Ethereum Price Analysis: ETH Bounces Back From $1,600; Time To Buy?

Ethereum price analysis for today’s session indicates a sharp recovery from the lower levels. This suggests a bounce back from the lower level as the fresh demand seems to be brewing up. The price of ETH has remained negative over the past few hours. Today, the price crashed below $1,600 but recovered sharply to test the intraday high above $1,660.

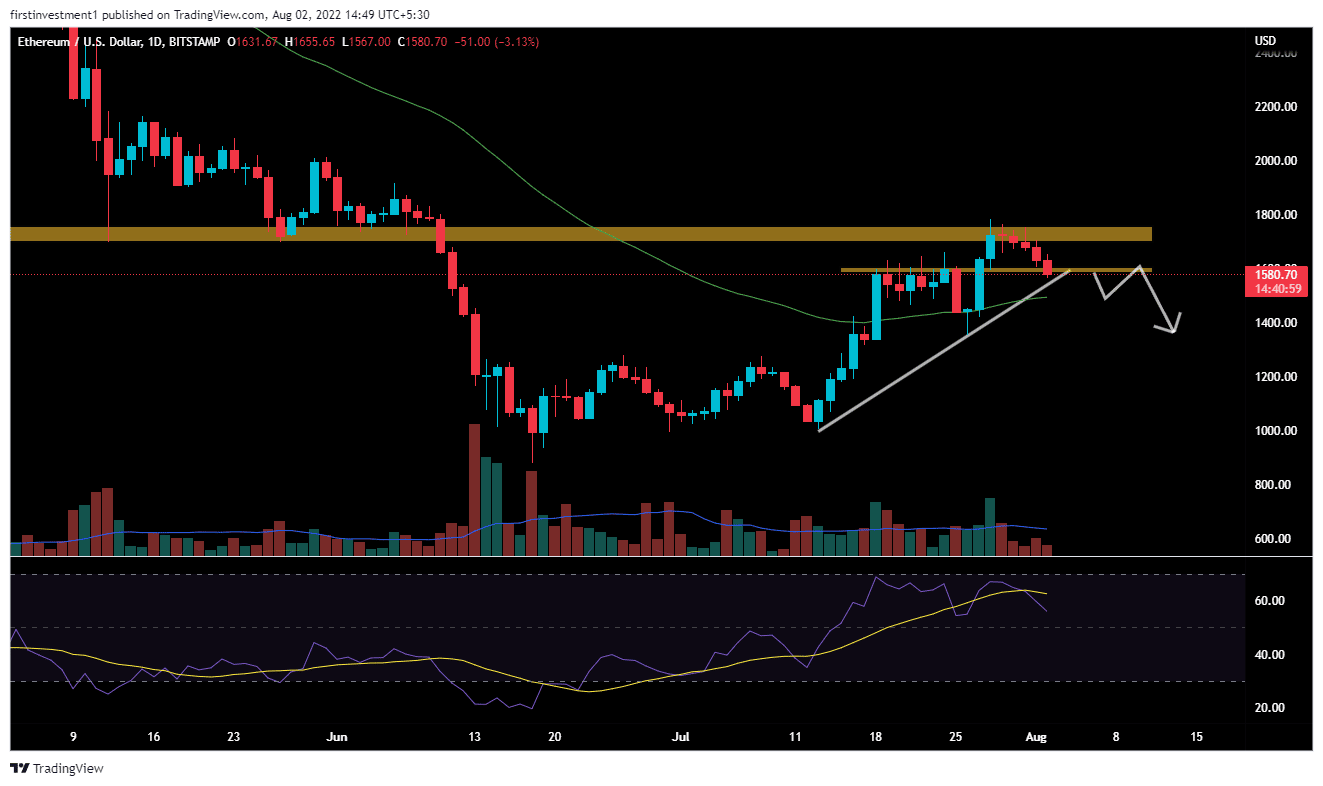

ETH is making higher highs and higher lows on the daily time frame, but facing strong resistance at the recent swing high of $1,760.The price is slowly dropping from its resistance for the last 5 days, with no volumes at all, indicating neither bullish nor bearish sentiment as of now.

- ETH price builds up on the dip-buying opportunity.

- A decisive break above $1,700 would bring in more gains.

- The pair trades at $1,665 with more than 2% gains as of writing.

ETH price looks for an upside extension

The daily chart shows ETH’s price faces a strong resistance hurdle at $1,760. The price formed a bullish Flag and pole pattern and gave a breakout from $1,602 levels. Currently, it retests the level price after making a recent swing high.

As the price has taken reliable support near the range of $1,600 to $1,570. This, also coincide with the 50% Fibonacci retracement level. Further, the price holds along the rising trendline connecting all the previous higher lows. This, all sums up for a bounce back in the ETH price.

Amid sustained buying pressure, the price could recapture the swing high near $1,792 and would aim for $2,000 next.

On the other side of the coin, if the price fell below $1,580 with good volumes, then we can expect a fall of around $1,500.A break below the 20-day moving average placed at $1,490 would open the gate for the low of July 26 at $1,356.07.

