MATIC Price Analysis: Ongoing MATIC Correction Is “Buy The Dip” Opportunity, Here’s Why

The short term MATIC price analysis showcases a correction phase in action. However, a bullish pattern in the 4-hour chart highlights the possibility of a bullish reversal. Nonetheless, traders must stay cautious in taking a side before the fruition of the pattern to avoid any traps in the chart.

Key technical points:

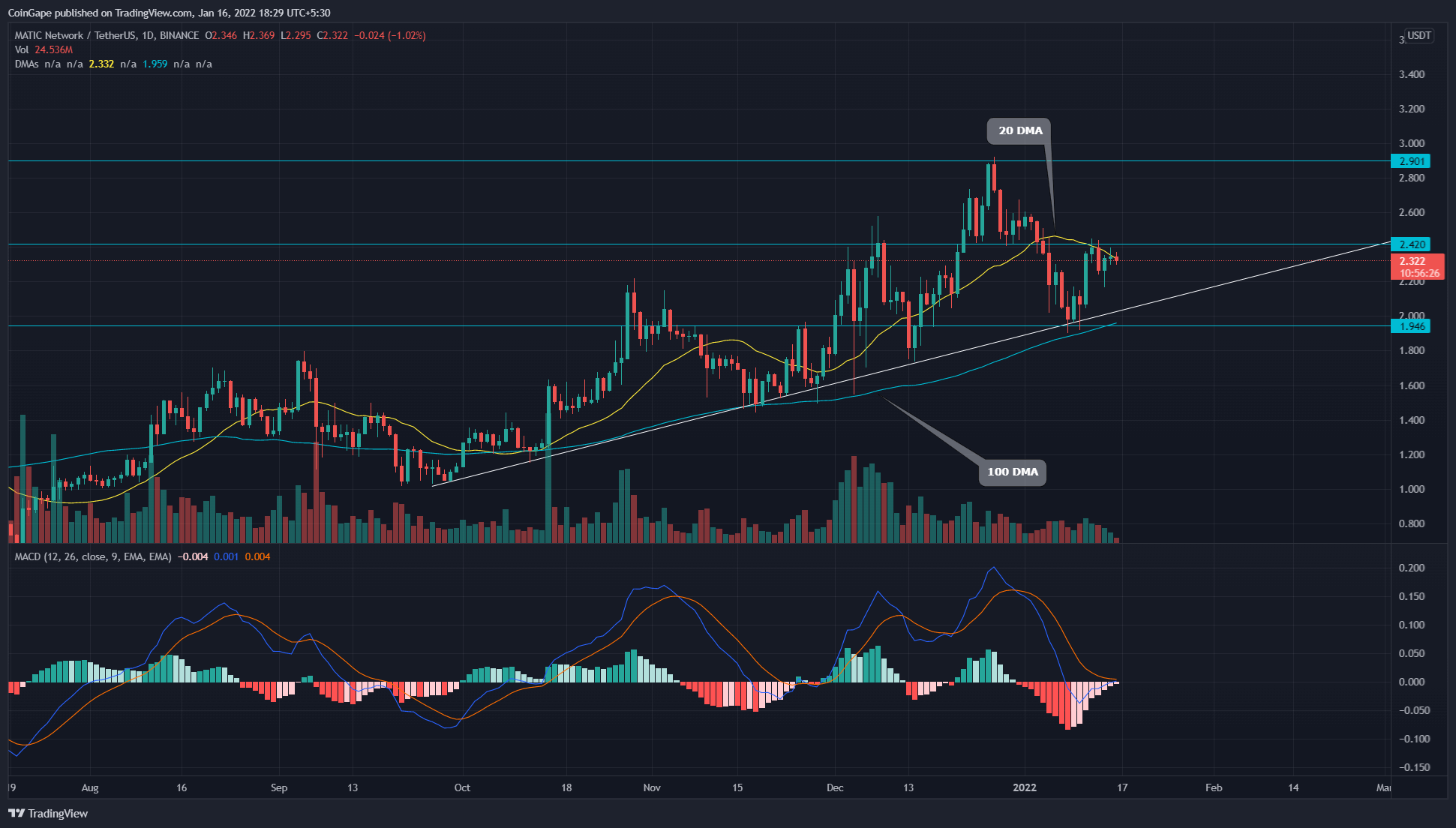

- The MATIC price struggles to rise above the 20-day DMA

- The selling pressure increases as the price hints at an evening star pattern formation

- The intraday trading volume in the MATIC coin is $1.21 Billion, indicating a 9.275% fall.

The MATIC price rose to the $2.5 resistance level after finding demand at the confluence of $2 level and the support trendline. However, the price action shows an evening star candle pattern justifying a 4% rejection from a high selling pressure area.

The support trendline maintains an uptrend resulting in the price jump of 20% from its inception. Therefore, the possible retracement can halt near the trendline.

Moreover, the 20-day DMA acts as a dynamic resistance keeping the recent bullish attack in check. However, the constant support from the 100-day DMA helps to carry an uptrend in action.

The Moving average convergence divergence shows a free fall in the MACD and signal lines in the daily chart. However, the falling distribution in the bearish histograms indicates a fall in underlying bearishness.

