Ethereum Price Poised for Breakout as Wyckoff Re-Accumulation Meets BlackRock’s $110M Purchase

Highlights

- Ethereum completes Wyckoff re-accumulation and enters Phase E, signaling a potential long-term breakout.

- Analyst projects Ethereum to rally toward $8,400 after completing its accumulation phase.

- BlackRock’s $110M ETF buy aligns with strong outflows, reinforcing bullish institutional conviction.

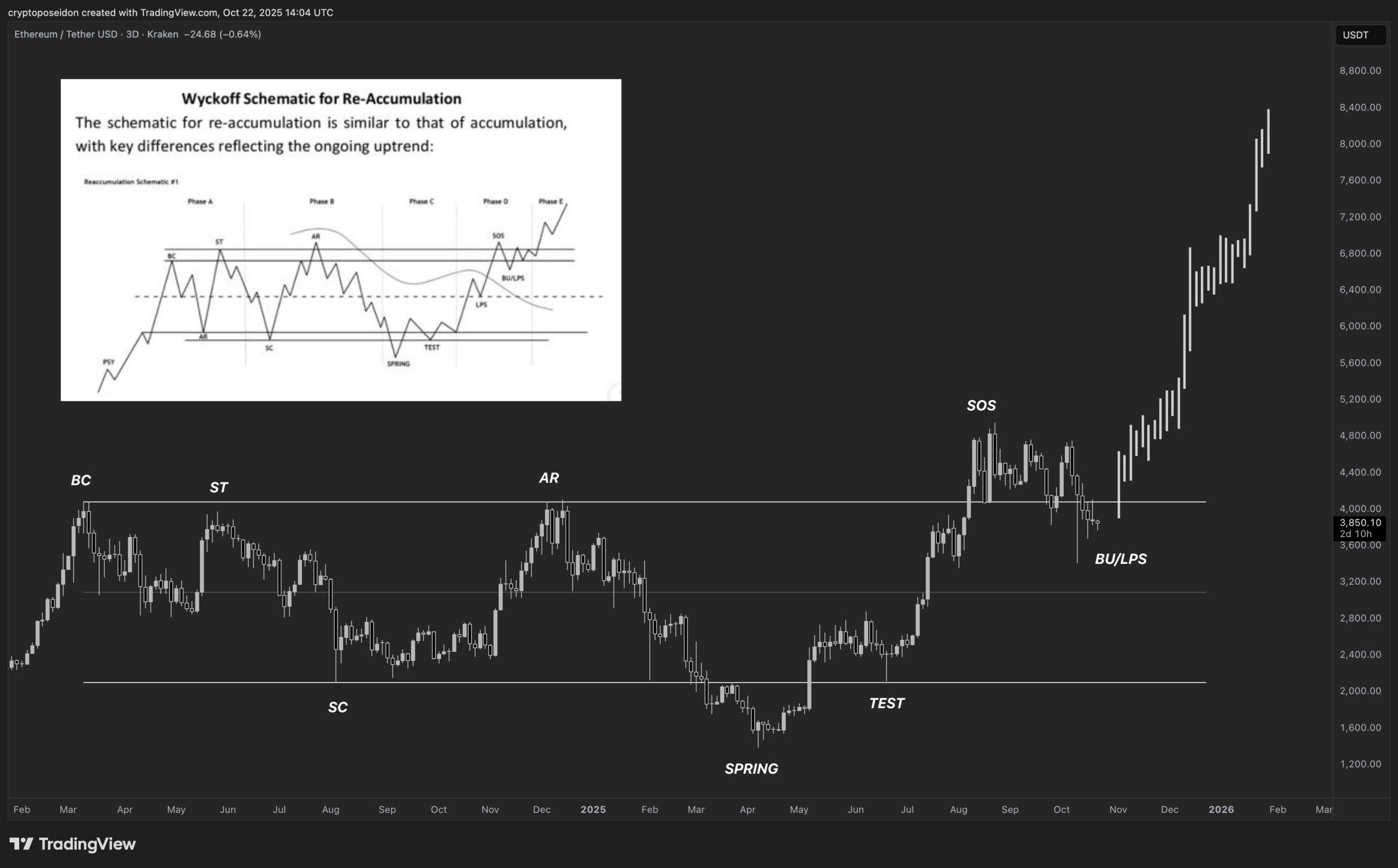

Ethereum price is gaining renewed attention as analysts highlight what they call the “perfect time to buy.” Ethereum has exhibited strong structural behavior consistent with the Wyckoff re-accumulation model. According to a market analyst, Ethereum is entering the final phase of the pattern, which could trigger a sustained rally toward $8,400. At press time, Ethereum trades at $3,870, marking a 0.87% daily increase.

Wyckoff Re-Accumulation Signals Ethereum’s Next Big Move

Specifically, the analyst notes that Ethereum price has tracked a precise Wyckoff re-accumulation structure since early 2024. Phase A began in March 2024 and extended to late June 2024, where the preliminary support (PSY), selling climax (SC), and automatic rally (AR) formed the initial framework.

Notably, phase B, from late June 2024 to March 2025, showed prolonged sideways action as the market absorbed supply through secondary tests (ST). Phase C, spanning March to late July 2025, introduced the Spring and Test patterns, confirming seller exhaustion and signaling accumulation completion.

Subsequently, Phase D, between late July and October 2025, recorded a clear sign of strength (SOS) followed by a backup to the last point of support (BU/LPS). Now in Phase E, Ethereum enters its expansion stage, which the analyst views as the perfect time to buy, projecting a rally toward $8,400.

Additionally, another analyst recently predicted a potential ETH rally to $10,000, amidst Vitalik Buterin’s new upgrade aimed at improving Ethereum’s proof system, a development that could accelerate adoption and strengthen Ethereum 2025 price forecast outlook.

