Ethereum Price Forms Rare Pattern as Tom Lee Makes Bold Prediction

Highlights

- Ethereum price has remained under pressure in the past few months and is hovering near its lowest level in months.

- Tom Lee believes that ETH will bottom this week and resume its uptrend.

- Technicals suggest that the token has formed a falling wedge pattern pointing to a rebound in the near term.

Ethereum price has been in a technical bear market after falling by nearly 40% from the year-to-date high. This decline has coincided with the ongoing crypto crash. Still, ETH has become oversold and formed a falling wedge pattern, pointing to an eventual rebound as Tom Lee predicts.

Tom Lee Believes Ethereum Price Will Bottom This Week

The ongoing Ethereum price crash could be a good buying opportunity, according to Tom Lee, the founder of FundStrat and the Chairman of BitMine, the biggest Ethereum treasury company. In a CNBC interview, he also predicted that the ongoing crash would end this week.

Lee believes that Ethereum is superior to most other cryptocurrencies because of its role in emerging technologies. He cited the fact that BlackRock and other Wall Street companies want to tokenize everything. To do that, they will need a neutral 100% uptime blockchain, and Ethereum fits the bill.

Indeed, the most recent data shows that Ethereum has a 63% market share in the RWA industry, with over $11 billion in assets. Some top Wall Street companies like BlackRock, Franklin Templeton, and Janus Henderson have all used its network to launch some tokenized funds.

Lee also believes that Ethereum price will bottom this week, noting that the coin bottoms when the ratio of Ethereum and the total value locked (TVL) is about 50%, a level it is about to reach. He also pointed to its Ethereum ratio to Bitcoin, which has remained low in the past few months.

In a bold long-term ETH prediction, he noted that the coin has a room to move to $12,000 if it returns to its eighth average, $22,000 if it reclaims its 2021 valuation ratio, and $62,000 of it becomes the global payment rail. A surge to $62,000 would push its market capitalization to $7.45 trillion. This optimism explains why BitMine has continued to buy ETH.

ETH Price Falling Wedge Pattern Points to a Rebound

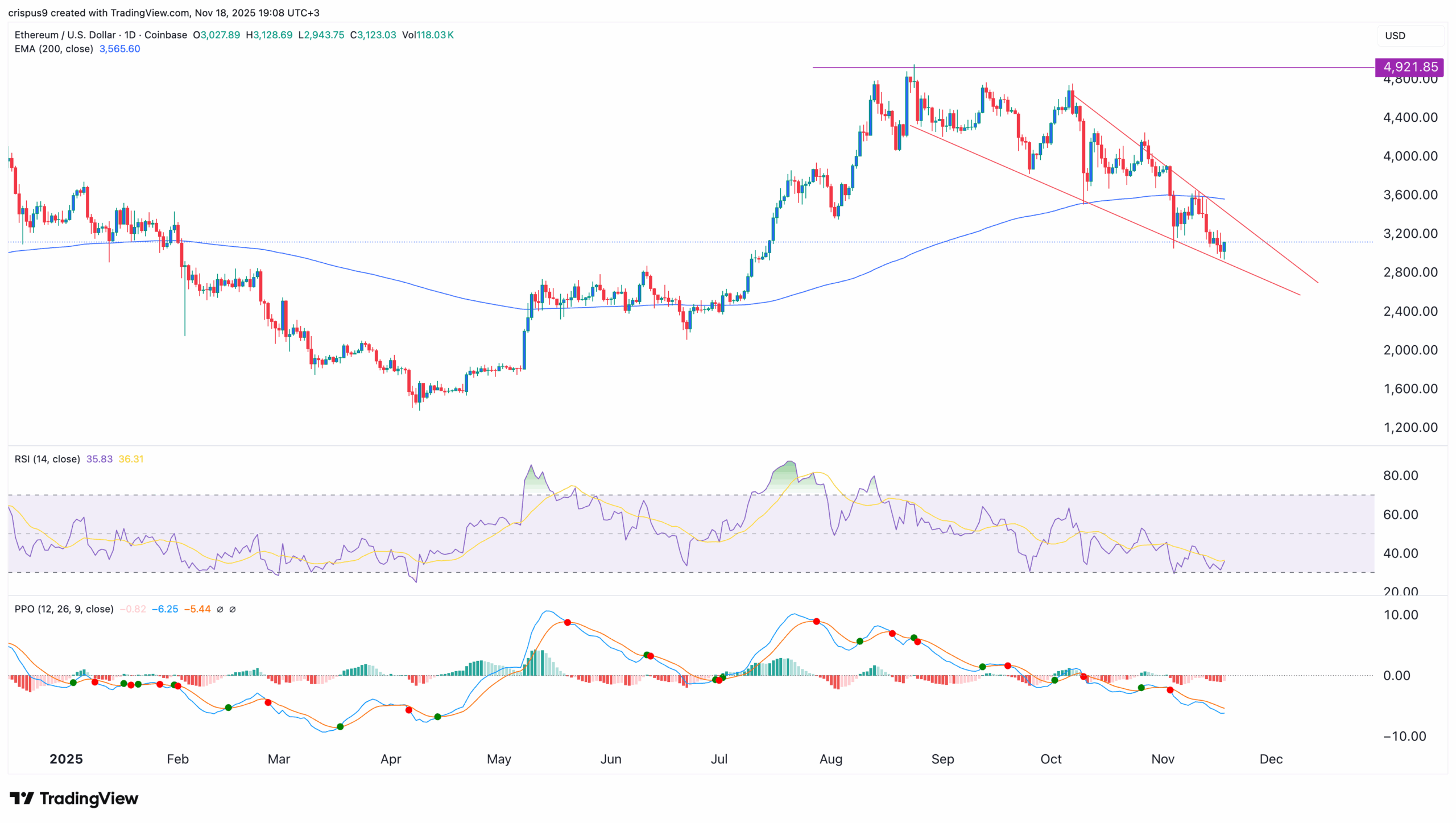

The daily timeframe chart shows that the Ethereum price has been in a strong freefall in the past few months, such that it has moved below the 200-day Exponential Moving Average (EMA).

Oscillators like the Relative Strength Index (RSI) and the Percentage Price Oscillator (PPO) have continued falling in the past few months. The RSI has moved closer to the oversold level.

On the positive side, it has formed the rate falling wedge pattern, which is made up of two descending and converging trendlines. These two trendlines are now nearing their confluence, meaning that it may stage a strong bullish breakout in the coming days. Such a move will push it to the next key resistance level at $4,000, which is about 28% above the current level.

On the flip side, a drop below the support at $2,900 will invalidate the bullish ETH price forecast and point to more downside.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

Frequently Asked Questions (FAQs)

1. What is the most likely Ethereum price forecast?

2. Is Ethereum a good asset to buy?

3. Is Tom Lee buying Ethereum?

- Crypto Market Today: BTC, ETH, XRP, SOL, and DOGE Rally as Geopolitical Tensions Ease

- Crypto Market Bill Hits New Deadlock as Banks Reject White House Deal

- Why Experts Are Warning Bitcoin Rally Could Be A “Dead Cat Bounce”

- BTC and Gold Price Bounce as Trump Admin Brokers US-Venezuela 1000 Kg Gold Deal

- SEC Advances Major Crypto Securities Plan to White House for Approval

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

Buy $GGs

Buy $GGs