Chainlink Price Outlook: Analyst Predicts $100 as Reserve Adds 63K LINK

Highlights

- Analyst forecasts a potential $100 target if Chainlink breaks above $25.

- LINK’s Reserve grows by 63,481 LINK, signaling stronger network accumulation.

- Futures Taker CVD data shows sustained buy-side dominance from institutional traders.

The Chainlink price has maintained steady traction near $17.6, with on-chain accumulation strengthening investor confidence. Following a sustained rebound from its demand zone, the market structure reflects growing optimism supported by recent reserve growth. Meanwhile, an analyst projects that a breakout above $25 could trigger an explosive rally toward the $100 region, highlighting a potentially pivotal setup for the weeks ahead.

Analyst Eyes $100 as Chainlink Price Compresses Toward Breakout

Analyst Ali highlights a tightening symmetrical triangle, with LINK consolidating between $15 and $25. This setup reflects long-term accumulation, where volatility narrows before a major expansion.

Besides, the symmetrical pattern suggests that a decisive breakout could soon unfold, with Fibonacci extensions pointing toward a potential $100 rally. The multi-year consolidation reinforces structural strength, supported by consistent higher lows since 2022.

Specifically, a break above $25 would confirm the anticipated bullish expansion, validating the upward projection and strengthening investor conviction. Therefore, the broader setup supports a favorable LINK long-term price forecast, particularly if the asset sustains levels above $18 through the upcoming sessions.

On the 1-day chart, Chainlink price has rebounded strongly from the $16 demand zone, the same level that previously triggered an 80% rally. Notably, the setup forms a clear bullish pennant flag, supported by consistent higher lows that highlight renewed buyer strength.

Immediate resistance lies around $19.95, a level that has historically sparked sharp acceleration once breached. This aligns with LINK’s previous analysis, which projected a move toward $27 before December, reinforcing ongoing bullish conviction.

The structure mirrors the earlier rally, where similar consolidation preceded a steep breakout. Therefore, if LINK maintains stability above $17, the market could see another 80% surge, potentially extending gains toward $30 by the end of Q4.

Reserve Growth and Futures Data Reinforce Bullish Bias

The Chainlink Reserve has expanded by 63,481 LINK, raising its total holdings to over 586,000 LINK. This steady accumulation underscores the network’s strengthening fundamentals and growing investor confidence in Chainlink’s long-term sustainability.

The reserve’s continuous growth indicates that both enterprise and ecosystem participants are contributing to the protocol’s expansion, signaling deeper adoption and sustained demand. Moreover, the rising reserve acts as a liquidity buffer, helping stabilize the token’s value during volatile market conditions.

