Chainlink Price Prediction: Whales Scoop 2M LINK as Analysts Eye 184% Breakout Rally

Highlights

- Analyst projects 184% Chainlink rally with $79 target if breakout sustains.

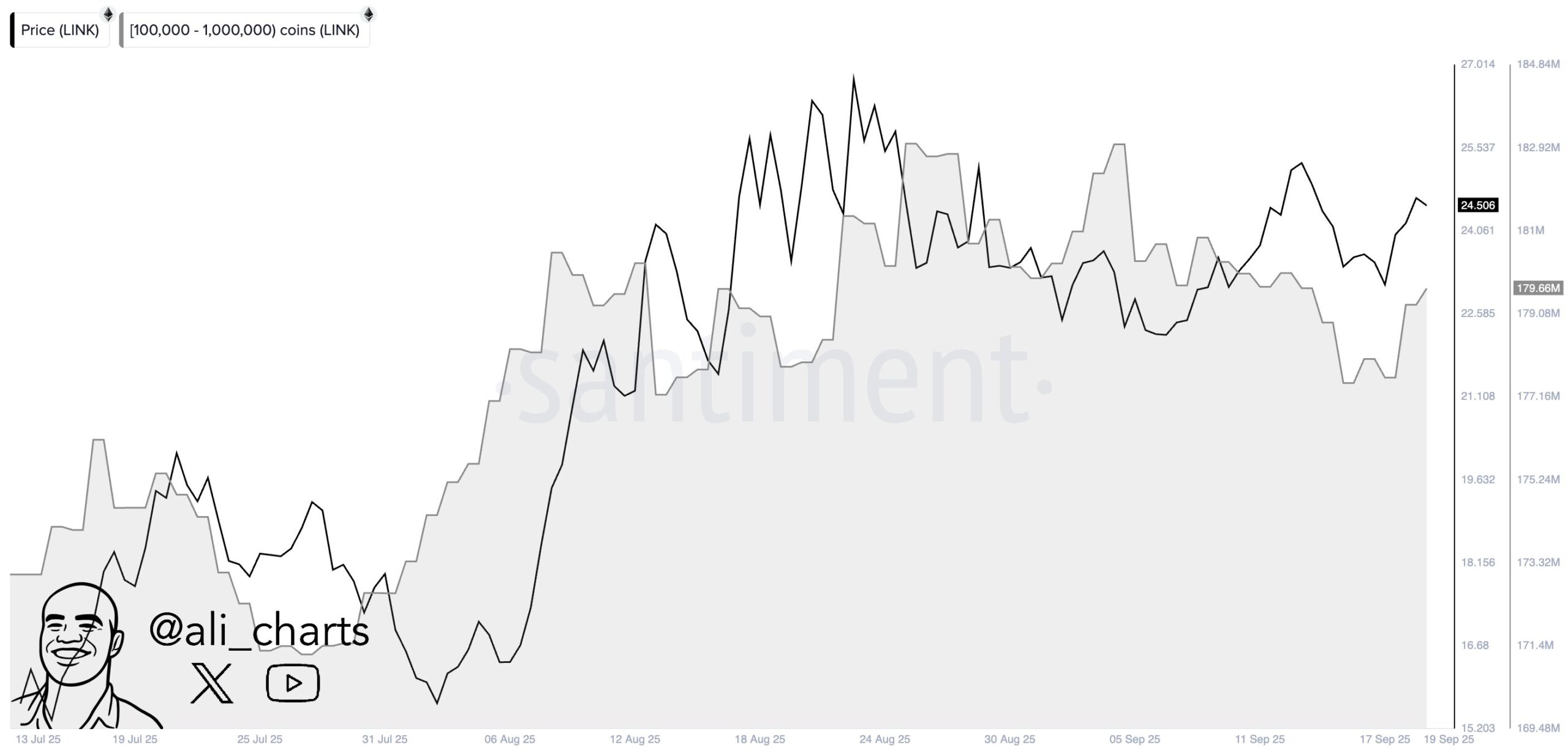

- Whales bought nearly 2M LINK in 48 hours, signaling strong market conviction.

