$PEPE Price At Risk of 14% Drop If Sellers Break this Key Support

In the final weeks of September, the PEPE price staged an impressive recovery, erasing all earlier losses from the first half of the month. The price surged from $0.0000006 to $0.00000083, marking a substantial 37.5% gain. However, this rally met a significant obstacle at a dual resistance level, consisting of the $0.00000083 price point and the upper trendline of a channel pattern. The question is whether the current bullish sentiment can help buyers overcome this hurdle.

Also Read: Is Pepecoin Worth The Hype

Will the PEPE Price Fall Back to $0.0000006

- The high supply pressure at $0.0000083 pushed the PEPE price lower.

- A falling channel pattern continues to pressure this memecoin for a more prolonged correction trend.

- The 24-hour trading volume in the Pepe coin is $79.2 Million, indicating a 1% loss.

On October 2nd, the Pepe coin price action showed a strong bearish engulfing candle at the resistance trendline of the channel pattern. This candle, which eclipsed the preceding three days of trading, could be an early warning signal for a potential bearish reversal.

Currently trading at $0.00000074 at the time of this analysis, and experiencing an intraday loss of 1.33%, the asset could be poised for a downward trajectory. A breach below yesterday’s low of $0.000000107 would provide the market with additional confirmation for an impending correction.

This could potentially trigger a 14% slide to retest the last swing low at $0.0000006, and possibly extend the downtrend even further should selling pressure continue to mount.

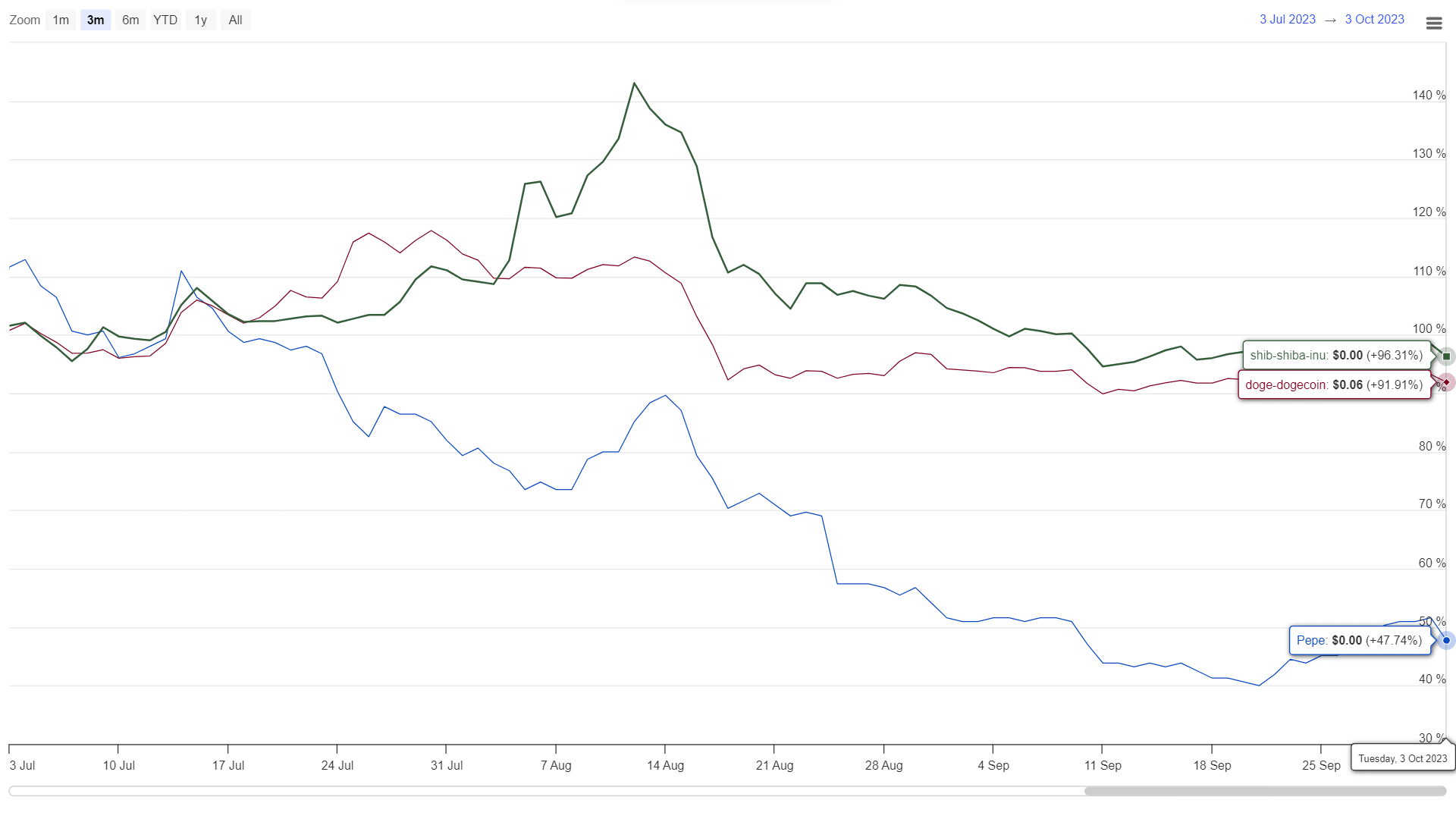

PEPE vs DOGE vs SHIB Performance

When comparing the price action over the last three months, the Pepe Coin has displayed higher volatility than the Dog-theme meme coins like SHIB and Doge. While Pepe Coin has been in a consistent downtrend, both Shiba Inu price and Dogecoin price have exhibited more sideways movements in their mid-term trends.

- Bollinger Bands: The flattening of the upper Bollinger Band suggests it could act as an additional resistance level, further challenging bullish attempts.

- Relative Strength Index: The daily RSI dipping below the 60% level implies that a managed reversal is increasingly likely, providing another cautionary signal for traders bullish on memecoin.

- Senator Kennedy Confirms CLARITY Act Markup Next Week After Bipartisan Senate Meeting

- Tom Lee’s BitMine Increases Staked ETH To $2.5B as Ethereum Staking Queue Surges

- Trump Tariffs: U.S. Supreme Court Sets January 9 for Possible Ruling

- Fed’s Stephen Miran Backs 100+ Bps of Rate Cuts as Crypto Traders Price In Only Two

- Why is SUI Price Up Today (Jan 6)

- XRP Price Prediction: Strongest Sessions in Weeks Boosts Early 2026 Rally, Will it Break 3$?

- Here’s Why Solana Price Will Hit $200 This Month

- Bitcoin Price Rally Could Hit $107K, Legendary Trader Predicts Ahead of US Jobs Data

- Top 3 Crypto Prices Prediction: Dogecoin, Cardano, and Chainlink Poised for Big Moves

- Ethereum Price Eyes $4K as BitMine Stakes $2.5B in ETH

- Bitcoin and Gold Price Prediction as Venezuela Conflict Fuels Investor Uncertainty