Ethereum Price Analysis: Bears In Control Below $1,600; Time To Sell?

Ethereum (ETH) price is under the influence of bears, leading to the recent price action. After breaking the short-term consolidation on July 15, the asset entered a consolidation phase. ETH expected to trade in range of $1,500 and $1,640 zone. A break above or below this range will set the next directional bias.

- ETH price is currently testing the $1,500-$1,550 confluence zone.

- The technical setup suggests consolidation with a negative bias on the daily chart.

- A daily candlestick above $1,670 would make bulls hopeful for upside gains.

As of publication time, ETH/USD is exchanging hands at $1,535.20, down 3.93% for the day. The 24-hour trading volume register gain of 14% at $18,554,286,161 according to CoinMarketCap.

ETH Price Extends Consolidation

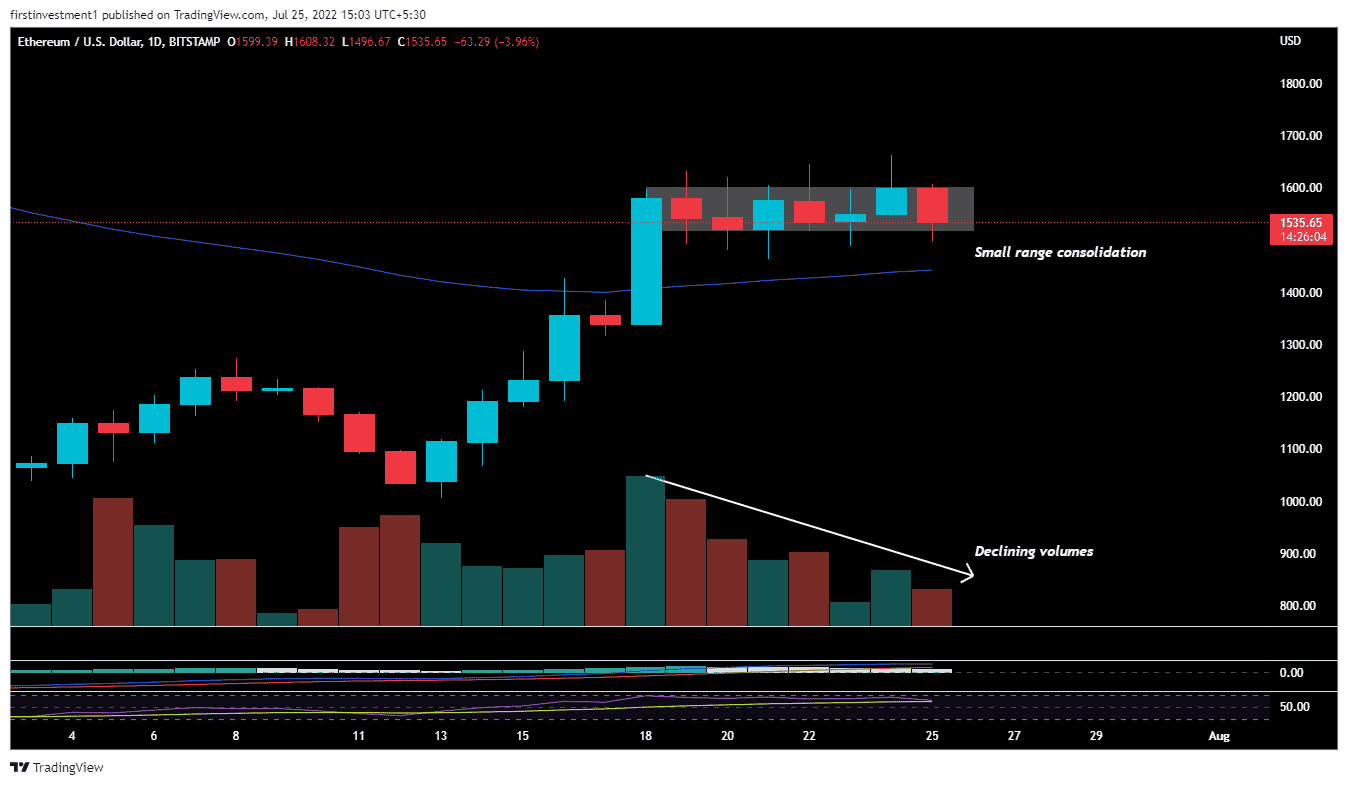

On the daily chart, the ETH price has been trading at higher levels for the past few days. The move was sponsored by the breakout of the short-term consolidation. The range extended from $1,000 to $1,200.

The price picked up the bullish momentum once breached the 20-day EMA (Exponential Moving Average) at $1,174 on July 15. ETH appreciated more than 30% since then.

However, for the past week, the price is making sideways movements with no clear directional bias. Further, the price action is accompanied by a low-volume phase.

RSI and MACD are both neutral to positive, favoring the bullish momentum to continue. If the price closes above the previous week’s high of $1,664.40, we can expect an excellent up move of up to $1760. This also coincides with the critical 50-day moving average.

Any downtick in the momentum oscillators would open the gates for the lower level near the $1,400 level.

Let’s dive into the short-term time frame to understand the immediate price action

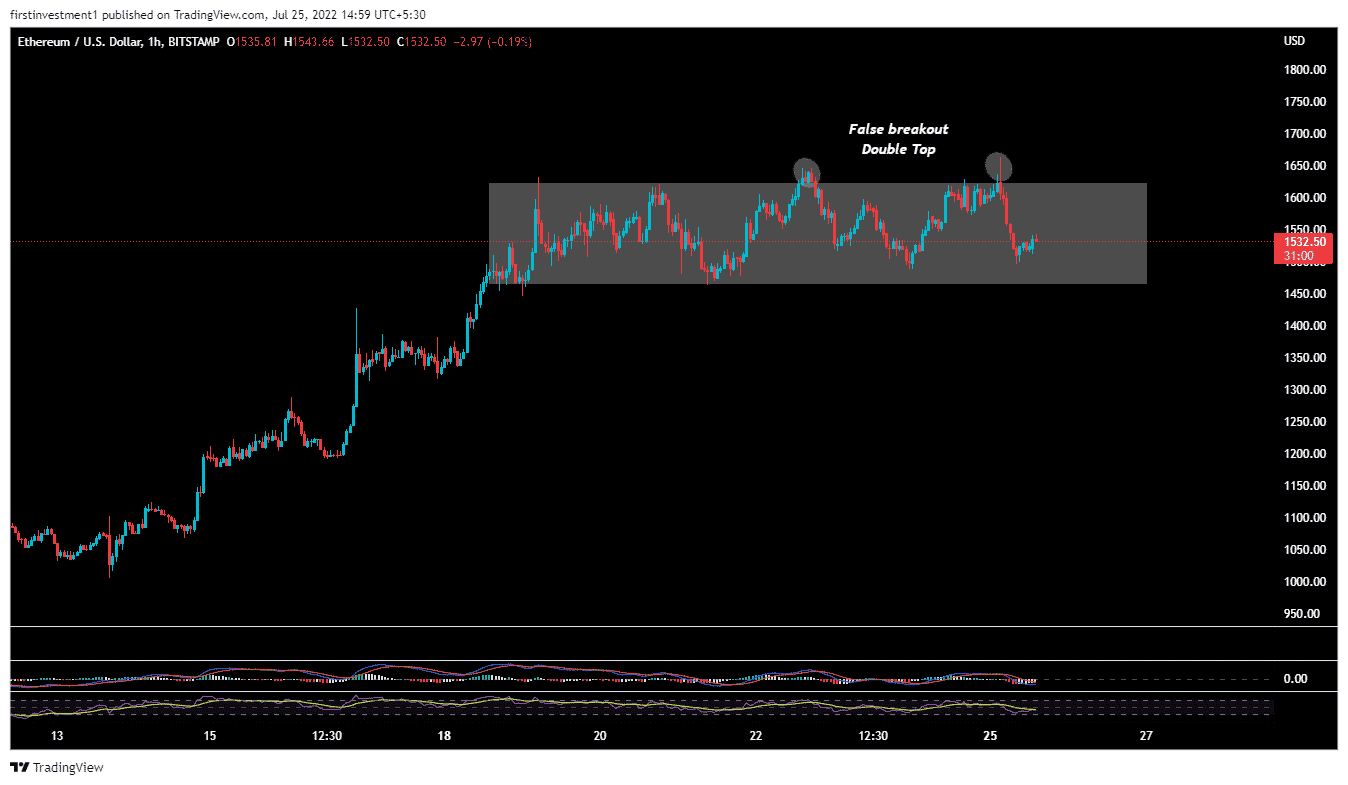

On the hourly time frame, ETH made a double top near $1,640 resulting in a price action toward $1,500. However, this level makes vital support for the asset.

Conclusion:

By studying multiple time frames, we found that ETH is showing weakness at higher levels.

A break below $1,500 would be a selling opportunity. On the other hand, a move above $1,640 would be a joy for the bulls.

- Tom Lee’s Bitmine Doubles Down on Ethereum With $34.7M Fresh Purchase

- BlackRock Buys $65M in Bitcoin as U.S. Crypto Bill Odds Passage Surge

- Bitcoin Sell-Off Ahead? Garett Jin Moves $760M BTC to Binance Amid Trump’s New Tariffs

- CLARITY Act: Trump’s Crypto Adviser Says Stablecoin Yield Deal Is “Close” as March 1 Deadline Looms

- Trump Tariffs: U.S. To Impose 10% Global Tariff Following Supreme Court Ruling

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?