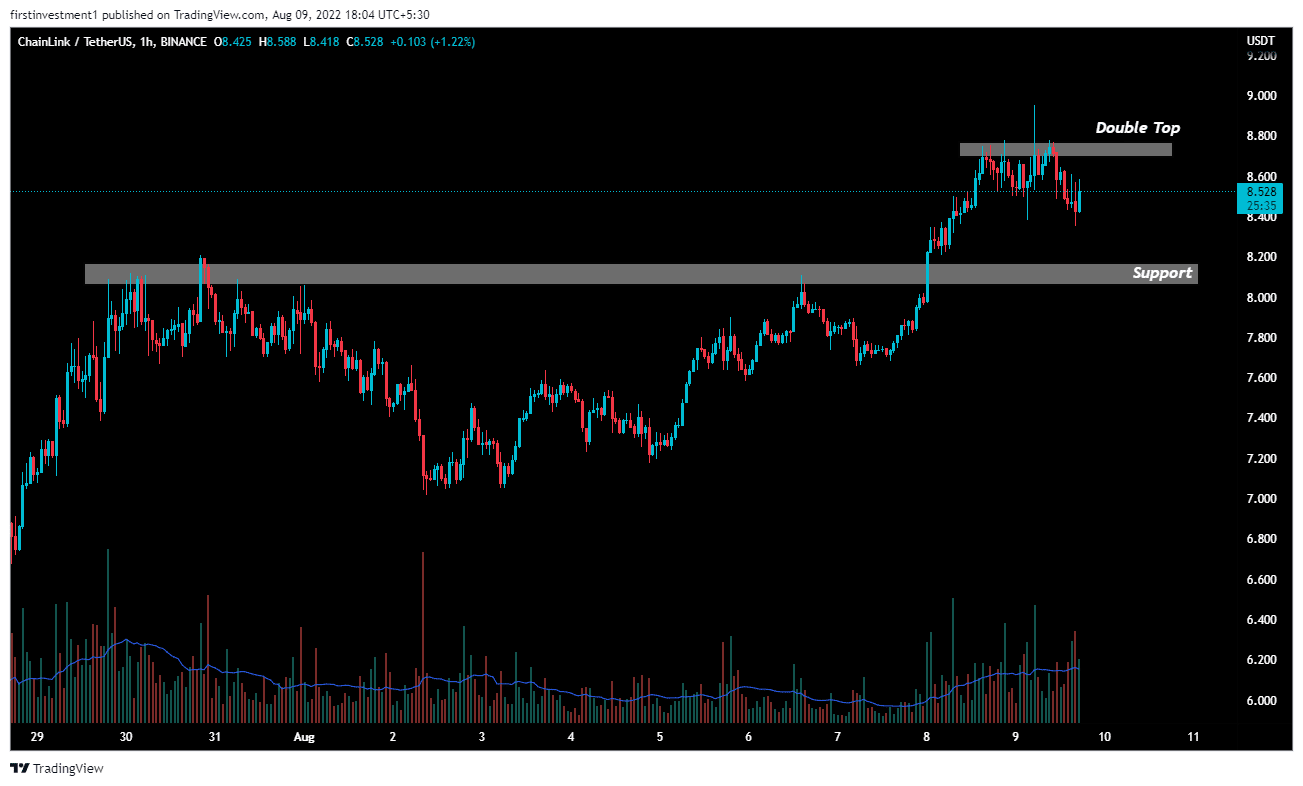

On the hourly time frame, the price formed a ‘Double Top pattern, indicating selling pressure on higher levels.

These constitute two-possible scenarios. First, if the price is not able to break above $8.760 within a day, then we can expect a good fall of up to $8.13.

Secondly, if the price is able to break above $8.760, then we can expect a good bullish momentum of up to $9.4. As reflected by above-average volumes, there is a higher probability of breaking above the $8.760 level, which is also resistance for now.

Conclusion

Chainlink price is consolidating with a positive bias on all time frames. Above $8.800 on a daily basis closing, we can put a trade on the buy side.

As of press time, LINK/USD is reading at $8.58, down 0.37% for the day. According to CoinMarketCap data, the 24-hour trading volume held near $642,818,628 with more than 14% gains.

- Ripple’s RLUSD Gets Institutional Boost as SEC Eases Stablecoin Rules for Broker-Dealers

- Crypto Market Weekly Recap: BTC Waver on Macro & Quantum Jitters, CLARITY Act Deadline Fuels Hope, Sui ETFs Go Live Feb 16-20

- Robert Kiyosaki Adds To Bitcoin Position Despite Market Decline

- XRP News: Ripple Partner SBI Reveals On-Chain Bonds That Pay Investors in XRP

- BitMine Ethereum Purchase: Tom Lee Doubles Down on ETH With $34.7M Fresh Buy

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral