Ethereum Price Prediction Ahead of the 2026 Glamsterdam Scaling Upgrade – Is $5,000 Back in Play?

Highlights

- Glamsterdam’s 2026 roadmap strengthens Ethereum’s Layer 1 scaling narrative.

- Price structure compresses near channel resistance, signaling absorption.

- Long–short positioning shows growing conviction ahead of confirmation.

Ethereum price is in a critical stage as ETH price is in line with the preparations of the 2026 Glamsterdam upgrade. It is worth noting that the scaling roadmap of Ethereum redefines the long-term price expectations of ETH, including the price of $5,000.

The ETH price action is technically more of consolidation than exhaustion. This setting combines protocol expansion and structural rebuilding on the chart. Importantly, the $5,000 Ethereum price discussion emerges from scalability progress and evolving price structure, not short-term speculation.

Glamsterdam 2026 Signals a New Era for Ethereum Scaling

Ethereum price conversations increasingly reference the 2026 Glamsterdam upgrade. Particularly, Glamsterdam succeeds Fusaka upgrade that increased block gas limits to 60 million. This move signifies the transition of Ethereum to more Layer 1 scalability.

It is important to note that Glamsterdam presents enshrined Proposer-Builder Separation. This transformation minimizes the risks of concentration of validators.

Meanwhile, Block-level Access Lists aim to lower execution costs. They also support parallel processing of transactions. These enhancements aid the increased throughput without jeopardizing decentralization. It is estimated that gas limits may go up to 200 million in the community. That scale would increase Layer 1 capacity considerably.

Verkle Trees are to be introduced by the Hegota fork later. This upgrade deals with state growth pressure directly. All these changes reinforce the long-term infrastructure story of Ethereum.

🚨ETHEREUM UPGRADE INCOMING

Ethereum is set for a major scaling leap in 2026. The Glamsterdam fork introduces true parallel processing and raises the gas limit to 200M, up from 60M today. pic.twitter.com/7gwXSpZtVn

— Coin Bureau (@coinbureau) December 25, 2025

Ethereum Price Structure Tightens Near Breakout Toward $5,000

Ethereum price now compresses near the upper boundary of a prolonged descending channel. This position is important in that it indicates pressure accumulation against trend resistance.

This structure imposed low highs and regulated rallies over months. However, ETH price behavior shifted after a firm rebound from a clearly defined demand zone. At the time of press, ETH market valuation sits at around $2930, after a mild 1% daily decline.

Following that rebound, Ethereum price advanced steadily toward descending resistance. Sellers tried to reject at this limit, but follow-through became weak.

This interaction signals absorption rather than renewed downside control. The closer the price is to the upper channel line, the more likely it is to break out.

If Ethereum price reclaims the $3,000 level decisively, structure strengthens materially. That acceptance would affirm demand dominance over preceding consolidation.

When the price reaches $3,000, the second resistance will be at 3,400. This tier had earlier limited upward efforts. A trend transition would be validated by a successful flip into support.

Beyond that, Ethereum price structure opens toward the $4,200 resistance zone. This region is the last supply obstacle to wider recovery.

If buyers absorb profit-taking above $4,200, Ethereum price could structurally reclaim $5,000. Therefore, long-term ETH price prediction increasingly centers on that target.

Long-Short Positioning Highlights Recovery Conviction

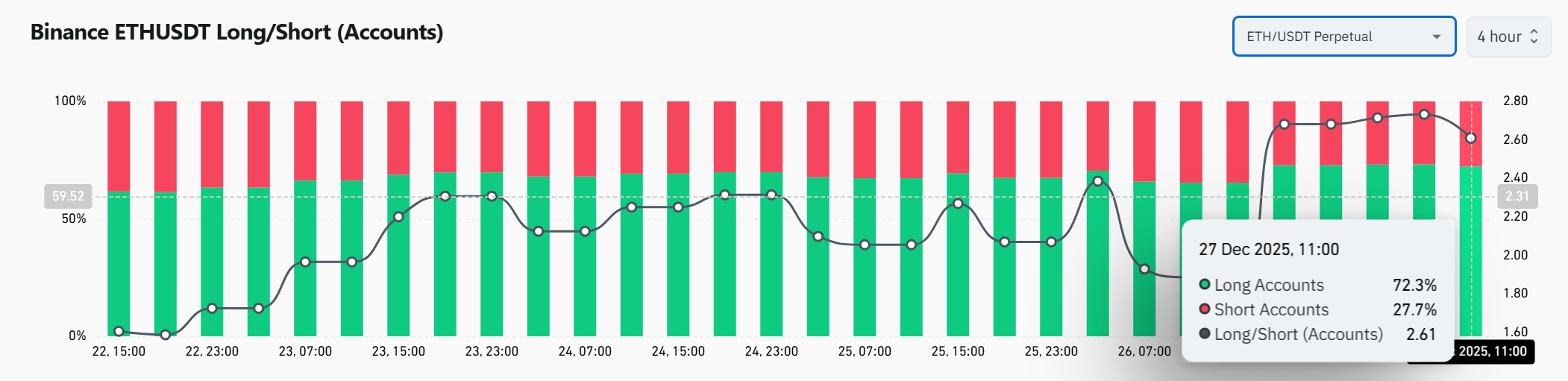

Additionally, the Ethereum price action is notably in line with the derivatives positioning shifts. According to CoinGlass analytics, the long accounts dominate 72% of positions. Meanwhile, short exposure remains at 28%, reflecting directional conviction but not defensive positioning.

With the long-short ratio sitting at around 2.6, this metric implies aggressive upside bias. However, the price expansion remains controlled. Therefore, this divergence implies positioning building ahead of structural confirmation.

These situations usually come before expansion phases. Nevertheless, the invalidation risk is close to resistance. An unsuccessful breakout would compel prolonged cuts in a short period.

Conversely, confirmation would validate the $5,000 Ethereum price narrative. This positioning dynamic reinforces upside sensitivity near key structural levels.

To sum up, Ethereum price now reflects a completed transition from correction to recovery. Compression of structure around resistance is an indication of strength and not hesitation.

Meanwhile, the Glamsterdam upgrade anchors long-term scalability confidence into price expectations.

The combination of technical structure and protocol expansion promotes a continuation phase. As this alignment persists, Ethereum price maintains a clear trajectory toward reclaiming the $5,000 level next year.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

Frequently Asked Questions (FAQs)

1. How could the Glamsterdam upgrade influence ETH price behavior?

2. What does compression near channel resistance indicate?

3. Why does long–short positioning matter for market structure?

- Crypto Market Update: Top 3 Reasons Why BTC, ETH, XRP and ADA is Up

- Crypto News: Bitcoin Sell-Off Fears Rise as War Threatens Iran’s BTC Mining Operations

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

Buy $GGs

Buy $GGs