Ethereum Price Risks $2,600 Drop Despite JPMorgan’s New Fund on its Network

Highlights

- Ethereum price has formed a highly bearish chart pattern on the daily chart.

- The coin may drop to the support at $2,500 despite having some good fundamentals.

- JPMorgan launched the first onchain fund on Ethereum network.

Ethereum price crashed for the second consecutive day, reaching its lowest level since Dec. 7. It has now dropped by ~40% from its highest point this year. Technicals suggest that the ETH token may be on the cusp of a strong bearish breakout to $2,600 despite JPMorgan selecting it for its first onchain fund.

Ethereum Price Alarming Pattern Points to a Dive to $2,622

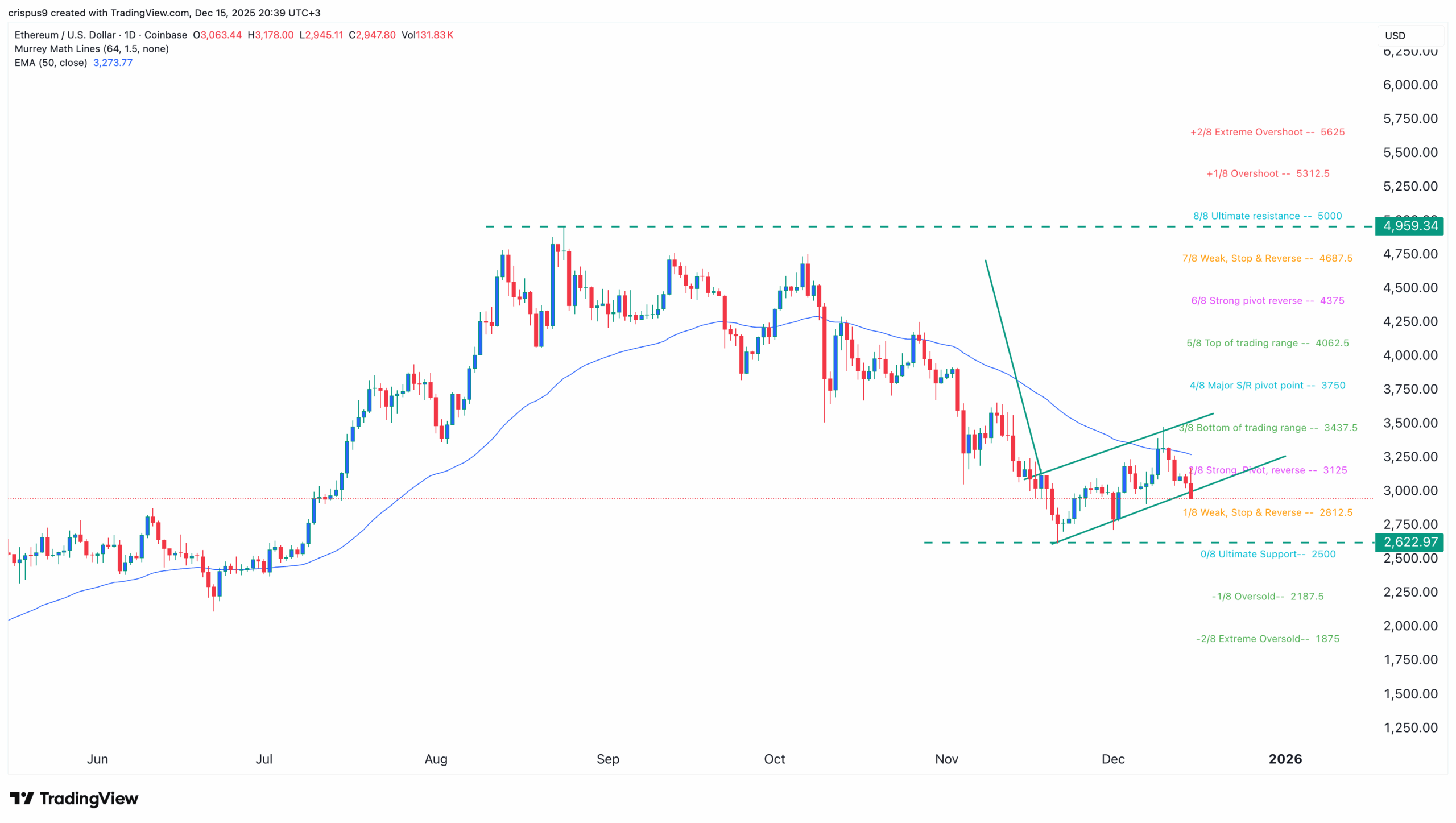

The daily chart shows that the ETH price has slumped from the year-to-date high of $4,968 to the current $2,978. This retreat accelerated as the crypto market crash continued today.

The chart shows that the token has formed a bearish flag pattern. This pattern started forming in October when it started its downward trend. It has already completed the formation of the flagpole section of this pattern and is now on the flag section.

Ethereum price has started moving below the lower side of the flag pattern. As such, there is a risk that the token will continue falling, potentially to the lower side of the flagpole at $2,620, which is ~12% below the current level.

A drop below that price means that the token may continue falling as sellers target $2,500. This ETH price prediction coincides with the Ultimate Support of the Murrey Math Lines tool.

On the other hand, a move above the upper side of the flag section will invalidate the bearish outlook. Such a move will point to more Ethereum gains, potentially to the psychological point at $4,000.

JPMorgan Launches OnChain Fund on Ethereum

The bearish Ethereum price prediction is happening even as the network gains a major partner after the recent Fusaka upgrade. In a statement, JPMorgan said that it had launched its first onchain fund on the network. The fund is known as the My OnChain Net Yield Fund (MONY) and will be offered to qualified investors.

JPMorgan joins other Wall Street companies like BlackRock, Apollo Management, and Janus Henderson that have launched tokenized funds in the past few months.

Ethereum has become the biggest chain in this industry, thanks to its legacy in the crypto industry. Data compiled by RWA shows that the network has over $12.6 billion in assets, a sizable sum considering that the industry has $18 billion in assets.

JPMorgan’s selection of Ethereum is important as Jamie Dimon heads the company. Dimon has a long history of criticizing the cryptocurrency industry.

It is also notable as it is the biggest bank in the United States by far with over $4 trillion. As such, there is a likelihood that other companies will embrace tokenization. Some of the potential ones are companies like Goldman Sachs and Bank of America.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

Frequently Asked Questions (FAQs)

1. What is the most likely Ethereum price forecast?

2. Is JPMorgan’s new fund bullish for ETH price?

3. How low can the value of Ethereum get?

- Breaking: Trump Says The U.S.-Iran War Could End Soon, Mulls Taking Over Strait Of Hormuz

- Bhutan Dumps More Bitcoin as BTC Price Climbs Amid Falling Oil Prices

- Bitget Upgrades Agent Hub to Enable OpenClaw, Claude Code to Trade Crypto in Real Time

- Why Next Two Weeks Are Do or Die for Crypto Market?

- Breaking: Tom Lee’s BitMine Acquires 60,976 ETH As BMNR Stock Eyes Recovery

- Top Analyst Explains Why Pi Network Price May Soar to $0.50 This Week

- Is MSTR Stock Going to Rally $150?

- Bitcoin And XRP Price Prediction As US Oil Prices Fall Sharply- Will This Spark a New Bull Rally?

- Is It a Good Time to Buy XRP As Price Falls 64% From All-time High

- Will Crypto Market Crash This Week? Analysts Predict Timeline for Volatility

- Gold Price Prediction Ahead of March 18 FOMC Meeting

Buy $GGs

Buy $GGs