The RSI(14) holds near 50 levels, favoring the bullish outlook in the price.

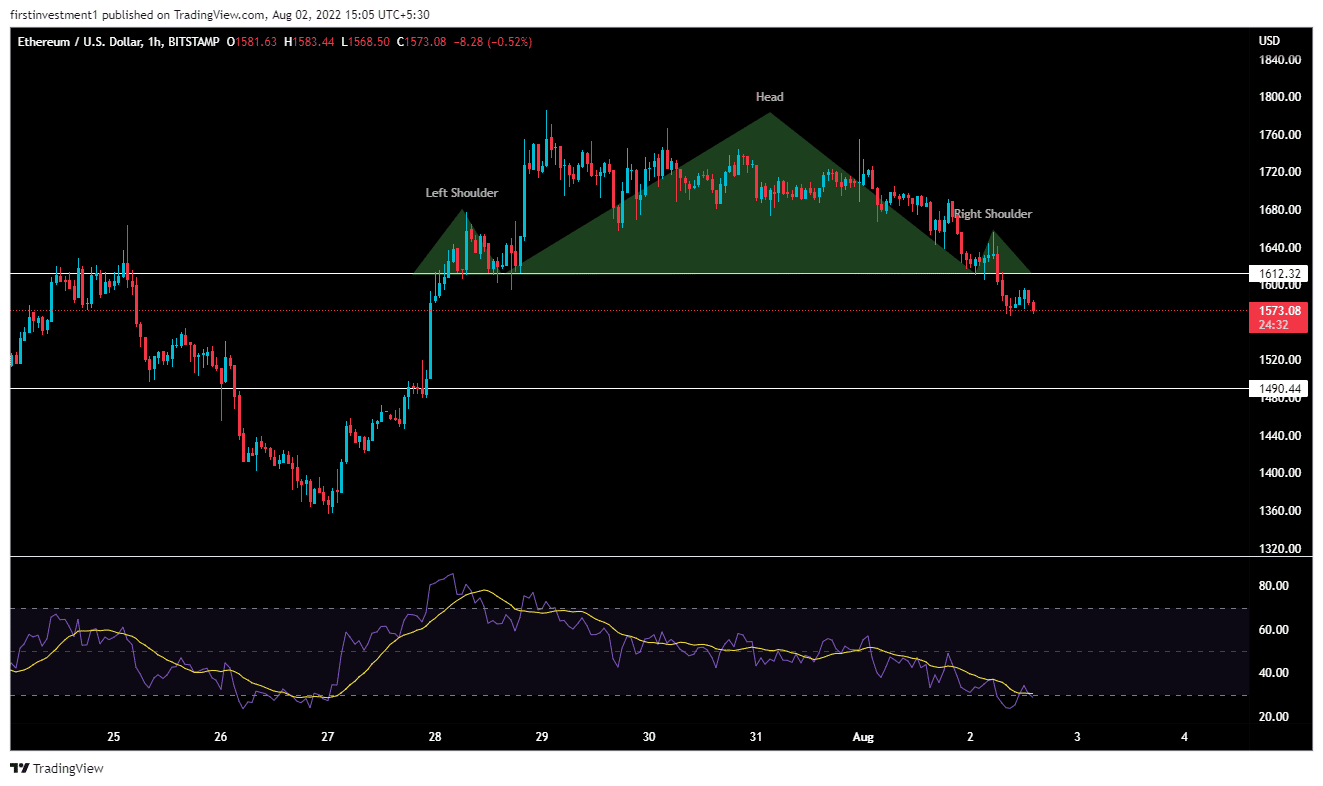

1-hour chart shows weakness

On the hourly time frame, the price gave a breakdown of the “Head & Shoulder pattern”, indicating bearishness. If the price breaks below the session’s low, we can expect further downside toward $1,400.

Alternatively, an acceptance above $1,660 with good volumes could mean the addition of buyers near the lower level. That might prompt further strength in the coin. The 24-hour trading volume rose 25% to $20,920,985,662 according to CoinMarketCap data.

Conclusion:

A dip-buying opportunity exists in ETH, as the price tentatively holds the support around the $1,550-$1,580 zone. The rising volume along with the spike in the price during the late hours indicates fresh buying in the asset.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Peter Schiff Predicts BTC to Fall, Gold to Rise as Markets Price in Prolonged Iran War

- Institutional Re-Accumulation Signs Emerge as Bitcoin ETFs See $1.1B Net Inflows Since Iran War Began: Glassnode

- From Mining Pool to Infrastructure Platform: Nine Years of EMCD

- U.S.-Iran War: U.S. Oil Prices Spike To One-Year High, Bitcoin and Gold Dip

- Crypto Traders Bet Against U.S.-Iran Ceasefire This Month as Iran Denies Peace Talks

- HOOD Stock Targets $100 as Robinhood Unveils Platinum Card and Advance Dividend Feature

- Bitcoin Price Prediction if Donald Trump Signs the CLARITY Act on April 3, 2026

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

Buy $GGs

Buy $GGs