Is Ethereum Price About to Crash Amid Relentless BlackRock Selling?

Highlights

- Ethereum price could be ripe for a pullback as BlackRock continues selling.

- Spot Ethereum ETFs have shed assets in the past five consecutive days.

- The coin will then bounce back in the coming weeks when the willing pressure fades.

Ethereum price has lost momentum this month. It dropped to $4,330 today, September 9, down by 13% from its August high. This pullback could be the start of more downside as BlackRock continues dumping ETH and ETF outflows rise.

Ethereum Price at Risk as BlackRock Continues Selling

There are signs that the Ethereum price is about to crash as BlackRock, the biggest asset manager, continues to sell some of its holdings.

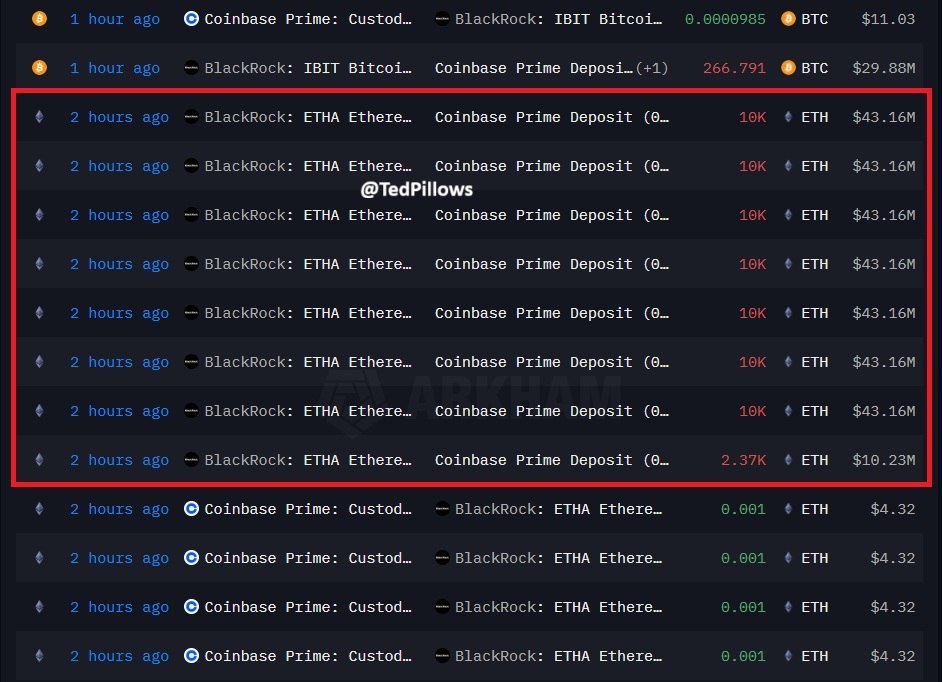

On-chain data shows that the company moved coins worth $312.5 million to Coinbase on Monday. Companies and individuals move tokens from self-custody to exchanges when they want to sell them.

The selling process has coincided with the recent Ethereum ETF outflows. Data compiled by SoSoValue shows that these funds had total outflows worth $446 million on Friday. They have had outflows in the last five consecutive days, lowering their cumulative inflows to $12.7 billion.

Therefore, the ongoing BlackRock selling could be because of the recent outflows. The iShares Ethereum Trust had outflows of $309 million on Friday.

On the positive side, ETF outflows are normal in an any asset. For example, they lost over $237 million in outflows in the week to August 22, followed by inflows of $1.08 billion a week later.

The other bullish catalyst for Ethereum price is that treasury companies have continued their accumulation. Tom Lee’s BitMine Immersion has bought Ether coins worth over $9 billion, making it the biggest corporate holder. SharpLink has over 797k coins worth $3.4 billion.

The other catalyst that may drive the ETH price is that the network is doing well. Total stablecoin assets jumped to over $154 billion, much higher than other crypto projects.

