Here’s Why Ethereum Could Rally 10% Before Continuing Its Downfall

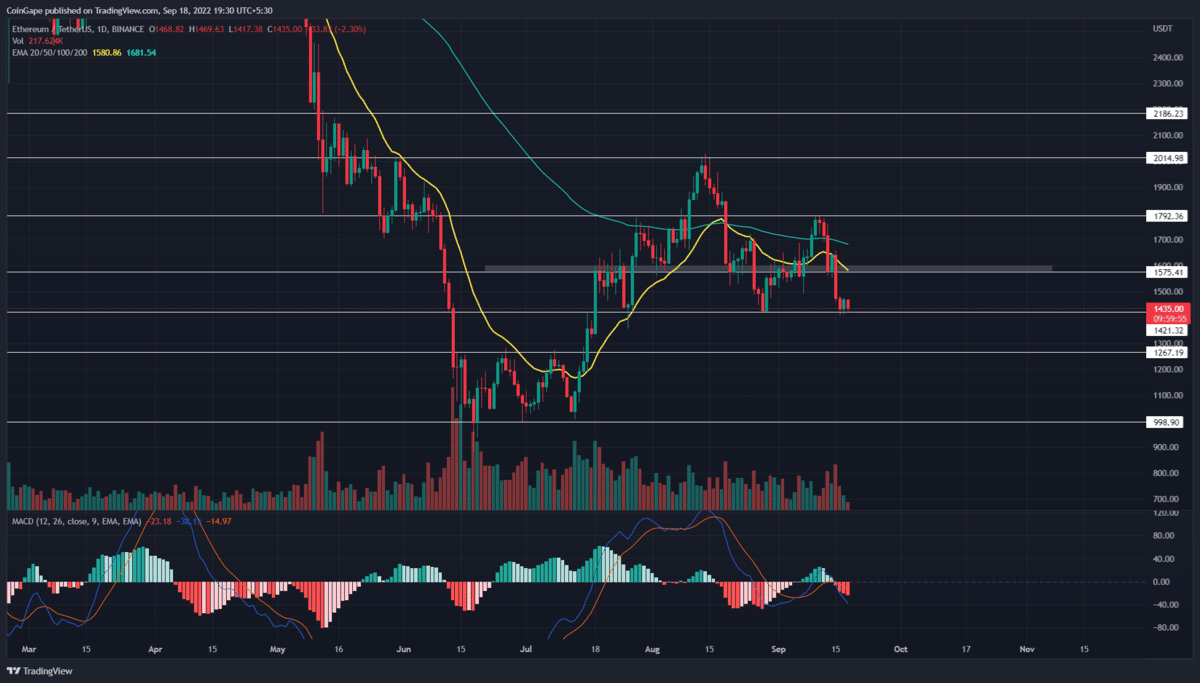

The recent widespread correction in the crypto market reverted the Ethereum price from $1800 resistance. This sell-off entirely evaporated the early September recovery and plunged the prices back to the monthly support zone of $1420. However, the price action shows reversal signs at this support, indicating a possible relief rally.

Key points:

- The coin chart shows the formation of a double bottom pattern in the 4-hour time frame chart.

- Losing the $1420 could plummet the Ethereum price bac

- The intraday trading volume in Ethereum is $10.65 Billion, indicating a loss of 12.2%.

Source- Tradingview

Source- Tradingview

Furthermore, it’s been three days since the sellers are wrestling buyers at this support to prolong this correction. Furthermore, with a 2.575% loss, the Ethereum price is painted red today and retests the $1420 support.

If the sellers manage a daily candle closing below the aforementioned support, the accelerated selling pressure will plunge the altcoin to $1000 psychological support.

Ethereum Could Rally With This Double Bottom Pattern

The four-time chart shows a lower price rejection candle at the $1420 support indicating the traders are actively buying at this level. Moreover, the RSI indicator displaying bullish divergence to base support indicates a better possibility for price reversal.

If this theory worked out, the Ethereum price could rally 3.88% higher to challenge the $1470 neckline of double bottom pattern. A bullish breakout from this resistance will further encourage buying activity and retest the $1575 supply zone.

Anyhow, the price action at this level is crucial to influence future Ethereum prices.

Due to the accumulation of daily EMAs at this level, a possible reversal could display a lower high in the daily chart indicating a losing bearing momentum.

However, if the Ethereum price surpasses this level, it indicates the recent correction was just panic selling in the market.

Technical indicator-

Bollinger band: the falling Ethereum price retest the indicator’s band support. Such activity has previously resulted in a bullish reversal, bolstering the relief rally theory.

MACD indicator: A widespread between the bearishly aligned fast and slow line below the neutral zone indicates aggressive selling in the market.

- Resistance level- $1470 and $1520

- Support level- $1400 and $1362

- Tom Lee’s Bitmine Doubles Down on Ethereum With $34.7M Fresh Purchase

- BlackRock Buys $65M in Bitcoin as U.S. Crypto Bill Odds Passage Surge

- Bitcoin Sell-Off Ahead? Garett Jin Moves $760M BTC to Binance Amid Trump’s New Tariffs

- CLARITY Act: Trump’s Crypto Adviser Says Stablecoin Yield Deal Is “Close” as March 1 Deadline Looms

- Trump Tariffs: U.S. To Impose 10% Global Tariff Following Supreme Court Ruling

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?