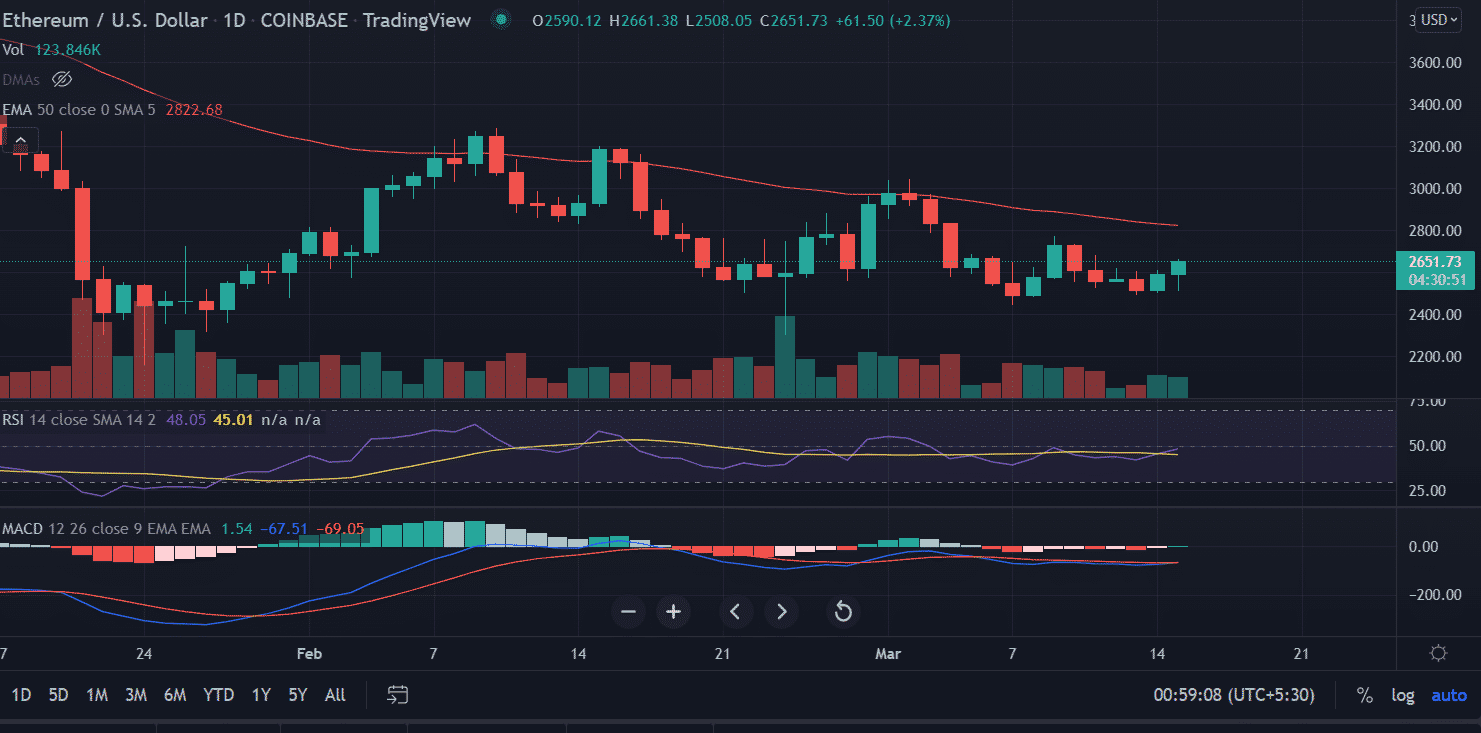

Ethereum Price Prediction: Remains Sideways Near $2,600 With Good Volumes; Is Sign For A Short-Term Upside?

Ethereum price trades with caution and makes consolidative moves. ETH opened lower but managed to recover and tested the session’s highs at $2,661.38 with above an average volumes. A sustained buying pressure could result in a short-term upside in the altcoin.

- Ethereum price trades in a very tight range on Tuesday.

- Expect more gains if the price gives a decisive close above $2,640.

- ETH faces upside rejection near 50-day EMA at $2,820.

At the time of writing, ETH/USD is trading at $2,614 up 0.99% for the day. The second-largest cryptocurrency by market cap holds the 24-hour trading volume at $12,100,941,234 with gains of 8%.

Ethereum price set to rise

On the daily chart, Ethereum price formed a ‘ Hammer’ pattern, which is a bullish reversal formation. The pattern forms when the market is oversold and looks for a bounce from the crucial support level. In addition to that volumes also supported the technical set-up.

Now, the price decisively broke the 1-hour chart upside resistance. This signifies the underlying strength in the current price action.

For bulls, the first upside target is placed at 50-day Exponential Moving Average (EMA) at $2,852.74. Ethereum price will be encouraged to test the psychological $3,000 level next.

On the contrary, a change in the bullish sentiment will spur another downside phase in the asset. Further moving downside the immediate support is found at $2,500 followed by the lows of February 22 at $2,300.

Technical indicators:

RSI: The daily Relative Strength Index pierced above the average line with a bullish bias. An uptick in the indicator could be a positive sign for the price.

MACD: The Moving Average Convergence Divergence still hovered below the midline with a neutral outlook.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto Traders Predict Oil Prices to Rally Above $100 as Iran War Enters Week 2

- Prediction Market Kalshi Faces Class Action Over Iran War-Linked Bets

- Binance Responds To U.S. Senate Probe, Denies Iran Sanctions Violations

- Fed Rate Cut Odds Jump Following Huge U.S. Jobs Report Miss

- U.S.-Iran War: Trump Rejects Iran Deal as Rising Oil Prices Threaten Crypto Market Rebound

- Here’s Why Cardano Price Has Not Reclaimed $0.30

- Will XRP Price Crash as U.S. Nonfarm Payrolls Fell by 92,000 in February?

- Pi Network Price Eyes a 40% Surge as Pi Day Looms on March 14

- Top Reasons Why Circle Stock Price is Surging

- Gold Price Prediction as US-Iran War Hits the Second Week

- HOOD Stock Targets $100 as Robinhood Unveils Platinum Card and Advance Dividend Feature

Buy $GGs

Buy $GGs