EOS Price Looks For A Reversal Near This Critical Level

EOS price analysis indicates a downside momentum for the day. The price is crawling in a very narrow trading range with a mild negative bias. We expect the price to make a swift recovery from the current levels. As the price corrected nearly from its swing highs, this might be a bargain buying opportunity for the new entrants.

- EOS price trades lower for the fifth straight session.

- A reversal is expected as the price took a breather near $1.50.

- Momentum oscillators warn of aggressive bids.

As of publication time, EOS/USD is exchanging hands at $1.52, down 1.94% for the day. The trading volume fell 37% to $4.89 in the last 24 hours according to CoinMarketCap data.

EOS price looks for trend reversal

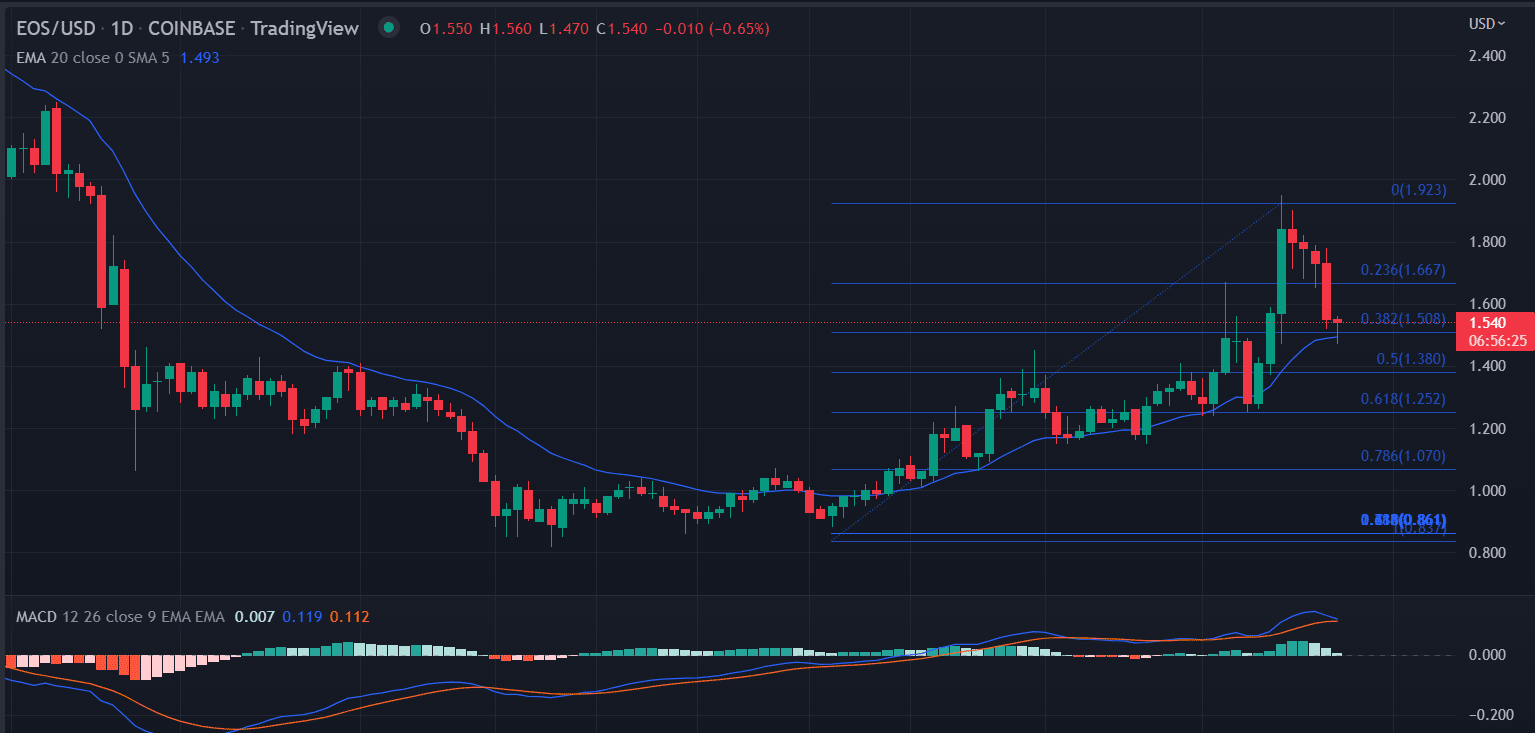

EOS price analysis on the daily chart revealed a trend reversal might be in the offering.

The price has formed a Doji candlestick in today’s session, following a big sell-off in the last trading day. Now, if the next day’s candlestick is a green one, then it would be a confirmation of a ‘bullish hammer’ pattern.

A hammer is a reversal pattern, generally formed at the end of either uptrend or a downtrend.

The sellers seem to be exhausted as the price took a swift recovery after testing the low of $1.47, testing it twice on the hourly chart. A spike in the buying order in the last one hour makes bulls hopeful.

A big green candle points at the renewed buying pressure. The price attempts to breach the 20-day exponential moving average at $1.53.

An hourly closing above the mentioned level would see $1.60 followed by the high of the previous session at $1.79.

The moving average convergence divergence (MACD) trades below the mid-line but with a bullish crossover. If it moved above the zero line more gains could be predicted.

On the daily time frame, the EOS price is taking support at the 20-day ema. This also coincides with the 0.38% Fibonacci retracement level. The Fibonacci retracement extends from the lows of $0.88.A long position could be initiated if the price gave closing above $1.55 on the daily basis. Next, the bulls could aim for an August 17 high at $1.67.

The MACD holds above the central line with a neutral bias.

On the flip side, a spike in the sell order could violate the bullish theory. A break of the support area of $1.47 could extend the losses toward the 0.50% Fibonacci retracement at $1.40.

Also read: https://Coinbase Launches New Token, Will It Ease Sanctions Uncertainty

In conclusion, the price looks mildly bullish, a trade above $1.55 should be confirmed for the buy side.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- ‘Iran Will Not Surrender’: Crypto Market Falls Again as US–Iran Tensions Rise

- Fed Vice Chair Michelle Bowman Calls for More Rate Cuts as U.S. Labor Data Disappoints

- CLARITY Act Likely to Pass by July, Says Kristin Smith

- Best Cross-Chain Swap Platforms in 2026 – Top 9 Picks Reviewed

- Crypto Traders Predict Oil Prices to Rally Above $100 as Iran War Enters Week 2

- Here’s Why Cardano Price Has Not Reclaimed $0.30

- Will XRP Price Crash as U.S. Nonfarm Payrolls Fell by 92,000 in February?

- Pi Network Price Eyes a 40% Surge as Pi Day Looms on March 14

- Top Reasons Why Circle Stock Price is Surging

- Gold Price Prediction as US-Iran War Hits the Second Week

- HOOD Stock Targets $100 as Robinhood Unveils Platinum Card and Advance Dividend Feature

Buy $GGs

Buy $GGs