Chainlink Price Surges 20%: What’s Driving Massive Upswing?

Highlights

- Chainlink price surges on ETF launch, boosting institutional access and demand.

- Technical indicators depict good bullish momentum despite the overbought market.

- Increased volume trading proves new investor confidence that enhances long-term upside growth.

Chainlink price has jumped by 20% in the last 24 hours, showing strong momentum amid a broader crypto market rebound. The LINK is currently holding firm above the $14 mark, following a sharp move up from recent support levels.

The technical indicators are also signs of a potential bullish continuation when LINK tries to consolidate its profits and check new resistance levels.

Here’s Why Chainlink Price is Up Today

Chainlink price saw a sharp price increase today, supported by a massive surge in trading volume. In the past 24 hours, LINK increased its volume by 92% to 1.21 billion. This increase is an indicator of the growing investor confidence, wherein the bullish sentiment is growing around the altcoin.

The boom is driven by the release of the first-ever U.S. Chainlink ETF. The Grayscale asset manager turned its previous Chainlink Trust to the GLNK ETF. This step brings in an institutionalized vehicle with direct exposure to LINK as it opens up institutional investments.

Grayscale Chainlink Trust ETF (Ticker: $GLNK) with 0% fees is now trading¹.

The first @chainlink ETP in the U.S. — from Grayscale, the world’s largest crypto-focused asset manager².

Gain exposure to $LINK, the core infrastructure for connecting blockchains to the real world.… pic.twitter.com/CjoemYxyEI

— Grayscale (@Grayscale) December 2, 2025

During the initial trading day, GLNK ETF had 1.17 million shares tradings. That is close to 28 times its former average volume as a private trust. This kind of institutional activity on the first day is an indication of heavy demand and new-found optimism in the market.

This ETF milestone comes in an overall upsurge in the crypto market. The total market climbed 6.61 within the last 24 hrs. Bitcoin has shot well above $93,000, and Ethereum price above $3,000, up 10%. Solana price gained by 12%, and it stayed above $140. Other altcoins, such as ADA, XRP, and HYPE, also registered significant returns.

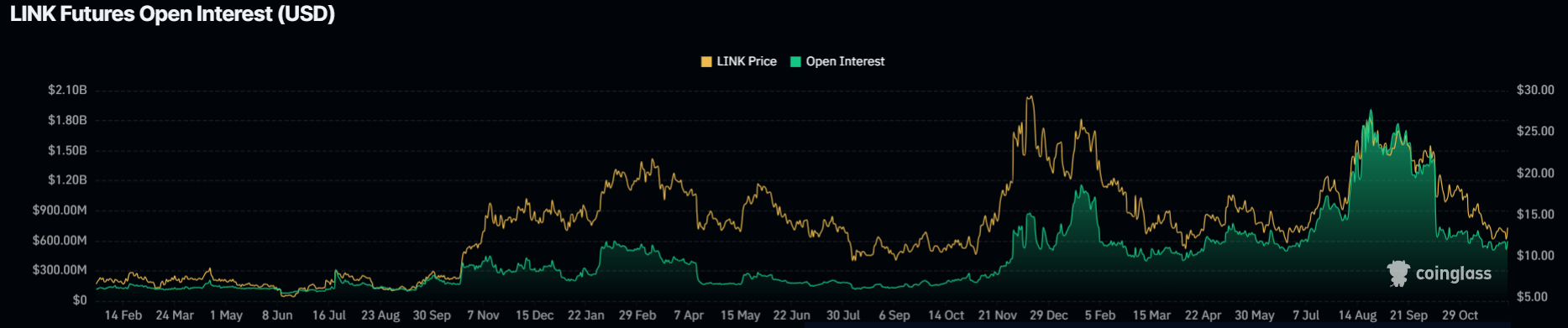

LINK Derivatives Activity Shows Strong Growth

Chainlink blockchain is demonstrating extensive resilience as line with the overall market direction of the bullish trend. With the introduction of the GLNK ETF, it is likely to introduce steady capital flow into LINK.

Following the weeks of lateral trading, LINK can be expected to carry on with the momentum, supported by this system shift in investment and the larger strength in the market.

Can LINK Price Hit $20 In 2025?

The LINK price surged to $14.60 as buyers pushed the token toward a key resistance zone.

The MACD line overtook the signal line and again started rising. The move signified an upward momentum, which has been a long time coming following mid-range trading. The RSI stood at 76, positioning the market at overbought levels.

The next resistance targets stood near $16.00, followed by $18.00 as the full Chainlink forecast report. A sustained move above these thresholds could open the path toward the $20.00 region.

If price loses momentum, support may form near $14.00, with additional could dip to $13.20.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

Frequently Asked Questions (FAQs)

1. Why did the Chainlink price surge 20% today?

2. What is the new GLNK Chainlink ETF?

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

Buy $GGs

Buy $GGs