Here’s Shiba Inu Price As “Death Cross” Emerges on Charts

Highlights

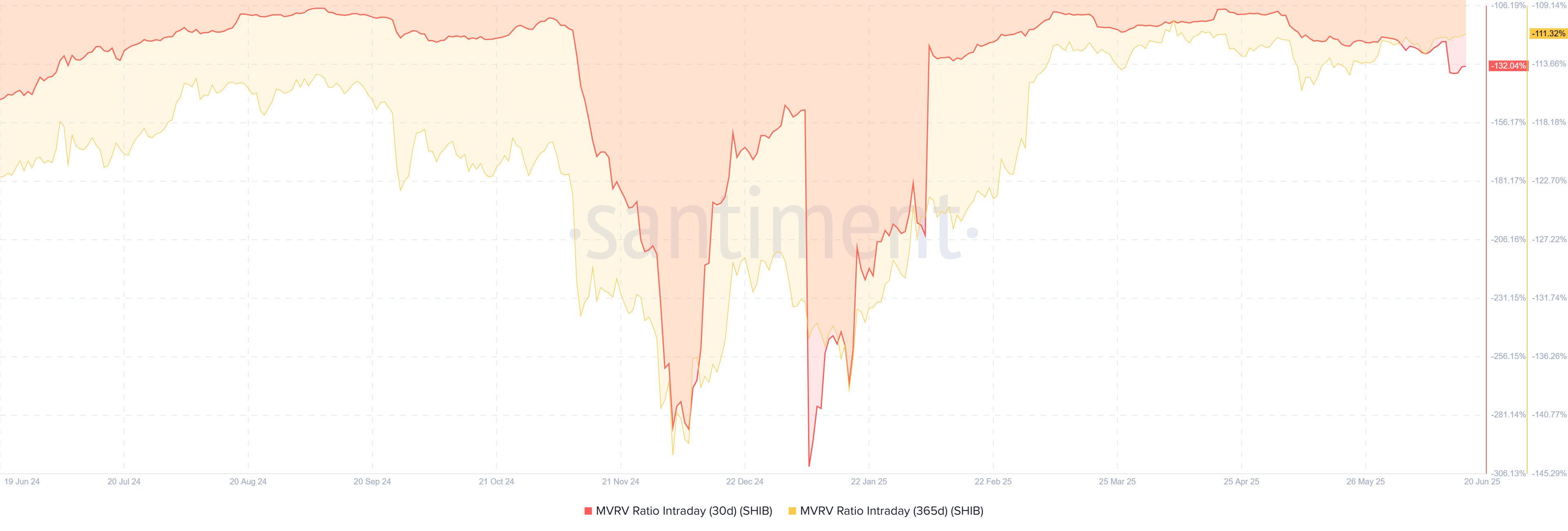

- Shiba Inu price is at an inflection point as the MVRV indicator forms a "death cross" signal.

- The 30-day MVRV has fallen to -132%, which is below 365-day signalling that recent buyers are experiencing losses.

- A head and shoulders pattern signals that a 14% crash to $0.0000097 may be imminent.

Shiba Inu (SHIB) trades at $0.0000115 today, June 20, as it continues the downtrend that has seen it shed more than 20% in value in just one month. At press time, SHIB’s daily trading volumes had declined by 38% to $78 million amid fading market interest. Meanwhile, a key on-chain metric had formed a “death cross,” which usually warns that the Shiba Inu price is about to enter a strong downtrend.

Shiba Inu Price Outlook as “Death Cross” Emerges

SHIB price could experience a spike in volatility as the Market Value to Realized Value (MVRV) creates a “death cross.” This bearish signal emerged after the 30-day MVRV dropped below the 365-day MVRV, indicating that the traders who bought SHIB in the last 30 days are in deeper losses compared to the traders who have held for a year.

Per Santiment’s data, traders who have held SHIB for 30 days are sitting 132% underwater, while those who bought in the last year have losses of 112%.

This crossover may have a bearish implication in the short term as recent buyers are beginning to capitulate. Moreover, when new buyers are beginning to make notable losses with top meme coins such as Shiba Inu, new capital inflows could dry up, increasing the downside risk.

However, while this move may affect the Shiba Inu price performance in the near term, it may precede a bounce in price. After short-term holders are done capitulating, it could give room for the price of SHIB to rebound to the upside. Such intense losses may also deter investors from selling until they break even.

Head & Shoulders Pattern Signals 14% Crash

A head and shoulders pattern has emerged on the four-hour Shiba Inu price chart, albeit with a slanted neckline support. This pattern usually highlights a bearish Shiba Inu price prediction that bears are about to have full control, and another crash could be looming.

The height of the shoulder is 14%, suggesting that if Shiba Inu falls below the support price of $0.000011, it could trigger a 14% decline to $0.0000097. Such a dip may happen as recent buyers start capitulating, causing a surge in sell-side pressure.

Technical indicators also remain bearish, with the RSI of 42 indicating that the momentum governing the price performance is bearish. The AO histogram bars also remain on the bearish side, and this negative momentum could be getting stronger as the bars shift to red.

However, as CoinGape recently reported, whales are accumulating SHIB after purchasing 1.3 trillion tokens within 24 hours. If these large addresses accumulate the coins that recent buyers are selling, it may prevent a crash and aid a price recovery.

In conclusion, Shiba Inu price is at a critical point as on-chain data flips bearish, indicating the likelihood of a downside correction. Meanwhile, the lower timeframe indicates that the bearish momentum is gaining strength due to a bearish formation and increasing selling pressure.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

Frequently Asked Questions (FAQs)

1. Why is Shiba Inu price dropping?

2. What does the MVRV death cross show about SHIB price?

3. Will Shiba Inu price crash further after forming a head and shoulders pattern?

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs