Multiple Resistance Levels Encourage Sellers To Plunge ETH To $1400

The parabolic recovery in ETH/USDT pair surged the prices by 101% from mid-June to August and formed a local top at the $200 mark. Furthermore, during this bull run, the coin price witnessed several pullbacks, which replenished the bullish momentum for further gains.

Key points ETH analysis:

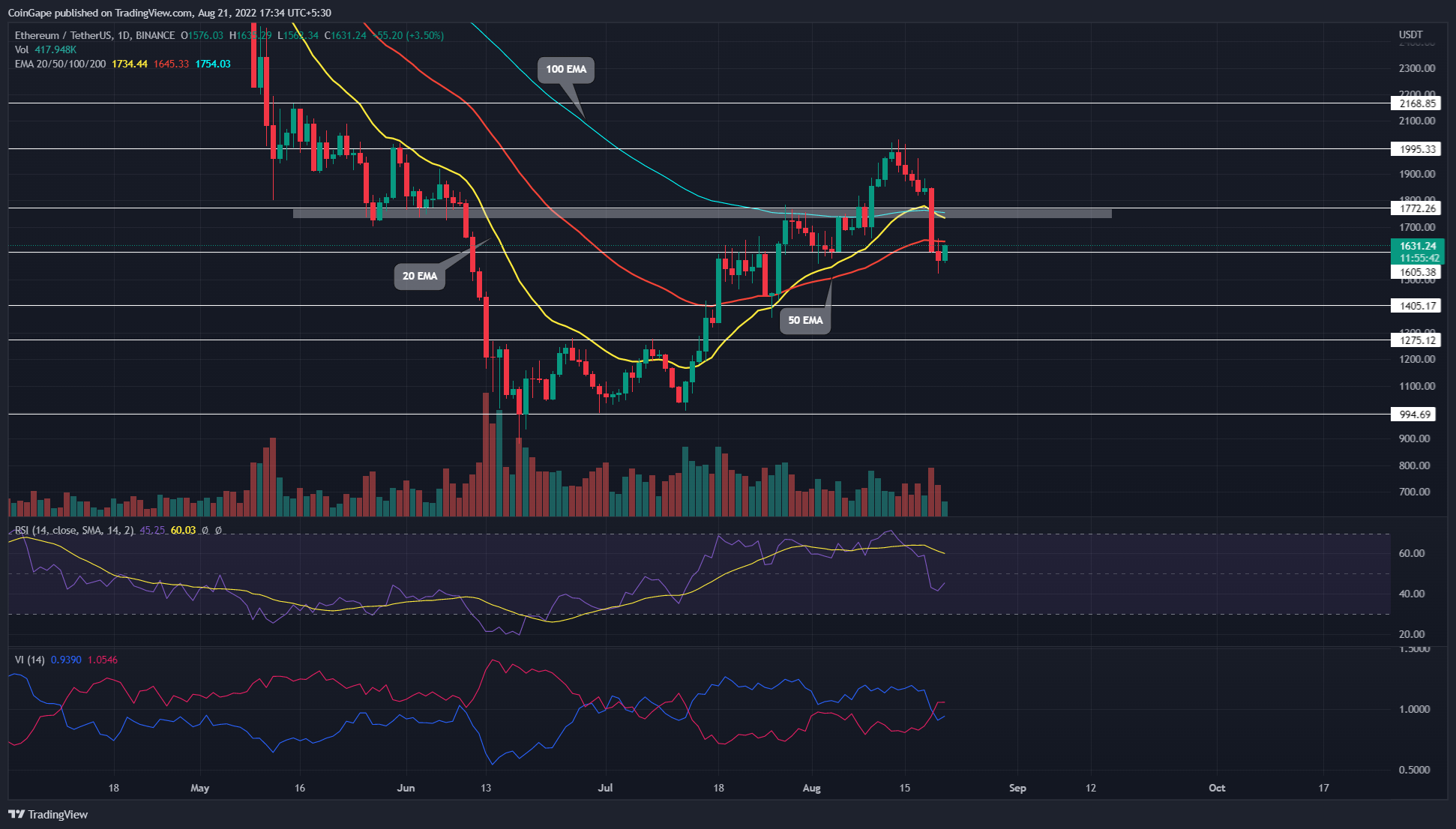

- Higher price rejection at 50-day EMA supports price sustainability below the $1600 mark

- The bearish crossover of the 20-and-100-day EMAs will strengthen the current correction

- The intraday trading volume in Ethereum is $18.6 Billion, indicating a 2.89% loss

On August 14th, the ETH price reverted from the $2000 resistance level, suggesting an occasional price correction. The fresh news that the US Fed plans to increase the rate hike in September by 0.75% accelerated the bearish momentum.

Thus, in the past seven days, the ETH price depreciated 21% and plunged below $1775, and the previous swing low of $1600. However, the coin price is 3.3% up today and plans to test the $1600 mark as potential resistance.

Moreover, the 50-day EMA moving at the same level puts an additional barrier against buyers. If by the end of the day, the altcoin gives a candle closing below the $1600 mark, the potential downfall may slump the ETH price 12.5% down to the $1400 psychological level.

However, even if buyers push the price higher today, the immediate combined resistance of $1775 and 100-day EMA will encourage sellers to follow the above setup.

On a contrary note, a bullish breakout from the $1775 resistance weakens the possibility of this bearish theory and provides a breakout opportunity from the swing high resistance of $2000.

Technical indicator-

Relative strength index: the daily-RSI slope nosedive below the neutral line from the overbought regions indicates a sudden turnaround in market sentiment.

Vortex indicator: the VI+ and VI- slopes last showcased a bearish alignment before mid-July. Thus, a bearish crossover among these slopes offers a sell signal for interest traders.

- Resistance level- $1600 and $178

- Support levels- $1400 and $1275

- CLARITY Act: Trump’s Crypto Adviser Says Stablecoin Yield Deal Is “Close” as March 1 Deadline Looms

- Trump Tariffs: U.S. To Impose 10% Global Tariff Following Supreme Court Ruling

- CryptoQuant Flags $54K Bitcoin Risk As Trump Considers Limited Strike On Iran

- Why Is Bitdeer Stock Price Dropping Today?

- Breaking: U.S. Supreme Court Strikes Down Trump Tariffs, BTC Price Rises

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?