- Polymarket integrates Chainlink’s data standard to enhance prediction markets.

Chainlink price has recently faced a pullback, reflecting a 4.31% decline over the past day. The LINK price currently trades at $23.45, holding near a key support level despite selling pressure. Market capitalization has slipped to $15.9 billion, though daily trading volume remains resilient above $1.1 billion. Meanwhile, an analyst is projecting a 184% rally, highlighting the potential for Chainlink to stage a parabolic breakout if bullish structures hold.

Chainlink Price Action: Will $79 Become the Next Target?

Chainlink price action has shown resilience even after the recent dip, keeping focus on higher resistance levels. The LINK current trading value at $23.45 sits just above immediate support near $22.58.

However, a decisive close above $26 could unlock upside toward the $30 region, which historically capped prior rallies.

Beyond this threshold, the chart indicates a Fibonacci projection aligning with the $46.85 target. Furthermore, an analyst highlights an ambitious 184% rally that could propel LINK toward $79.

Such a surge would represent a parabolic phase, similar to historical breakout cycles. Therefore, sustaining momentum above $22 remains vital to confirming these upward projections, reinforcing the strength for long-term LINK price prediction.

Whale Moves and Polymarket Partnership Fuel Confidence

In the past 48 hours, whales have accumulated nearly 2 million LINK, reinforcing conviction in a bullish continuation at press time. This large-scale acquisition reflects confidence in future valuations and aligns with technical breakout structures.

Additionally, whale activity often signals upcoming expansions, making this development significant. Current inflows into long-term wallets confirm growing interest among deep-pocketed investors.

As a result, such accumulation enhances the credibility of the projected breakout targets. Therefore, whale buying strengthens the bullish narrative surrounding the Chainlink price trajectory.

Moreover, Chainlink announced that Polymarket will integrate its data standard into resolution processes, expanding real-time pricing accuracy. This partnership, already live on Polygon, aims to support secure prediction markets across crypto assets.

With Polymarket reentering the U.S. market, the timing adds greater relevance to this collaboration. Together, whale buying and new integrations bolster the case for sustained bullish growth in Chainlink price.

To sum up, Chainlink price remains at a critical junction as both whales and technical signals point upward. The LINK price holding above $23 while whales accumulate strengthens the bullish case. With analysts forecasting a 184% parabolic surge, the potential upside cannot be overlooked. Therefore, the broader outlook supports bullish continuation if support levels remain intact.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

Frequently Asked Questions (FAQs)

1. What role do whales play in Chainlink’s market structure?

2. How does Chainlink benefit from exchange inflows and outflows?

3. Why is the Polymarket partnership significant for Chainlink?

- Analyst Predicts Bitcoin Price Dip to $55K as ETFs See Outflows Amid Middle East Tensions

- Ethereum Co-founder Sparks $157M Sell-Off Fears as ETH Struggles Below $2k

- Analyst Predicts XRP Price Could Fall to $1 as XRP ETFs Record Net Weekly Outflows

- U.S.-Iran War: Trump Threatens to Hit Iran ‘Very Hard’ Today as Bitcoin Faces New Selling Pressure

- Crypto Market Weekly Recap: US-Iran War Steer Crypto Prices, Kraken Gets Fed Master Account, Tokenization Push March 2-6

- Dogecoin, Pepe coin, and Shiba Inu Price Prediction As BTC Crashes Below $70k

- Here’s Why Cardano Price Has Not Reclaimed $0.30

- Will XRP Price Crash as U.S. Nonfarm Payrolls Fell by 92,000 in February?

- Pi Network Price Eyes a 40% Surge as Pi Day Looms on March 14

- Top Reasons Why Circle Stock Price is Surging

- Gold Price Prediction as US-Iran War Hits the Second Week

Buy $GGs

Buy $GGs