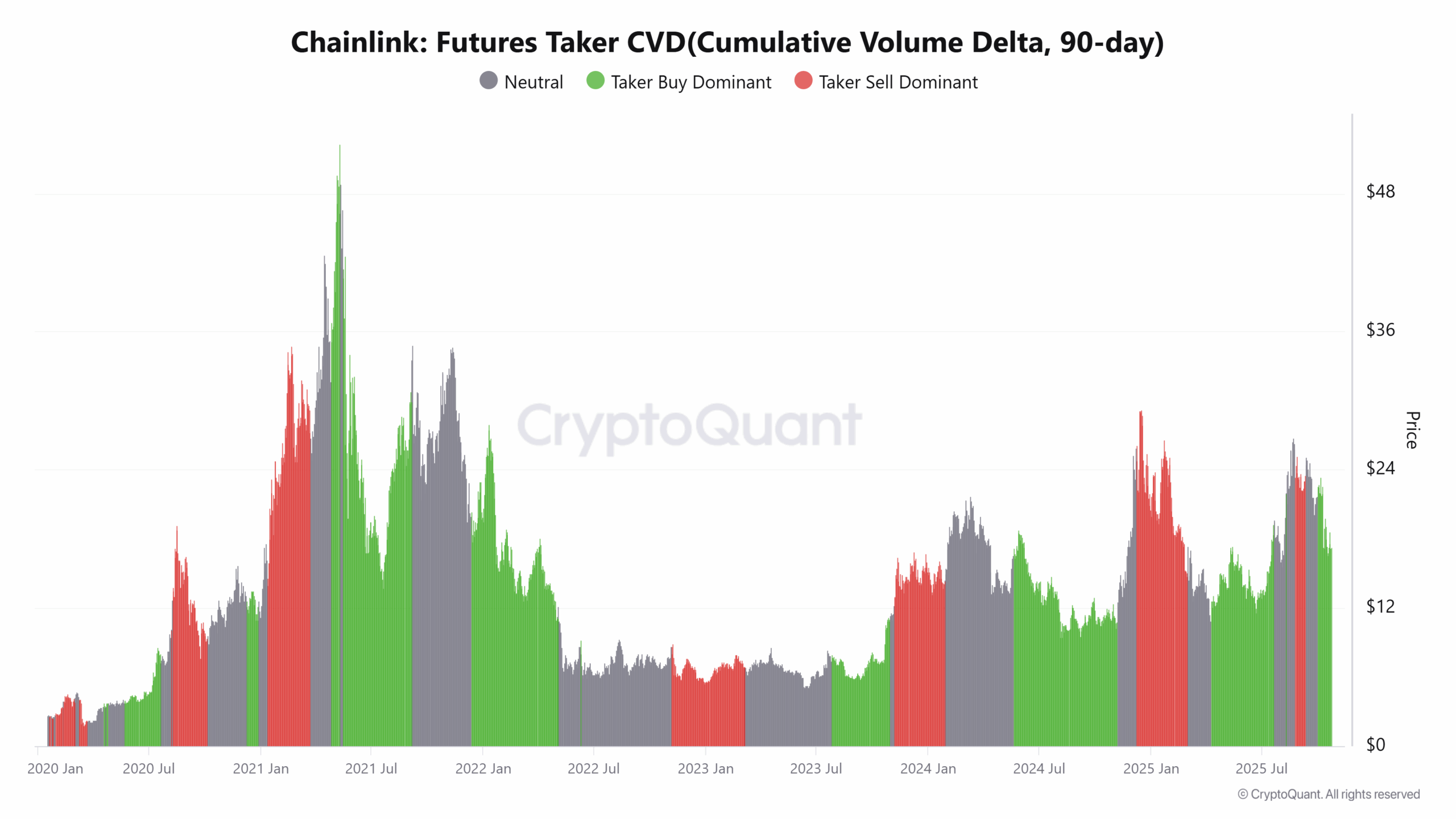

Meanwhile, the 90-day Futures Taker CVD remains firmly in “Taker Buy” dominance, confirming that aggressive buyers continue to dictate derivatives market activity. This persistent buy-side control often aligns with institutional accumulation, suggesting that large players are positioning ahead of a potential breakout.

The combination of strong on-chain accumulation and futures data paints a unified bullish picture. Therefore, the current Chainlink price outlook appears reinforced by both spot and derivatives strength, supporting continued upward pressure into year-end.

Could $25 Be The Trigger?

Chainlink’s tightening structure, reserve expansion, and strong taker dominance indicate rising bullish strength. The $25 level remains the crucial breakout threshold that could validate the analyst’s $100 target. Sustained buying pressure above this level would likely confirm a long-term structural reversal. If this pattern holds, LINK could enter a powerful uptrend heading into 2026.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

Frequently Asked Questions (FAQs)

1. How does the symmetrical triangle affect LINK’s outlook?

2. What does the Chainlink Reserve represent?

3. Why is the Futures Taker CVD important?

- Peter Brandt Flips Bullish, Predicts Bitcoin Rally As Price Holds Above $70k

- XRP News: Institutional Use Case Expands as Doppler Finance Integrates WXRP for Multi-Chain Access

- Trump Tariffs: Bitcoin Faces Fresh Headwinds as 15% Global Tariffs Begin This Week Amid Iran War

- Bitget Unveils ‘Crypto Anti-Bias Pledge’ To Support Women’s Inclusion In Crypto

- U.S.-Iran War: Crypto Market Rebounds as Iran Reportedly Reaches Out To U.S. To End Conflict

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

Buy $GGs

Buy $GGs