Pepe Coin Price Bounce Likely as Support Zone Aligns With Rising Social Activity

Highlights

- PEPE Coin price retests demand zone after previous 105% rally.

- Descending resistance trendline caps moves, $0.00001500 target in play.

- Social dominance surge and $24.23M outflows strengthen bullish setup.

The PEPE Coin price has returned to a crucial demand zone after a sharp decline, with charts outlining a decisive structure. Meanwhile, social sentiment has shown signs of growth, keeping attention fixed on the next possible breakout. These conditions frame the PEPE price outlook heading into October.

PEPE Coin Price Action From Key Demand Zone

The chart highlights a clear descending resistance trendline while support continues to hold within the $0.00000884 to $0.00000984 range. Notably, the last retest of this zone in May triggered a 105% rally that pushed the price above $0.00001800.

The current PEPE Coin market price trades at $0.00000935, showing another touch of the same support level. Specifically, the setup now suggests that a breakout above the descending resistance could open the path toward the $0.00001500 level. This target reflects a projected gain of around 69% from current levels.

Meanwhile, failure to hold above the support would shift focus back to $0.00000884 as a key lower boundary. However, repeated demand zone retests strengthen the potential for another rebound. The chart pattern clearly defines the next upside zone at $0.00001500, giving direction to a long-term PEPE Coin price prediction.

Social Dominance Rises as Outflows Support the Base

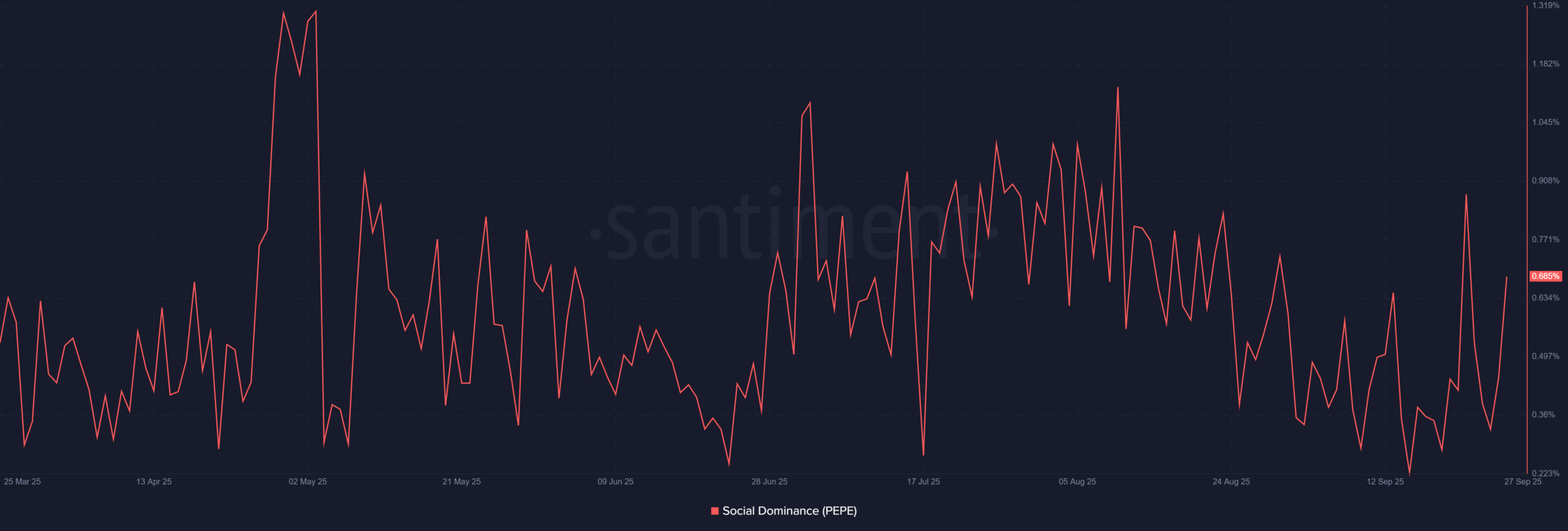

Social dominance jumped from 0.4489% to 0.685% in the last 24 hours, marking a noticeable pickup in crowd activity. This reflects stronger discussion volume at a point where price is testing crucial structure.

Meanwhile, weekly netflows show consistent outflows, with a recent figure of $24.23M, signaling fewer tokens entering exchanges for sale, according to CoinGlass. Reduced inflows often reflect lower immediate sell pressure, reinforcing price stability around support.

Together, the higher social dominance and exchange outflows align with the demand zone retest.

Specifically, these metrics suggest that both sentiment and liquidity back the chance of a rebound. If conditions hold, the projected $0.00001500 level remains achievable in the short term. Altogether, the PEPE price outlook combines chart structure with sentiment cues favoring recovery.

To sum up the PEPE Coin price sits at a decisive area where historical rallies have begun. Key support remains at $0.00000884 while resistance lies near $0.00001500. With sentiment and outflows in sync, the probability of another surge remains high. If buyers hold the base, the path to the projected upside stays intact.

Frequently Asked Questions (FAQs)

1. What chart pattern is visible on the PEPE Coin price chart?

2. Why is social dominance relevant to PEPE Coin?

3. How do exchange outflows affect PEPE Coin price action?

- Ripple’s RLUSD Gets Institutional Boost as SEC Eases Stablecoin Rules for Broker-Dealers

- Crypto Market Weekly Recap: BTC Waver on Macro & Quantum Jitters, CLARITY Act Deadline Fuels Hope, Sui ETFs Go Live Feb 16-20

- Robert Kiyosaki Adds To Bitcoin Position Despite Market Decline

- XRP News: Ripple Partner SBI Reveals On-Chain Bonds That Pay Investors in XRP

- BitMine Ethereum Purchase: Tom Lee Doubles Down on ETH With $34.7M Fresh Buy

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral