Is BitTorrent (BTT) Price Rally A Classic Pump and Dump? Here’s What You Should Know

The BTT token, native to BiTorrent, a file-sharing protocol acquired by Tron in 2018, surged in value on Wednesday following a significant leap by the Tron blockchain.

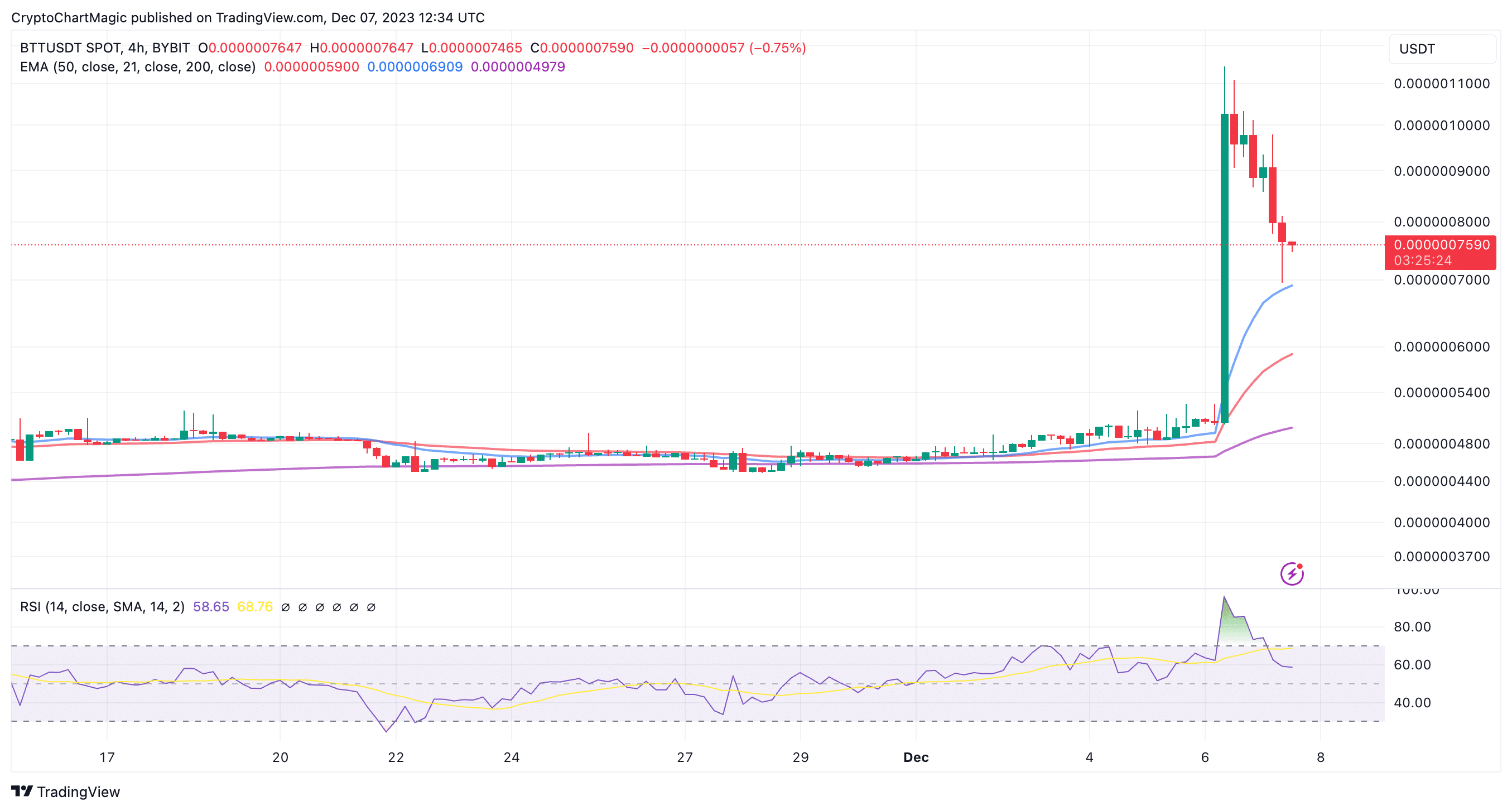

BitTorrent price climbed to $0.0000011 for the first time since May 2022, as the Tron blockchain, on which it is issued achieved another milestone, rising to 200 million users.

🎉🎉🎉Congratulations!!! #TRON's total accounts have reached 199,027,826, exceeding 199 million! #TRON ecosystem has developed rapidly and continues to make efforts to decentralize the web.

🥰Appreciation to all #TRONICS! pic.twitter.com/yz1oLIP1wW

— TRONSCAN (@TRONSCAN_ORG) December 2, 2023

Trading volume increased by $1,157% to $374 million as traders found BTT price movements attractive, possibly for scalping, market data by CoinMarketCap showed.

📈Trading Volume of $BTT has increased 1157% in the last 24 hrs on @CoinMarketCap! #BitTorrent #BTT #BTTC pic.twitter.com/hjgSOsnUT9

— BitTorrent (@BitTorrent) December 7, 2023

Aside from Tron’s achievement, there was no news driving the rally which saw cumulative gains in the past week increase by 67%. This could also be one of the factors resulting in a 27% correction to $0.00000075.

Recommended for you: Top 3 Meme Coins To Buy In December For 2024: DOGE, BONK and Optimus AI

Is BitTorrent (BTT) Price Rally A Pump And Dump Affair?

The BitTorrent market cap closed in on the $1 billion mark following the specular breakout, from support at $0.0000005. BTT also formed the biggest weekly candle in history, as it doubled in value.

It is too early to tell if the rally will continue. However, traders may want to closely monitor the direction of the Relative Strength Index (RSI). A persistent uptrend into the overbought region which is the case at the moment validates a bullish theory.

Therefore, higher support in the region between the 50-week Exponential Moving Average (EMA) (red) at $0.0000005919 and the current market value of $0.00000075 could help keep bulls in control, and lead to another breakout above resistance in the area running from $0.000001 to $0.0000011.

The RSI in both the daily and the four-hour time frames paints a grim picture for BitTorrent as it slides into the neutral area. This trend change underscores the intensifying sell-side pressure, possibly due to profit-booking activities.

If support highlighted by the 21-EMA on the four-hour chart holds, bulls could have an early chance to deal with the overhead pressure above $0.0000007. With support confirmed, investors could pique interest in buying the dip while betting on another breakout—an uncertain future.

Tron (TRX), the token powering the Tron blockchain did not see see massive price surge like BitTorrent. Trading 1.4% lower on the day and 0.6% lower in a week, TRX is barely holding onto support at $0.1.

Related Articles

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Senate Eyes CLARITY Act Markup This Month as Banks, Crypto Continue Stablecoin Yield Talks

- Why XRP Price Rising Today? (2 March)

- Breaking: Bitcoin Price Rises to $70k as Gold Crashes Amid U.S.-Iran Conflict

- Bitcoin News: Anthony Pompliano’s ProCap Buys 450 BTC, Gold Bug Peter Schiff Reacts

- Fed Rate Cuts More Likely If U.S.-Iran Conflict Extends, Arthur Hayes Predicts

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

Buy $GGs

Buy $GGs