HBAR Price Prediction as SEC Approves Generic ETF Framework – Analyst Targets $1.80

Highlights

- HBAR price rebounds from $0.22 support, with analyst long-term forecast aiming at $1.80.

- Hedera price gains momentum as CoinGape earlier predicted potential push toward $0.50 zone.

- SEC approval of generic ETF framework cuts approval timelines, boosting market optimism.

HBAR price has gained fresh traction after climbing above $0.24, reflecting renewed strength in Hedera price performance. The token’s market cap has risen 5.6% to $10.5B, while daily volume surged more than 100% past $430M, signaling renewed market conviction. The broader environment is riding on optimism after the SEC approved generic ETF framework, cutting approval timelines and fueling digital asset interest. Meanwhile, an analyst has set an ambitious target of $1.80 for HBAR, citing technical resilience and strong structural support.

Is Hedera Price Ready for a Major Breakout After Holding Key Levels?

HBAR price recently rebounded from the 0.382 Fibonacci support zone around $0.22, reinforcing a bullish setup as highlighted by a market analyst. Hedera price currently trades near $0.25, maintaining stability above key retracement levels that act as strong support.

A flag formation breakout earlier this year hinted at continued upside, with technicals now pointing to sustained accumulation. If buyers protect the $0.22 level, the next resistance lies near $0.40, followed by a broader extension toward $0.65.

Beyond these, Fibonacci projections suggest $1.21 as an achievable medium-term target, while the analyst long-term HBAR price forecast aligns with $1.80. This path remains valid as long as HBAR sustains its higher lows.

CoinGape earlier predicted that speculation over a potential HBAR ETF could help drive the token toward the $0.50 zone, a view now reinforced by ongoing technical strength.

SEC ETF Framework Approval Boosts Hedera Price Outlook as Speculation Intensifies

The SEC’s approval of generic ETF framework has provided regulatory clarity, reducing approval timelines from 240 to 75 days. This decision is expected to accelerate the launch of more than 100 digital asset ETFs within the next 12 months.

Such regulatory certainty often acts as a catalyst for stronger institutional flows into assets like Hedera price. Besides, the ETF approval framework has boosted confidence across the digital asset space, reinforcing expectations that crypto ETFs could expand significantly in the months ahead.

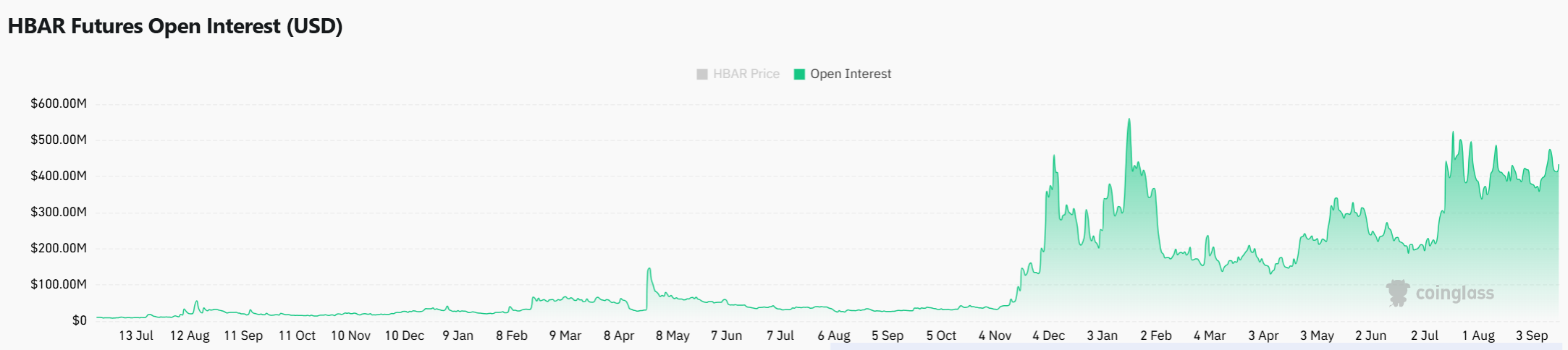

Meanwhile, Open Interest in HBAR derivatives jumped 13.42%, hitting $466M, reflecting heightened speculative engagement, according to CoinGlass. This surge highlights how policy shifts can quickly align with growing market participation. Therefore, the backdrop remains favorable for HBAR as both technicals and regulatory clarity support a bullish narrative.

Summary

HBAR price remains supported by technical strength and regulatory tailwinds. Hedera price forecasts point toward higher levels if support zones continue to hold. With ETF clarity and rising Open Interest, the path toward the analyst’s $1.80 target looks more credible. The overall outlook appears decisively bullish.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

Frequently Asked Questions (FAQs)

1. What impact does the SEC’s generic ETF framework approval have on crypto?

2. Why is Hedera often mentioned in connection with ETF speculation?

3. How does Open Interest affect overall market sentiment for digital assets?

- Peter Schiff Predicts BTC to Fall, Gold to Rise as Markets Price in Prolonged Iran War

- Institutional Re-Accumulation Signs Emerge as Bitcoin ETFs See $1.1B Net Inflows Since Iran War Began: Glassnode

- From Mining Pool to Infrastructure Platform: Nine Years of EMCD

- U.S.-Iran War: U.S. Oil Prices Spike To One-Year High, Bitcoin and Gold Dip

- Crypto Traders Bet Against U.S.-Iran Ceasefire This Month as Iran Denies Peace Talks

- HOOD Stock Targets $100 as Robinhood Unveils Platinum Card and Advance Dividend Feature

- Bitcoin Price Prediction if Donald Trump Signs the CLARITY Act on April 3, 2026

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

Buy $GGs

Buy $GGs