Ethereum Price Analysis: A 20% Fall On The Cards Below $1,680; Time To Exit?

Ethereum price analysis remained bearish for the session. The opening session was optimistic but the bulls could not sustain the gains at higher levels and failed to the previous session’s gains. At first look, it seems the price lost its steam at $1,800.

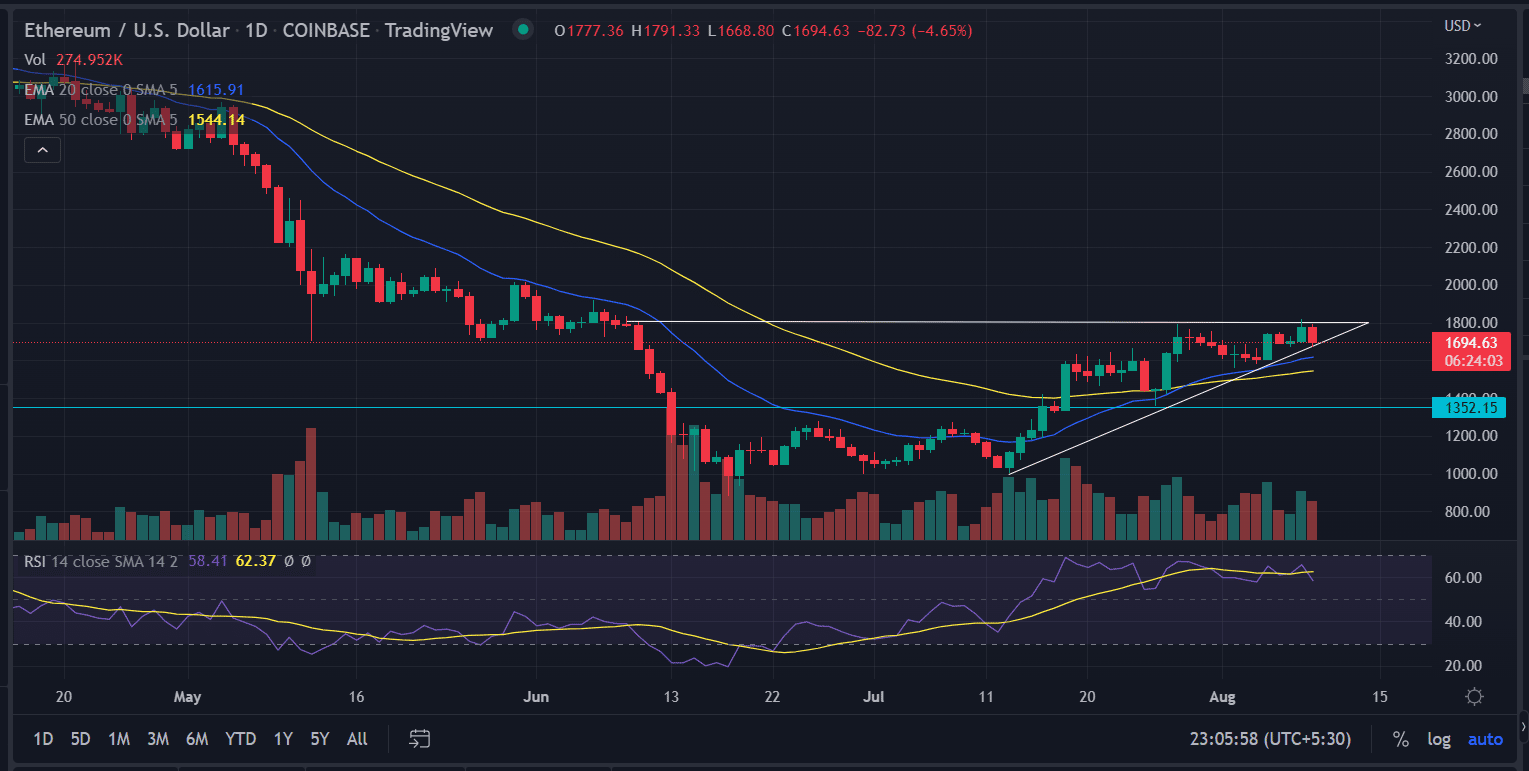

But on the daily chart, the price is taking support near the bullish trendline, making bulls hopeful. However, it would be a difficult task for ETH buyers to maintain the upside momentum.

To be in-game the ETH buyers must hold the critical support of around $1,670 on a daily closing basis.

- Ethereum price trades lower with substantial losses.

- The upside is capped near $1,800.

- More downside, if breaks below $1,680 on the daily basis.

As of writing, ETH/USD is exchanging hands at $1,689, down 5.78% for the day. The 24-hour trading volume for the second largest cryptocurrency is standing at $16,660,453,241 with a gain of more than 7%.

ETH price makes a lower move

Ethereum price analysis shows a probable downtrend as the price remains at the edge of the critical trend line. The current market structure favors bears. However, there is a twist in the story.

On the daily chart, the ETH price refreshes a two-month high above $1,800 in the previous trading session. The bulls immediately retrace lower after making the remarkable move. This was very much anticipated as the bulls are scaling up from the lows of $1005.25 since July 13.

The price appreciated nearly 81%. Further, for the first time price breached the 20-day and 50-day EMA crossover since April. ETH bulls managed to flip the $1,800 support level to resistance.

