Ethereum price prediction following $57.6M ETF Inflows – What’s Coming?

Highlights

- Ethereum price holds within a strong accumulation phase supported by institutional demand.

- ETF inflows and BlackRock activity reinforce stability around the key support range.

- Whale clusters strengthen structural resilience and reduce downside pressure across the accumulation zone.

Ethereum price remains a key discussion point as the asset trades inside a defined accumulation structure. The interest of the market increases when the existing range coincides with significant support clusters. The ETH price now fluctuates inside a zone where large players and institutions are showings a clear activity..

Ethereum Price Set-up Signals a Crucial Decision Zone for Buyers

The Ethereum price chart shows a clear downtrend that transitioned into a structured Wyckoff accumulation cycle. The first reaction point in the decline was at $3100 when selling pressure started to take effect. This formed the upper limit of the range.

The next to be formed was that of selling climax at approximately $2680 which made the deepest discount zone in the structure and was highly bought. Automatic rally followed towards $3097 with a 15% increase.

The Secondary Test was then established at approximately $2700, which verified demand in the lower area and strengthened the larger accumulation form. These levels now enclose the inner logic of the cycle and put the area of $3000-$3100 in the centre of structural control.

A fake breakout formed near $3471 and captured liquidity before price slipped back into the range. The ETH market valuation trades at $3179, sitting just above the support band.

This tendency is usually seen prior to major expansions since breakout traps enable larger players to re-take control. The $3000 – $3100 zone has become the main decision point as both the bullish and bearish directions meet at this point.

Two situations develop out of this. Ethereum price could rebound around the $3000-$3100 region, targeting $4000. However, a deeper retest would send the price toward $2600, completing the spring phase and ready for a mark-up phase. Ultimately, both scenarios points towards a rebound to the $4000 level, with time being the only variation.

This level would form an ideal entry point within Wyckoff theory as it eliminates weak points prior to strong attacks. As far as time is concerned, the future Ethereum price outlook therefore depends on control inside this critical support band, which now anchors both outcomes.

ETF Flows Reinforce Support

On Wednesday, ETF inflows hit $57.6M and confidence in the Ethereum market was bolstered by the fact that various issuers reported positive balances. This indicates that the market has wide institutional backing.

BlackRock added $56.5M during a corrective phase, implying strong conviction around current price levels, which strengthened support within the accumulation range. New share issues in Spot ETFs need physical ETF, and therefore regular inflows constrain the supply of exchange and minimize downward pressure in cases where sellers seek to make sharp moves.

The ETH price often benefits from this absorption effect because reduced float increases the strength of key support zones. The recent inflow patterns are in this format and reflect more profound interest among key issuers.

$ETH ETF inflow of $57,600,000 🟢 yesterday.

BlackRock bought $56,500,000 in Ethereum. pic.twitter.com/jGLf0box4u

— Ted (@TedPillows) December 11, 2025

Whale Clusters Strengthen Floors

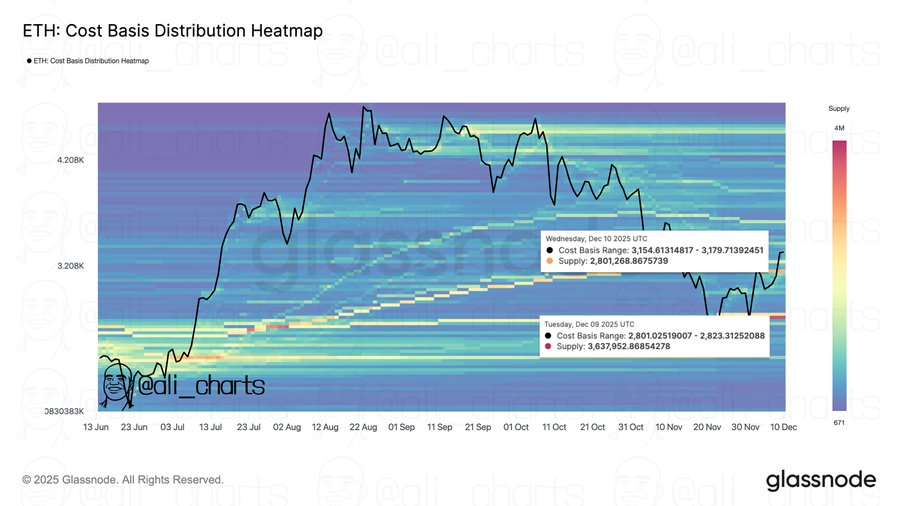

Glassnode highlights two strong whale clusters that anchor the most important support zones for Ethereum price, with 2.8M tokens accumulated near $3150 and 3.6M tokens acquired near $2800.

These clusters show deliberate positioning from large holders that view these zones as attractive value zones rather than speculative points. The constant interest they have enhances the reaction points since whales tend to protect areas where they amass.

The ETH price now sits between both clusters, which increases the importance of the 3000–3100 band as the primary decision zone. This correspondence links technical organization and definite on-chain power.

To conclude, Ethereum price sits at a critical structural zone shaped by Wyckoff levels and strong demand layers. The range is reinforced by ETF inflows. Large holders reinforce multi-layered accumulation zones.

As the institutional and whale accumulation increases, ETH has a better probability of recovering above the $3000 – $3100 support than falling below to finish the Wyckoff spring phase.

Frequently Asked Questions (FAQs)

1. What does the Wyckoff structure indicate for market behavior?

2. Why do ETF inflows matter for Ethereum’s market structure?

3. How do whale clusters affect short-term volatility?

- Crypto Market in Panic Mode Ahead of Bitcoin, ETH, XRP, SOL Options Expiry & US CPI Today

- Digital Assets Are Fixed In The Future Of Traditional Finance

- U.S. CFTC Committee Appoint Ripple, Coinbase, Robinhood CEOs to Boost Crypto Regulation

- What Will Spark the Next Bitcoin Bull Market? Bitwise CIO Names 4 Factors

- U.S. CPI Release: Wall Street Predicts Soft Inflation Reading as Crypto Market Holds Steady

- Solana Price Prediction as $2.6 Trillion Citi Expands Tokenized Products to SOL

- Bitcoin Price Could Fall to $50,000, Standard Chartered Says — Is a Crash Coming?

- Cardano Price Prediction Ahead of Midnight Mainnet Launch

- Pi Network Price Prediction as Mainnet Upgrade Deadline Nears on Feb 15

- XRP Price Outlook Amid XRP Community Day 2026

- Ethereum Price at Risk of a 30% Crash as Futures Open Interest Dive During the Crypto Winter