Ethereum Price Outlook as Whales and Institutions Boost Holdings — Can ETH Reclaim $4K Before Year-End?

Highlights

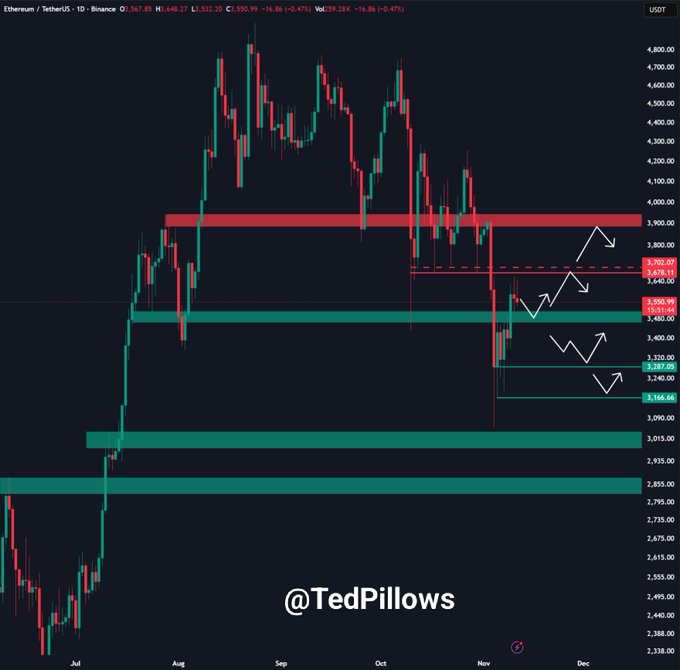

- Ethereum faces rejection near $3,700, with strong liquidity resistance between $4,000 and $4,100.

- Bearish momentum confirmed by DMI indicator could lead to a retest of $3,272 support before recovery.

- Whales and BitMine have accumulated over 500,000 ETH combined, signaling growing institutional confidence.

The Ethereum price has struggled to stay above $3,700 after facing renewed selling pressure. Despite the ongoing correction, the ETH price continues to attract growing interest from whales and institutions. Buying activity has intensified around key support zones, showing confidence among long-term holders. Analyst Ted highlighted that Ethereum’s ability to reclaim $3,700 will likely determine whether it can approach higher resistance levels. However, to retest $4,000 before year-end, bulls must first defend lower supports and establish stronger footing.

Ethereum Price Battles Key Liquidity Zones

The current Ethereum value sits at $3,437 after another rejection near the $3,700 threshold. Analyst Ted explained that this resistance remains significant, with liquidity concentrated between $4,000 and $4,100.

Strong demand has held near $3,400, acting as a base during repeated pullbacks. If Ethereum dips below this level, the next support rests near $3,200, which could attract renewed buying interest.

Meanwhile, a recovery above $3,700 would signal improved market confidence and open a path toward $4,000. Therefore, the Ethereum price outlook depends on whether bulls can reclaim control at these important liquidity points in the short term.

Symmetrical Triangle Signals Potential Reversal

In a different view, Ethereum continues to consolidate within a symmetrical triangle, showing a market coiled for a decisive breakout. This structure reflects a balance of power between buyers and sellers as volatility narrows. The DMI indicator confirms a clear bearish setup, with +DI at 13 and -DI at 30, showing that sellers remain dominant.

Meanwhile, the ADX value at 32 indicates a strong trend, validating that the bearish momentum is still intact. This means the ongoing decline remains active, and a further move downward appears likely before a recovery attempt.

Given this setup, Ethereum may revisit the $3,272 support area before seeing renewed strength. That level has acted as a short-term base where buyers previously reentered with confidence. A successful retest could reset liquidity and build the foundation for an upward reversal.

Once selling pressure weakens, the ETH price may rebound toward $3,700 and later challenge $4,000 resistance. Altogether, the Ethereum long-term price outlook remains cautiously optimistic, supported by the likelihood of a rebound once the current bearish phase completes.

Whales and Institutions Strengthen Ethereum Exposure

Whales and institutional investors have intensified accumulation as Ethereum consolidates below major resistance levels. Lookonchain revealed that the whale who previously borrowed 66,000 ETH to short has now bought aggressively during recent dips.

The same address just withdrew another 60,000 ETH worth about $213 million from Binance, marking a continuation of its buying spree. Since November 2, this whale has purchased a total of 392,961 ETH, valued at roughly $1.38 billion. Such consistent accumulation from a single entity underscores rising confidence among deep-pocketed investors despite short-term volatility.

Meanwhile, BitMine increased its holdings to 2.9% of the total supply after acquiring 110,000 ETH during the latest pullback. Confidence among institutions could also strengthen following the U.S. Treasury and IRS guidance allowing crypto ETFs to stake digital assets.

This new framework gives funds a clear path to earn staking rewards, making Ethereum more attractive for regulated participants. With large entities accumulating and fresh regulatory support emerging, the groundwork appears stronger for ETH to reclaim $4,000 before the end of the year.

Summary

Ethereum remains caught between firm support and heavy resistance but shows underlying resilience. Consistent whale and institutional buying continues to provide stability amid short-term volatility. Holding $3,400 could preserve bullish structure while keeping recovery chances alive. A decisive break above $3,700 would strengthen confidence and set Ethereum on track to reclaim $4,000 before year-end.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

Frequently Asked Questions (FAQs)

1. How does the symmetrical triangle pattern affect Ethereum’s market behavior?

2. Why are whales accumulating Ethereum despite market weakness?

3. What does the new U.S. Treasury and IRS guidance mean for Ethereum?

- ChangeNOW Is Settling Crypto Swaps in Under a Minute.

- $3B Western Union Expands Into Crypto With USDPT Stablecoin Launch on Solana

- XRP News: Key Ripple Whale Indicator Turns Bullish After Months, Price Rally Ahead?

- Crypto Market Today: BTC, ETH, XRP, SOL, and DOGE Rally as Geopolitical Tensions Ease

- Crypto Market Bill Hits New Deadlock as Banks Reject White House Deal

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

Buy $GGs

Buy $GGs