The bearish RSI divergence hints at a probable impending downside momentum. The oscillators slipped below the average line. It reads at 57.

Also read: https://coingape.com/eth-whale-adds-312-billion-shiba-inu-tokens-amid-price-dip/

A break below the ascending trendline could drag the price lower toward the 20-day EMA at $1,589 followed by the low of July 27 at $1,420.

On the other hand, a daily candlestick above $1,690 could mean a shift in the bearish sentiment. In that case, the bulls would aim for the highs of June 6 at $1,918.47.

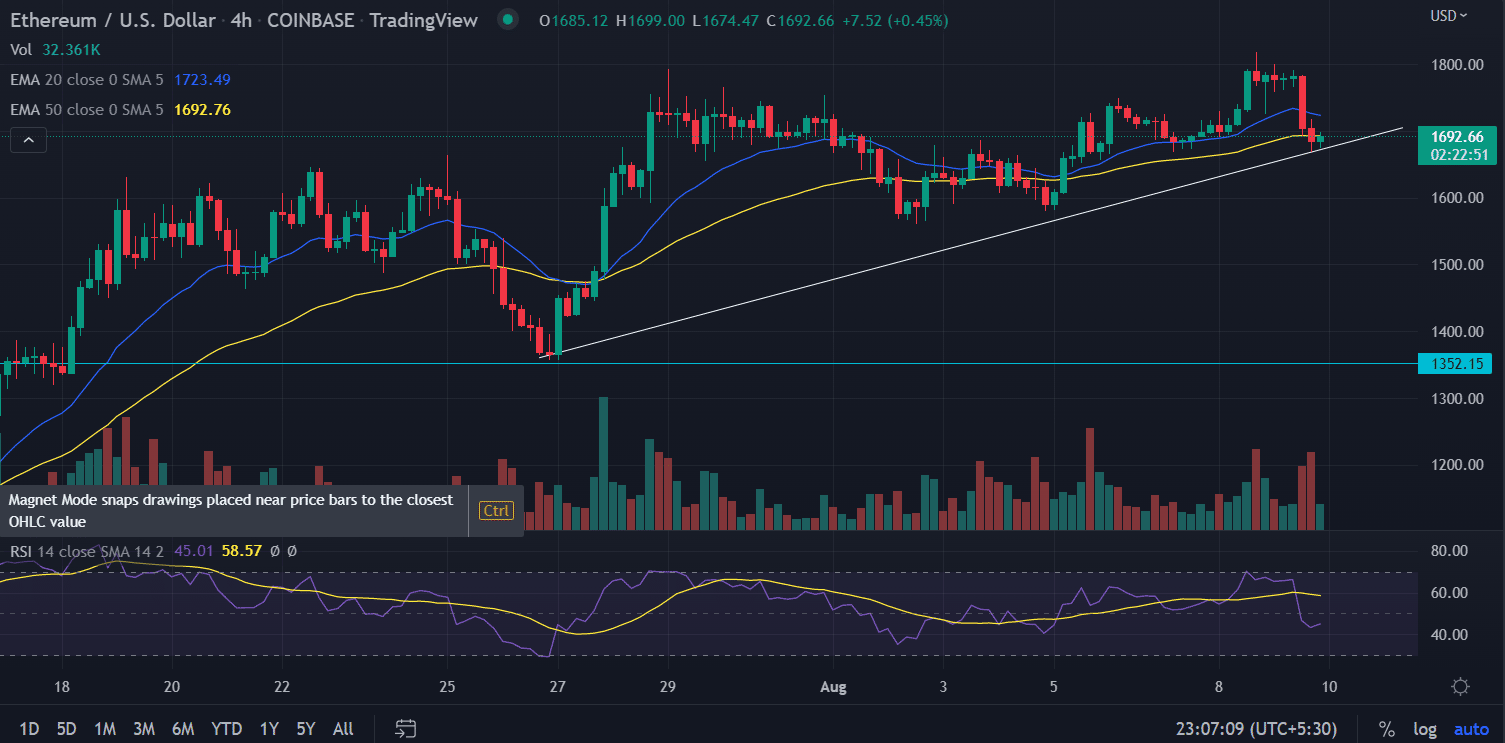

On the 4-hour time frame, the ETH price respects the ascending trend line as it holds the $1,692 mark. The price is making higher highs and higher lows, a classic bullish trend.

It is crucial for the bulls to sustain the $1,690-$1,700 support zone. A renewed buying pressure could push toward the psychological $1,800 level.

On the contrary, the ETH/USD pair remained pressured below the exponential moving averages.

The RSI is trading at 42, below the average line. Any downtick in the indicator could initiate another round of profit booking.

In that case, the market participant would seek $1,580.

- Breaking: U.S. Supreme Court Rules Trump Tariffs Are Illegal, BTC Price Rises

- Breaking: U.S. PCE Inflation Rises To 2.9% YoY, Bitcoin Falls

- BlackRock Signals $270M Bitcoin, Ethereum Sell-Off as $2.4B in Crypto Options Expire

- XRP News: Dubai Tokenized Properties Trading Goes Live on XRPL as Ctrl Alt Advances Project

- Aave Crosses $1B in RWAs as Capital Rotates From DeFi to Tokenized Assets

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?

- Dogecoin Price Eyes Recovery Above $0.15 as Coinbase Expands Crypto-Backed Loans