ETH Price Technicals Point to More Downside Before Rebounding

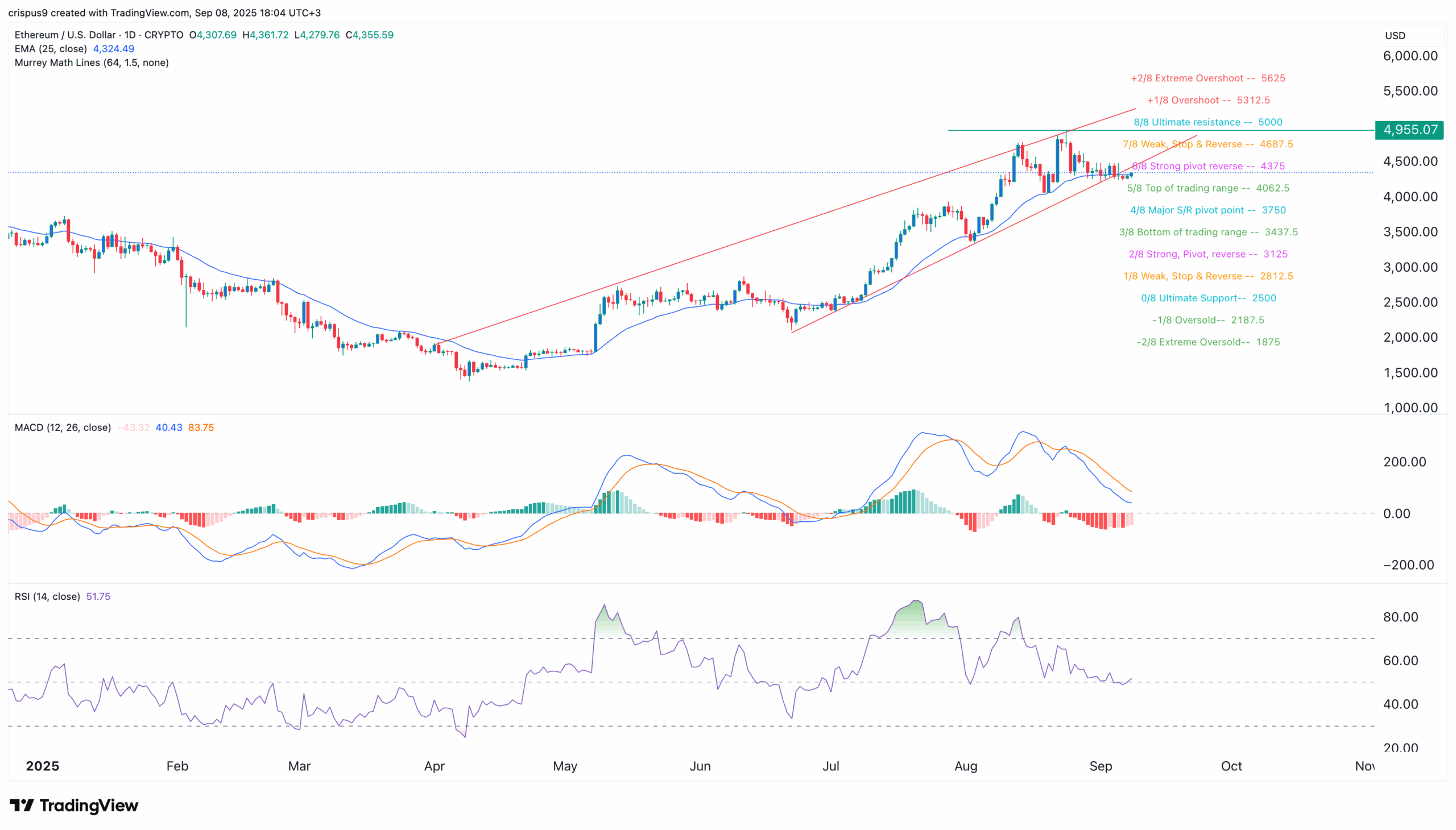

The daily timeframe chart reveals that the ETH price peaked at $4,955 on August 24 to $4,350 today. It has moved below the lower side of the ascending channel a sign that bears are gaining momentum.

Ethereum token has dropped slightly below the 25-day Exponential Moving Average. Also, the Relative Strength Index (RSI), a top oscillator, has dropped below the overbought level at 87 in July to 51.

In most cases, an asset continues falling when the RSI is falling, with a reversal happening when it moves to the oversold level.

The two lines of the MACD indicator have formed a bearish crossover pattern. Therefore, the coin will likely continue falling as sellers target the major S/R pivot point of the Murrey Math Lines at $3,750.

The bearish ETH price forecast for 2025 will be invalidated if it rises above the year-to-date high of $4,955.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

Frequently Asked Questions (FAQs)

1. What is the most likely Ethereum price forecast?

2. What is the most bearish ETH price outlook?

3. What are the top ETH price targets?

- XRP News: XRPL Set to Add Options Trading for Investors Amid Major Upgrade

- Is World War III Near? Bitcoin Price Drops As UK, France, Germany Consider Iran Action

- Is Bitcoin Dead? Here’s What the Data Really Says

- US-Iran War: Meme Coin Market Plunges After Iranian Drone Hits US Embassy in Kuwait

- Arthur Hayes Sees 5x HYPE Token Rally as Oil Perps Pump on Hyperliquid Amid U.S.–Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

Buy $GGs

Buy $GGs