Key Reason Why Investors Must Avoid MATIC, SHIB, UNI

Highlights

- MATIC, SHIB, and UNI may indicate a lack of stability as a small entity controls the major portion of their supply.

- The aforementioned coins are significantly down from their All time high and heading lower to test key support levels.

- While the centralization of supply presents risks, it could also indicate confidence in the asset’s long-term prospects if large holders are not selling.

The crypto market has showcased a sideways trend for the past few months following the consolidation trend in Bitcoin price. As a prolonged correction looms, altcoins like MATIC, SHIB, and UNI are at risk for significant downfall as a small number of entities hold the majority of supply.

Centralization Risks Loom Over MATIC, SHIB, UNI

Centralization is a key issue in the cryptocurrency market that continues to stir debate. Centralization in this context refers to the concentration of a cryptocurrency’s total supply in the hands of a few wallets. If a small group holds the major portion of a particular asset, it could lead to market manipulation and other malpractice that could sabotage retail investors. MATIC, SHIB, and UNI currently show such a high degree of centralization as significant portions of their supply are held by the top 10 wallets

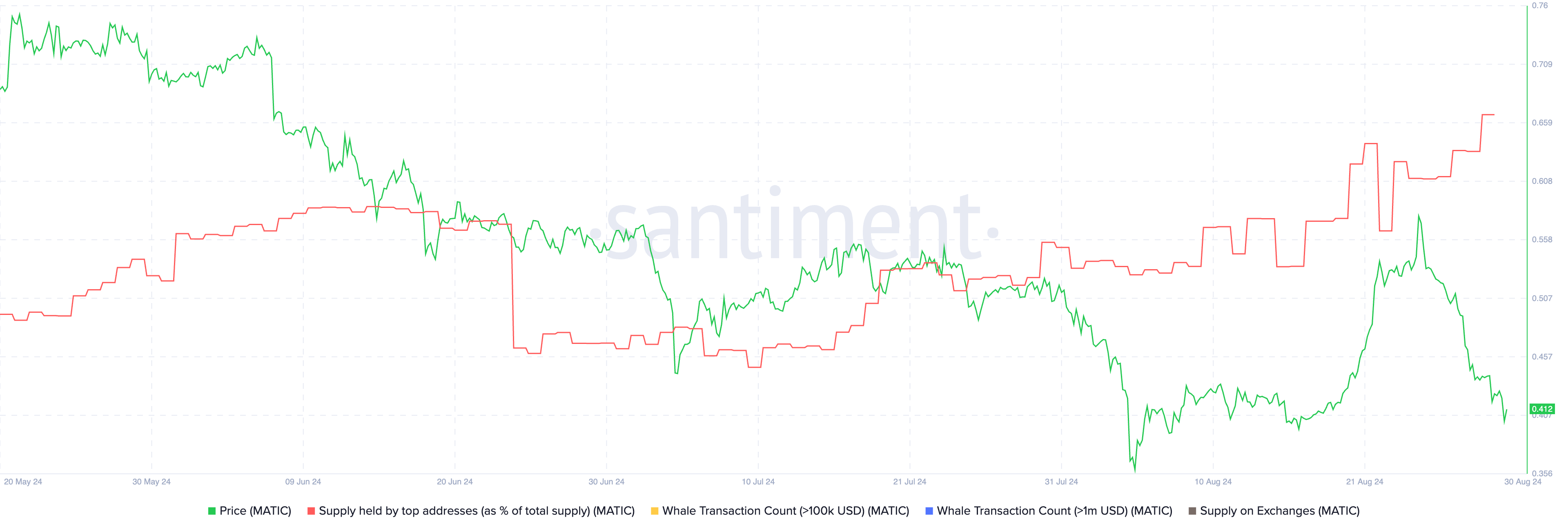

Polygon (MATIC)

Polygon (MATIC) tops the list with 69.4% of its total supply held by the top 10 wallets. This heavy level of centralization suggests that only a few key players control a major portion of the supply; therefore, their movement could have a major impact on MATIC price.

The polygon coin currently trades at $0.4, boosting a market cap of $4 Billion. The MATIC coin is 86.2% down from the all-time-high (ATH) of $2.9 and has shown a sideways trend since May 2022.

While the network is preparing to implement the migration from MATIC token to POL, the buyers could attempt to defend $0.33 support. A further breakdown could push the asset to $0.26, followed by $0.18.

Shiba Inu (SHIB)

According to Santiment data, the Shiba Inu (SHIB) 61.2% of its supply is concentrated in the top 10 wallets. While this dog-themed meme coin takes pride in its large community and massive fanbase, this centralization hints that the actions of a few could significantly impact the SHIB price.

The Shiba Inu price prediction suggests that the asset’s value, currently at $0.00001378, has returned to the same level it has fluctuated around since May 2022, following a six-month correction.

The SHIB price is 84.5%, down from $0.00008845 ATH, steadily heading to the next support of $0.000012. A potential breakdown from this support could plunge the asset back to $0.00001.

Uniswap (UNI)

Uniswap (UNI), a leading decentralized exchange (DEX) token, has 50.8% of its total supply held by the top 10 wallets. While Uniswap boosts itself on decentralization, especially in its governance, the concentration of tokens among large holders could significantly influence the decision-making process.

By press time, the UNI price trades at $5.6 and holds a market cap of $3.38 Billion. The major trend in Uniswap coin is sideways and is down 87.4% from ATH of $44.97. With sustained selling, the coin price could retest the $4.6 support, followed by $3.8.

However, the immediate resistances are at $6.6 and $8.6.

Conclusion

An asset with most of its supply controlled by a small group should be approached cautiously, as it may be prone to instability. However, it could be a positive indicator if the holders refrain from selling, as it may also reflect their confidence in the asset’s long-term potential.

Frequently Asked Questions (FAQs)

1. What is the key concern with centralization in cryptocurrencies like MATIC, SHIB, and UNI?

2. How does the current market trend affect MATIC, SHIB, and UNI?

3. Can high centralization indicate confidence in an asset’s long-term potential?

- Bitcoin Sell-Off Ahead? Garett Jin Moves $760M BTC to Binance Amid Trump’s New Tariffs

- CLARITY Act: Trump’s Crypto Adviser Says Stablecoin Yield Deal Is “Close” as March 1 Deadline Looms

- Trump Tariffs: U.S. To Impose 10% Global Tariff Following Supreme Court Ruling

- CryptoQuant Flags $54K Bitcoin Risk As Trump Considers Limited Strike On Iran

- Why Is Bitdeer Stock Price Dropping Today?

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?