Ethereum Price at Risk of a 30% Crash as Futures Open Interest Dive During the Crypto Winter

Highlights

- Ethereum price may be at risk of falling to its 2025 lows after invalidating the inverted head-and-shoulders pattern.

- The futures open interest has crashed to the lowest level in nine months.

- The weighted funding rate has also continued falling in the past few days.

Ethereum price continued its recent sell-off on Wednesday as the crypto winter gained steam. ETH was down by 3.3%, reaching a low of $1,950, down by over 60% from its all-time high. The ETF and futures markets suggest that the coin has more downside, potentially to its lowest level in 2025.

Ethereum Price at Risk as Futures Open Interest Falls

The value of ETH continued its downtrend and is now in the fourth consecutive week in the red. This decline accelerated after the US published strong jobs data, which removed the urgency of the Federal Reserve cutting interest rates in the near term. The economy added 130k jobs in January as the unemployment rate fell to 4.3%.

A major risk facing the Ethereum price is that demand in the futures market continues to fall this year. Data compiled by CoinGlass shows that the futures open interest fell to a month low of $23 billion. At its peak in 2025, the coin had an open interest of over $70 billion.

The futures open interest is a good metric seen as a proxy for the amount of leverage that investors are using in the crypto industry. This leverage has been in a strong downward trend since October 10 when positions worth over $20 billion in a single day.

In most cases, crypto prices drop whenever the open interest is falling. At the same time, the weighted funding rate has tumbled to minus 0.0067%, its lowest level since February 6.

Funding rate is an important metric in the perpetual futures market that looks at the small fee that bulls and bears pay to maintain the position. A negative funding rate is a sign that these investors anticipate the future price to be much lower than where it is today.

Additionally, the ETF market is also showing signs that there is weak demand as the crypto winter gains steam. These funds have shed over $94 million in assets this month, the fourth consecutive month in the red.

ETH Price Prediction: Technical Analysis

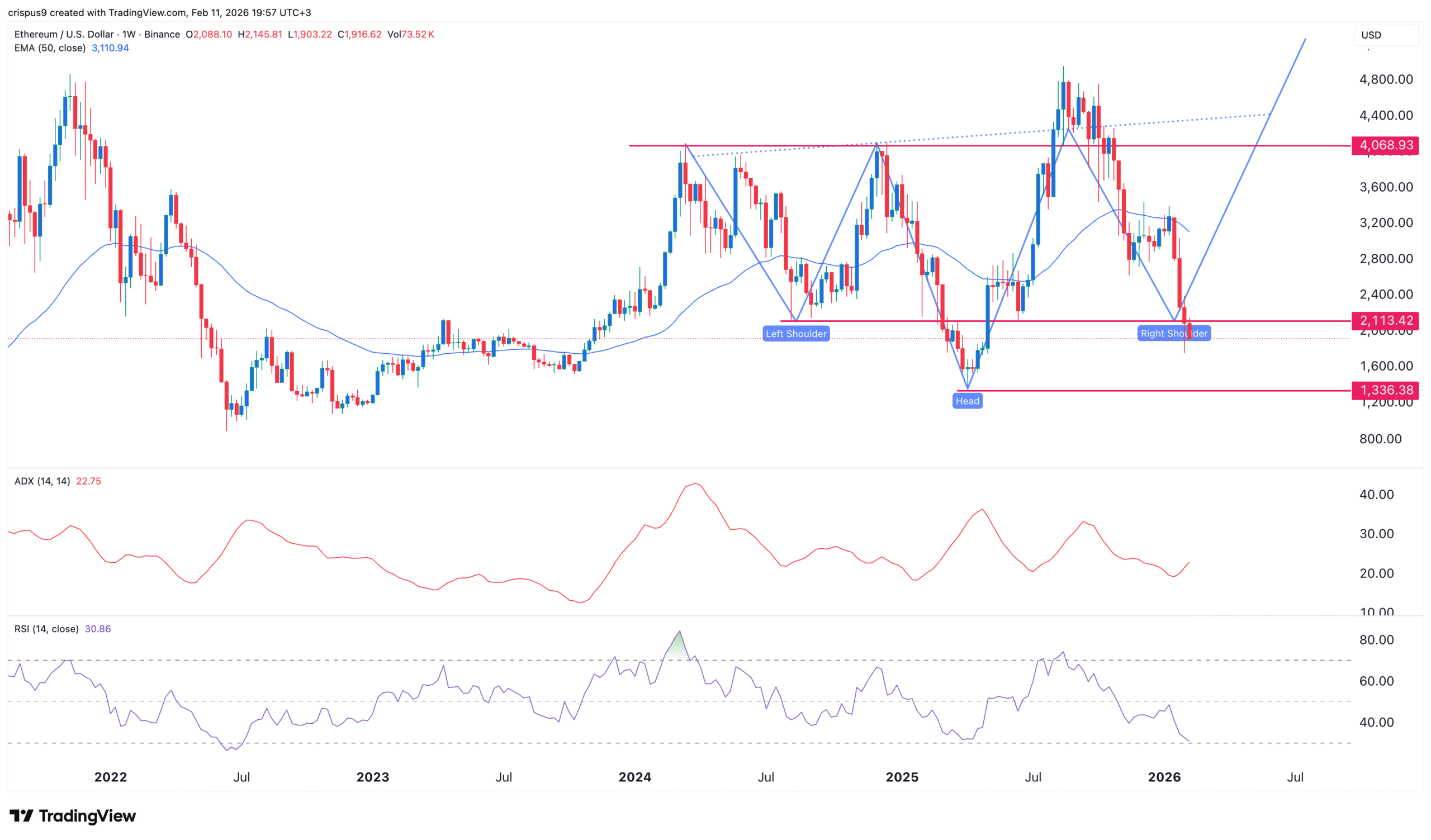

The weekly timeframe chart shows that the ETH price has been in a sell-off in the past few months. This crash may accelerate as it has dropped below the key support level at $2,113, invalidating the forming inverted head-and-shoulders pattern.

The Average Directional Index (ADX) has risen to 22 and is pointing upwards, a sign that the rally is gaining momentum. It has also moved below all moving averages, while the Relative Strength Index (RSI) continues falling.

Therefore, the most likely ETH price forecast is bearish, with the next target price being at $1,340, its lowest level in 2025, which is about 30% below the current level. On the flip side, a move above the key resistance level at $2,200 will invalidate the bearish outlook.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

Frequently Asked Questions (FAQs)

1. What is the most likely Ethereum price prediction?

2. Is ETH token a good buy today?

3. Why is Ethereum’s open interest plunging?

- CFTC Chief Mike Selig Signals US Crypto Perpetual Futures Rollout in Coming Weeks

- Fed Rate Cut Odds Drop as Inflation Fears Rise Due To U.S. Iran Conflict

- Here’s Why Tether Gold (XAUt) Price Is Falling Even With Growing Gold Demand

- XRP News: Ripple Expands Payments Platform To Unify Fiat and Stablecoins Globally

- U.S.–Iran War: Bitcoin Price Extends Decline as Oil Prices Surge To Two-Year High

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

Buy $GGs

Buy $GGs