Chainlink Price Targets $32 As Short-Term Holder Profitability Soars

Highlights

- Chainlink price eyes a 126% rally to $32 if it can break out from a bullish double bottom pattern.

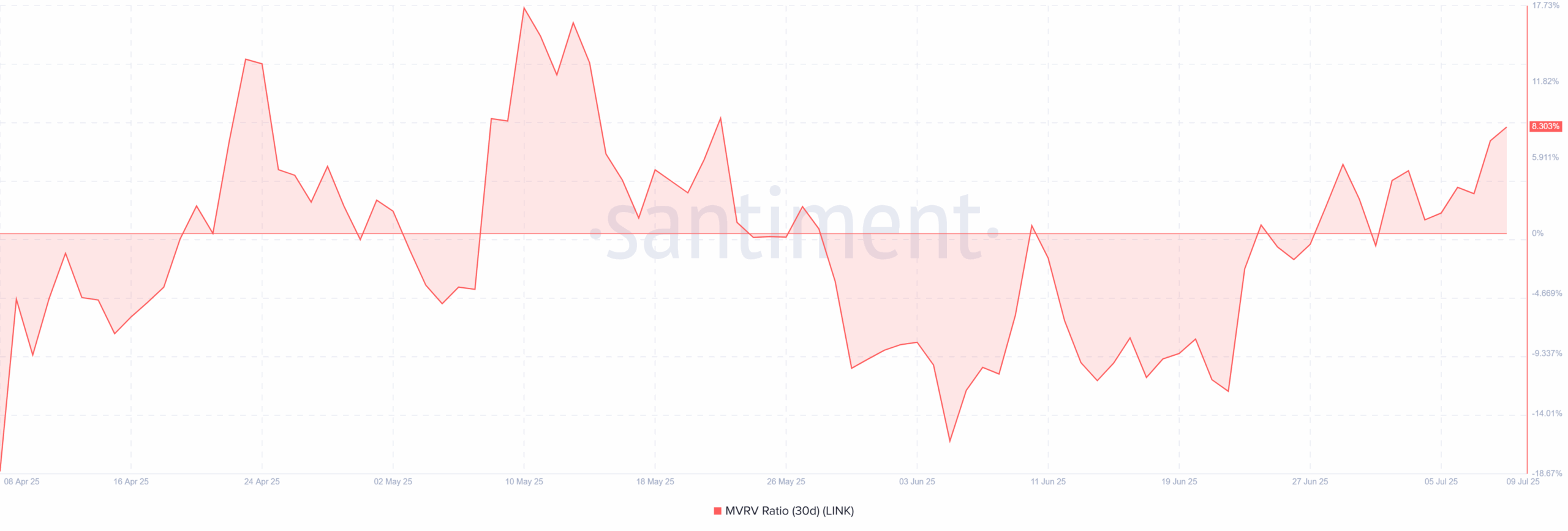

- Short-term holder profitability is rising and has reached the highest level in seven weeks.

- LINK's MACD indicator has created a buy signal, making it more likely for the price to rally.

Chainlink (LINK) is mirroring the gains across the broader crypto market today, July 9, as it trades at $14, with a 3.5% gain in 24 hours. Amid this uptrend, Chainlink price has printed a double bottom chart pattern, alluding to a potential 126% rally to the upside. Meanwhile, bullish sentiment among traders is increasing following a rise in the 30-day MVRV to the highest level in one month.

Chainlink Price on the Verge of a 126% Rally

Chainlink is emerging as one of the crypto tokens that might perform quite well in July 2025, following the emergence of a double-bottomed pattern on the weekly time frame chart. This pattern shows that bulls have been defending the support level at $10, and if it does hold, it might be a major factor that will drive a price rally.

LINK price has bounced from this support two times now, and the bullish traders are now targeting the resistance level that stands at $18. If it is successful in defending it, this might trigger a strong price increase, whereby the token will record a 126% gain to $32.

This double bottom pattern is still in the early stages, and it will mature after the price crosses above $18 and turns this price level into a strong support. However, a gradual increase in buying activity is supporting a bullish Chainlink price prediction.

The stochastic RSI has been rising slowly, and it has moved above 50 for the first time in one month, which indicates that the momentum is now in favor of bullish traders. Making a higher high will show that this bullish momentum is strong, and it is possible that the price of Chainlink will move higher.

The MACD indicator is also supporting the bullish narrative by creating a buy signal that might be the key to the 126% increase above $30. If traders react to this signal, it might create higher highs for the stoch RSI indicator and drive a strong surge for Chainlink price.

Short-Term Holder Profitability Surges

Chainlink holders who bought the token in the last 30 days are sitting on significant profits. This increase is observed in the 30-day MVRV ratio, which has increased to 8.3%, the highest level in late May, a sign that the traders who bought when LINK created a buy signal last month are enjoying a high level of profitability.

The positive MVRV ratio can be both bullish and bearish for the Chainlink price. This indicator is bullish in the sense that new traders who are making profits might consider LINK to be an ideal investment option. On the other hand, it might end up being bearish if the same traders choose to sell when the price starts showing some signs of weakness.

Besides the optimism being seen in the spot market, futures traders also seem to be increasing their exposure to Chainlink following a $190 million increase in open interest in under two weeks, per Coinglass data. Oftentimes, this indicates that many traders are speculating that the LINK price is about to make an explosive move because of the positive funding rate showing long positioning.

To sum up, Chainlink price appears to be ready for a strong move to the upside because of creating a double bottom pattern that might be the fuel that drives it above $30. The profit-making by short-term holders might also create a strong rally north when traders decide that it might be a good altcoin to buy.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

Frequently Asked Questions (FAQs)

1. Why is Chainlink price gaining today?

2. How will the increased short-term holder profitability affect LINK price?

3. Can Chainlink reach $30?

- $2T Barclays Explores Blockchain to Tap Into Stablecoin and Tokenization Boom

- Breaking: U.S. PPI Inflation Rises To 2.9%, BTC Price Falls

- XRP News: Ripple-Backed Ctrl Alt Completes $280M in Diamond Tokenization on XRPL

- Bitwise CIO Calls Bitcoin Selloff ‘Classic Cycle,’ Dismisses Manipulation Rumors

- Cardone Capital Takes Real Estate On-Chain With $5B Tokenization Plan

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

Buy $GGs

Buy $GGs