MATIC Price Action Hints Bullish Pattern Breakout

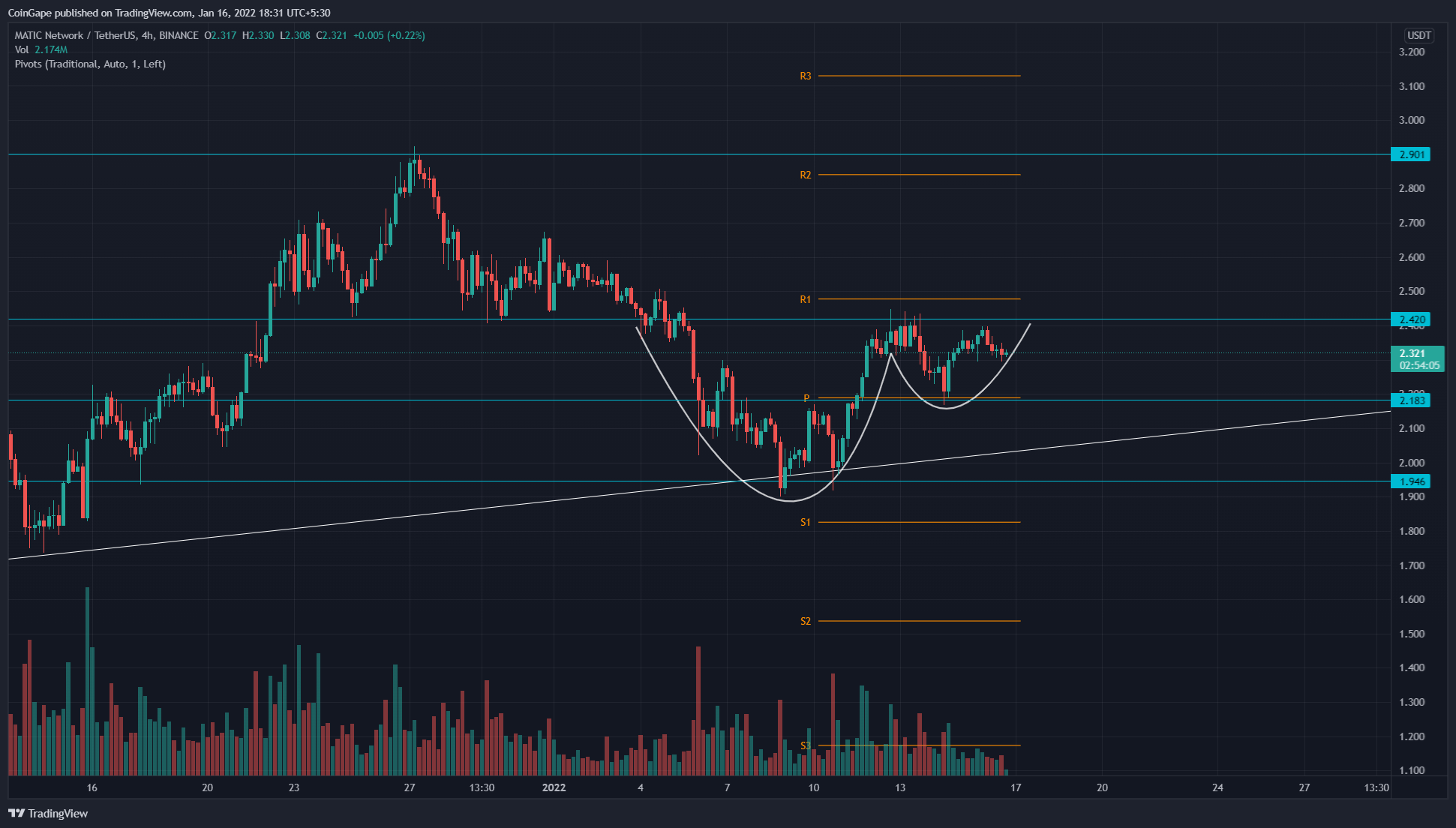

The MATIC price action forms a cup and handle pattern in the 4-hour chart. The neckline of the pattern is at the horizontal level of $2.40. Therefore, a price jump above the neckline will initiate a new bull run.

The decrease in trading volume during the handle formation of the pattern reflects trapping of momentum. Therefore, a breakout of either side will unleash the trapped momentum, and lead to a strong directional move.

The price action suggests the crucial high supply levels for MATIC price is at $2.84 following the neckline at $2.4 in the 4-hour chart. Meanwhile, the demand levels are at $2.2 and $1.8.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Best Cross-Chain Swap Platforms in 2026 – Top 9 Picks Reviewed

- Crypto Traders Predict Oil Prices to Rally Above $100 as Iran War Enters Week 2

- Prediction Market Kalshi Faces Class Action Over Iran War-Linked Bets

- Binance Responds To U.S. Senate Probe, Denies Iran Sanctions Violations

- Fed Rate Cut Odds Jump Following Huge U.S. Jobs Report Miss

- Here’s Why Cardano Price Has Not Reclaimed $0.30

- Will XRP Price Crash as U.S. Nonfarm Payrolls Fell by 92,000 in February?

- Pi Network Price Eyes a 40% Surge as Pi Day Looms on March 14

- Top Reasons Why Circle Stock Price is Surging

- Gold Price Prediction as US-Iran War Hits the Second Week

- HOOD Stock Targets $100 as Robinhood Unveils Platinum Card and Advance Dividend Feature

Buy $GGs

Buy $GGs