Here’s How Descending Triangle Pattern Limits The Solana Coin Recovery

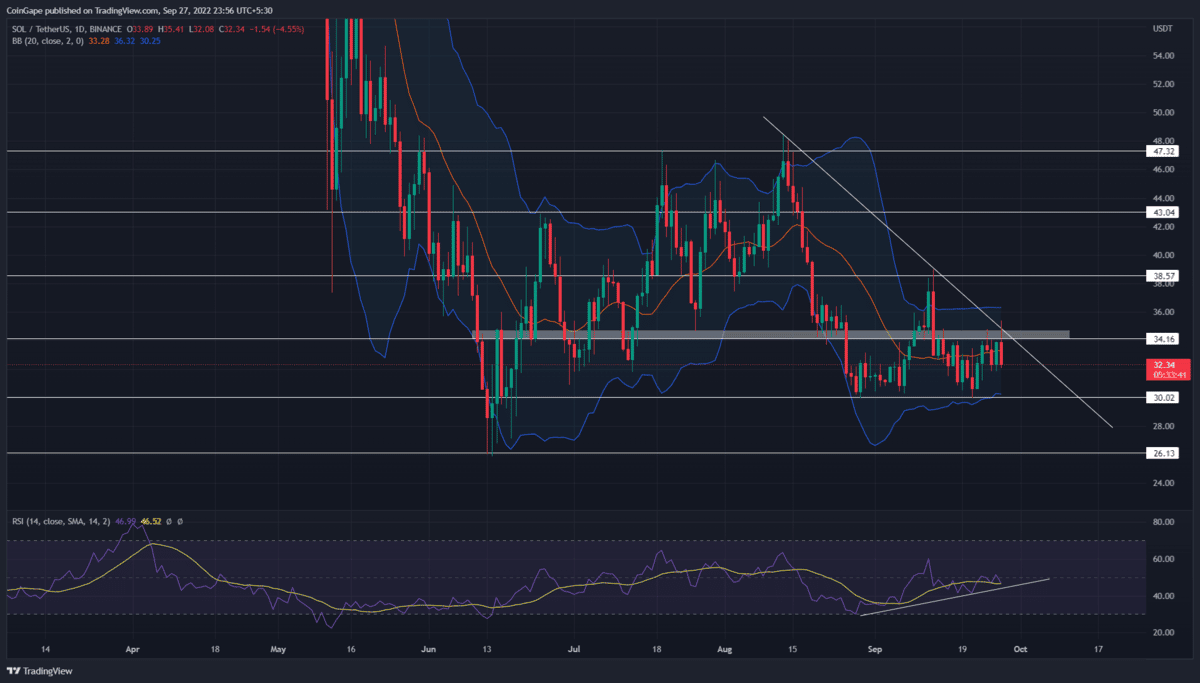

The daily technical chart shows the Solana coin price is in a short-term range-bound rally. Furthermore, this sideways is restricted within the top resistance of $47.4 and bottom support of $26. The coin holders should keep a keen eye on these levels as they will have a significant impact in the near term future.

Key points Solana coin analysis:

- The high wick rejection candles at $34.1 validate it as a strong supply zone

- The Solana price will continue its downward spiral until the resistance trendline is intact

- The 24-hour trading volume in the Solana coin is $1.2 Billion, indicating a 42% gain

Source-Tradingview

Source-Tradingview

The ongoing bear cycle within the aforementioned range has revealed a descending triangle pattern formation. In theory, this bearish continuation pattern triggers a significant boost in selling pressure once the coin price breaks below its neckline support.

Concerning this pattern, the Solana coin chart shows the $30 as the neckline support and a descending trendline as a dynamic resistance. Earlier today, the altcoin showcased a 4% gain and tried to break the $34.5 resistance.

However, the descending trendline intersected at the same level, creating a strong resistance zone for buyers. Moreover, the crypto market faces sudden selling pressure and evaporates the entire intraday gains.

The Solana coin price is currently trading at the $32.84 mark, with a 3.04% loss from yesterday’s closing.

Thus, a strong rejection candle formed at $34.5 resistance indicates the coin price is likely to tumble 9% lower to hit the $30 support. Under the influence of this pattern, the SOL price should eventually break the neckline support and carry the downfall another 12.5% down to reach the June low support of $26.

On a contrary note, a possible breakout from the resistance trendline will indicate a switch in market sentiment and an opportunity for price recovery.

Technical indicator

RSI: the daily-RSI slope shows an evident bullish divergence concerning the price restest to the $30 support. This divergence strengthens the possibility of a bullish recovery.

Bollinger band indicator: the coin price nosedive below the indicator midline indicates the sellers will remain in charge of price behavior.

- Resistance level- $34.5 and $38.5

- Support levels- $30 and $26

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- U.S.-Iran War: U.S. Oil Prices Spike To One-Year High, Bitcoin and Gold Dip

- Crypto Traders Bet Against U.S.-Iran Ceasefire This Month as Iran Denies Peace Talks

- Ripple Prime Adds Support For Bitcoin, Ethereum, XRP, Solana Derivatives on Coinbase

- Bitcoin Price Still Risks Decline If Iran War Mirrors Ukraine War Market Reaction, JPMorgan Warns

- Bitget Unveils Upgrade For Stock, Gold Trading Alongside Crypto As Part Of Universal Exchange Push

- HOOD Stock Targets $100 as Robinhood Unveils Platinum Card and Advance Dividend Feature

- Bitcoin Price Prediction if Donald Trump Signs the CLARITY Act on April 3, 2026

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

Buy $GGs

Buy $GGs