BlackRock’s $110M ETF Purchase Reinforces The Bullish Setup

BlackRock’s purchase of 28,600 ETH worth approximately $110.7 million through its spot ETF strengthens the conviction behind Ethereum’s current rally. This institutional inflow aligns perfectly with the ongoing Wyckoff Phase E, confirming deep-pocket confidence in Ethereum’s next move.

Meanwhile, CoinGlass highlights consistent outflows from exchanges, including a $5 million net withdrawal on October 23. These persistent outflows indicate that investors prefer holding or staking rather than selling, tightening available supply.

As liquidity leaves centralized platforms, buying pressure becomes more impactful, accelerating price strength. Consequently, this combination of institutional demand and supply reduction positions Ethereum price for a potential breakout toward higher valuation zones.

Perfect Time To Buy?

Ethereum’s technical structure, on-chain flows, and institutional participation converge to present an optimal buying window. The Wyckoff model reinforces that Phase E typically triggers aggressive markup periods. As long as the BU/LPS zone holds, Ethereum could sustain its upward trajectory toward $8,400. Therefore, this alignment of market phases and smart-money inflows strengthens the case that now may indeed be the perfect time to buy.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

Frequently Asked Questions (FAQs)

1. What does Wyckoff re-accumulation mean for Ethereum?

2. How does BlackRock’s ETF investment impact Ethereum?

3. What is the purpose of Vitalik Buterin’s latest Ethereum upgrade?

- “There Is Only One Gold,” Billionaire Ray Dalio Says Amid BTC’s Quantum Threats

- Goldman Sachs CEO Predicts ‘Weeks’ of Crypto Market Crash as U.S Iran War Continues

- Polymarket Axes ‘Nuclear Detonation’ Prediction Market Amid Public Fury

- Indiana Signs Bitcoin Bill Into Law Allowing Crypto in Retirement Plans

- ‘Time to Act Is Now’: CFTC Chief Pushes Swift Passage of CLARITY Act

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

Buy $GGs

Buy $GGs