Ethereum Price Prediction: Is ETH Ready For New ATH In 2024?

Ethereum Price Prediction: Ethereum (ETH) price stayed relatively unchanged on Thursday despite the trading volume dropping by 20% to $8.5 billion. Intriguingly, the altcoin’s market cap is holding up above $245 billion, according to market data by CoinMarketCap.

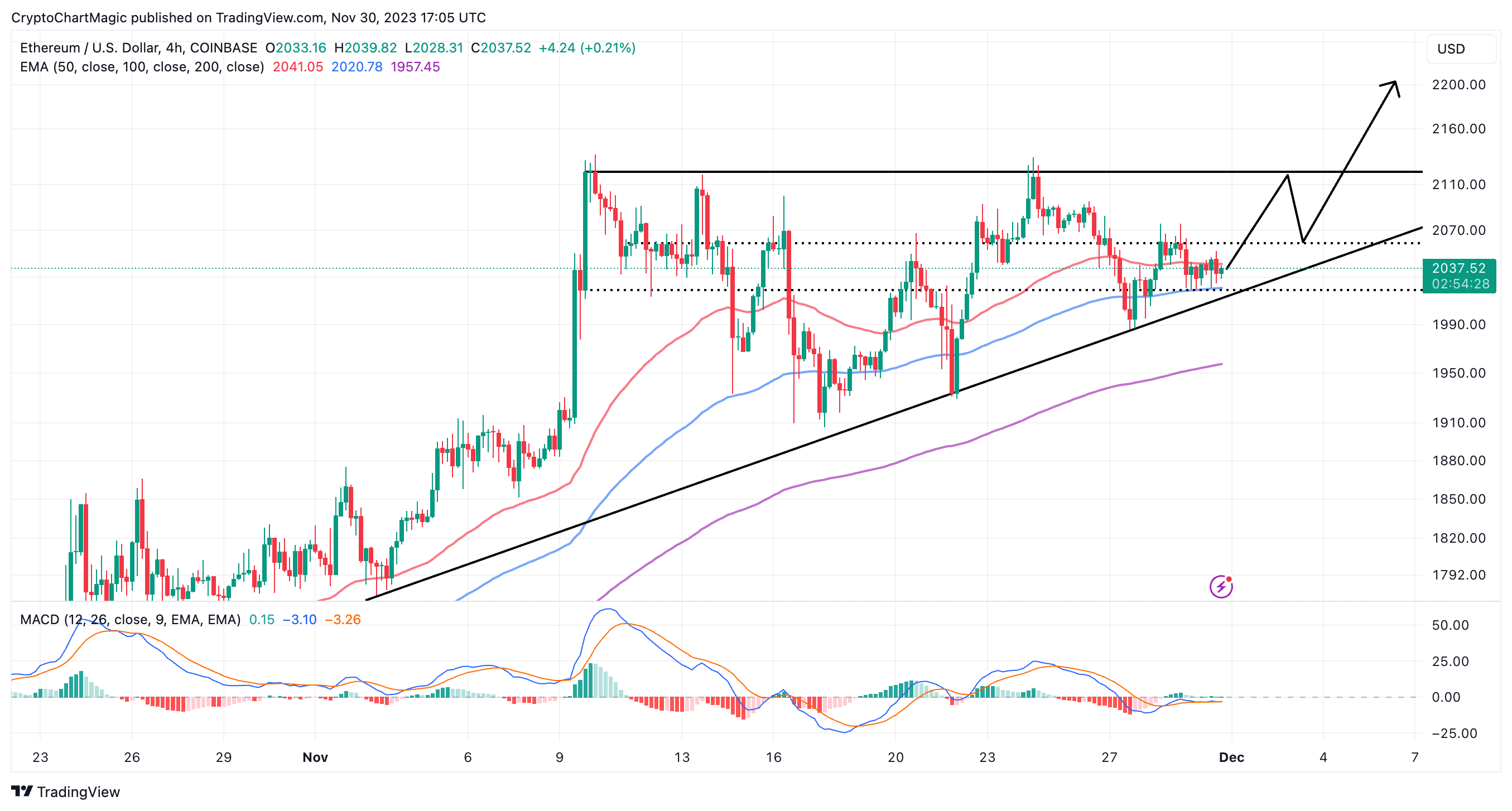

This has been a week of consolidation with Ethereum price sitting above the $2,000 level. Recovery has become an uphill battle leaving Ether to wobble between support at $2,020 and a short-term resistance at $2,070.

Ethereum Price Prediction: How Far Is Ethereum From Breakout?

The Moving Average Convergence Divergence (MACD) indicator upholds the mundane sideways trading Ethereum has displayed since Monday. Its downside is protected by the 100 Exponential Moving Average (EMA) (blue) at $2,020 and the ascending trendline.

Ethereum price tends to react bullishly every time it has retraced to touch the trendline. Therefore, in case of dips towards the $2,000 mark, bulls could seize the opportunity to buy into ETH while speculating on the next breakout first to $2,200, and later to the subsequent levels at $2,500 and $3,000.

Traders should exercise caution and restraint as long as Ethereum is trading below the short-term resistance at $2,040, as highlighted by the 50 EMA (red). The action above this level and the next resistance between $2,058 and $2,070 would serve as a breakout signal, paving the way for a bigger move to $2,200.

The momentum indicator will confirm the uptrend’s continuation with the blue MACD line flipping above the red signal line.

A triangle pattern forming on the four-hour chart could nurture a bigger breakout towards $3,000 if validated. Bulls must focus on breaking above resistance at $2,120 to activate the triangle breakout. Most traders would consider going long on Ethereum slightly above the triangle.

Recommended for you: Dogecoin Price Could Blast Through $0.12 Resistance If This Technical Pattern Plays Out

A glimpse of the daily chart assures traders of support at $2,015 but based on the current technical, as depicted by the sell signal from the MACD, ETH might drop again before making another significant recovery attempt.

However, backing the bullish outlook in ETH is the position of all three moving averages; the 50-day EMA, the 100-day EMA, and the 200-day EMA. If the MAs uphold the ongoing uptrend, the path with the least resistance is likely to stick to the upside.

Ethereum DeFi TVL Shoots To $26 Billion

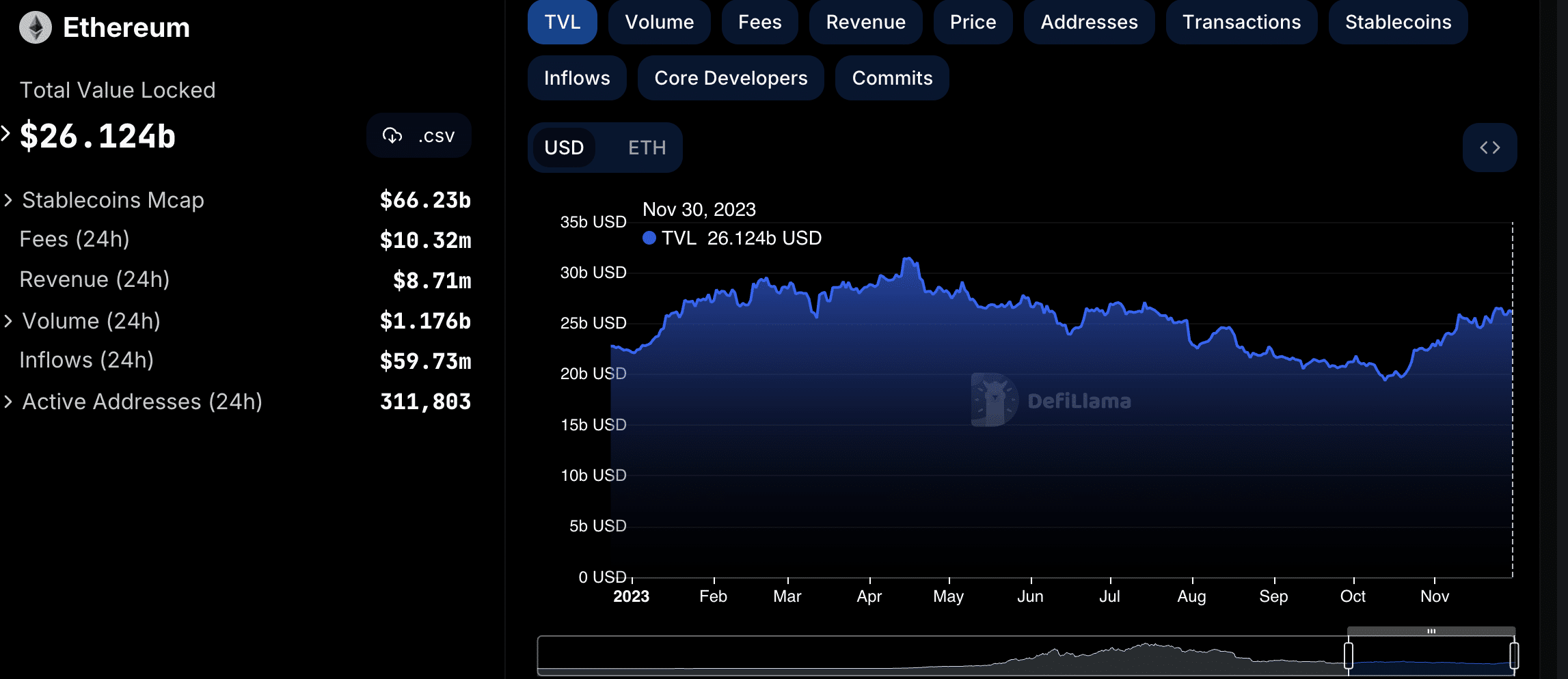

The dollar value of all ETH locked in staking protocols and other decentralized finance (DeFi) networks is increasing rapidly. According to data by Defi Llama, the total value locked (TVL) currently stands at $26 billion from approximately $19.4 billion in mid-October.

The growth in TVL underscores the long-term bullish outlook investors have for Ethereum price. They are willing to lock up their Ether for longer periods, expecting that the uptrend will continue into 2023. A high TVL value significantly reduces the selling pressure.

Related Articles

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Hong Kong Moves Closer to Crypto Tax Cuts Amid Stablecoin Regulatory Framework

- Popular Analyst Willy Woo Predicts Major Bitcoin Price Crash, Bear Market Bottom Timeline

- Vitalik Buterin Maps Out Quantum Risks as Ethereum Foundation Unveils ‘Strawmap’

- BlackRock Adds $289M in BTC as Bitcoin ETFs Log 2-Week High Inflows Of $500M

- Glassnode Signals Bitcoin Still Faces Downside Risk Amid Massive Sell Pressure at $70K

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

Buy $GGs

Buy $GGs