SOL Faces Macro Trend Shift: Will Solana Price Crash To $70?

Highlights

- Solana price trend shifts bearish, facing strong resistance at key levels.

- Whale transfers indicate strategic positioning despite the market downturn.

- Broader crypto decline pressures SOL, with $70 as possible support.

Solana (SOL) price dropped to $130 on Friday, extending its losses after falling 25% last week. The broader crypto market is also struggling, with Bitcoin slipping below $80k. Over $870 million in crypto positions were liquidated in the past 24 hours. Analysts now speculate whether Solana could decline further and potentially test the $70 support level as SOL faces a macro trend shift.

Will Solana Price Fall To $70 As SOL Faces Macro Trend Shift?

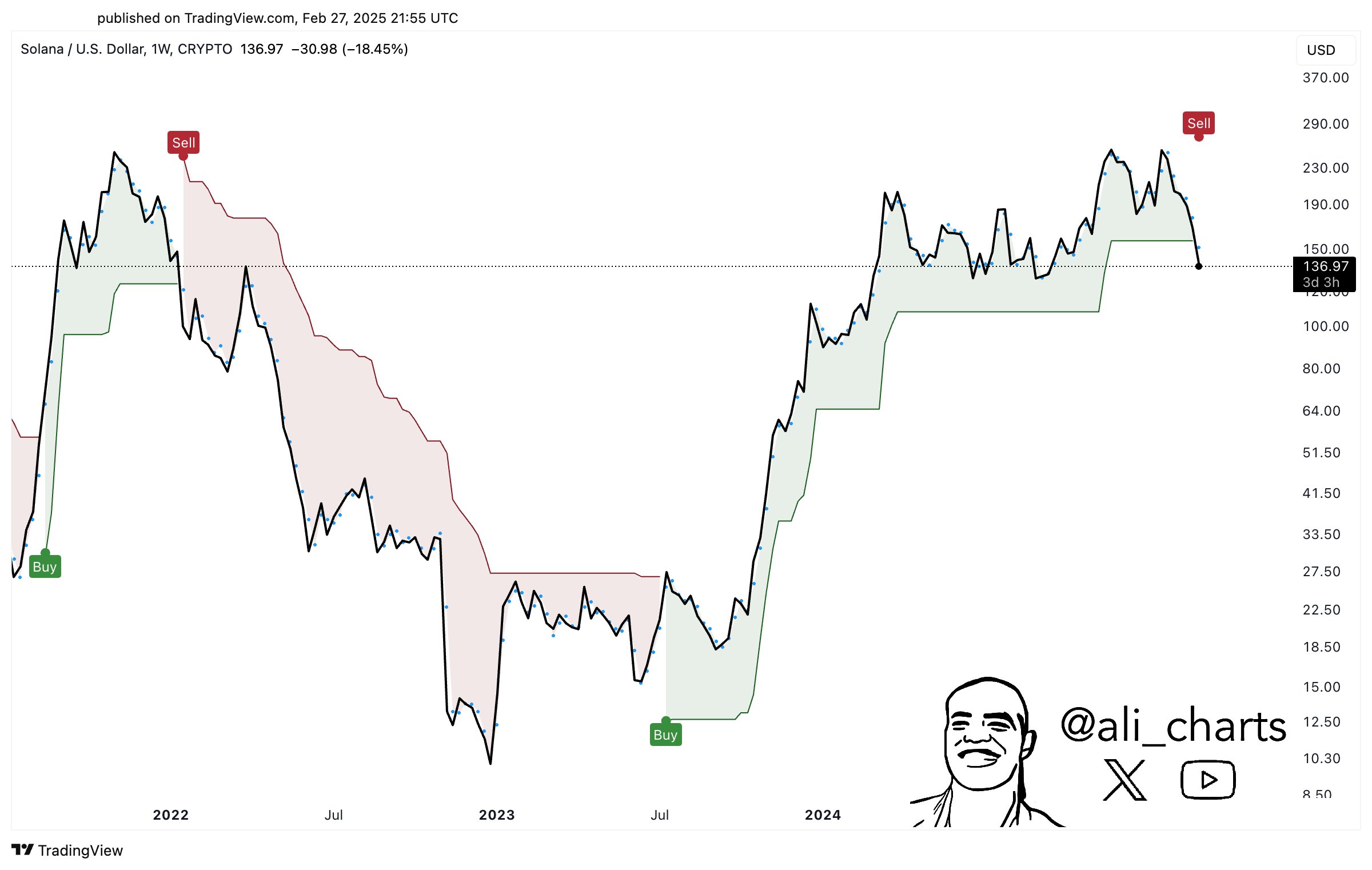

Crypto Expert Ali shared an X post suggesting that the Solana price is undergoing a macro trend shift. This signals a potential change in its long-term market direction. The overall market trend experiences a change when it moves between rising and falling patterns.

Traders use the Supertrend indicator to determine trend direction from price action and volatility but also to detect this shift. The analyst states that this bearish indicator change in the indicator suggests possible future market declines.

Supertrend indicator generates trend lines that rest either above or beneath price based on market speed opinion. The indicator generates a buy signal when the price stays above it and the price movement below the indicator activates a sell signal.

In Solana’s case, the indicator has switched to a sell mode, reinforcing the bearish sentiment. Additionally, the second chart shows Solana struggling below key resistance levels at $150 and $160, indicating continued weakness.

The continued downtrend will trigger two successive significant levels of support at $100 followed by $70. A Solana price prediction recovery above $150 acts as the essential point where bullish traders should watch because it suggests a reversal in trend.

Whale Alert Records $64.4 Million Solana Transfer

According to Whale Alert, a significant Solana transaction was detected, with 500,000 SOL valued at approximately $64.4 million being transferred. The movement originated from the Bybit exchange and was sent to an unidentified wallet. The transaction occurred on Feb 28, 2025, with a minimal fee of 0.00041 SOL.

Whale activity points to persistent accumulation patterns despite current market uncertainties. Significant transactions at this level confirm that the Solana community stays committed which demonstrates lasting faith in the project’s future success. Large movements of capital to private wallets serve as an indicator of strategic investment instead of liquidation.

SOL Price Faces Steep Decline Amid Market Crash

Solana price has experienced a a notable decline since reaching its ATH of $295 on Jan 19 2025, according to coinmarketcap data. Over the past seven days, the SOL price saw a notable crash of nearly 25%. The top altcoin is hovering below $130 support level, and if the downward trend persists, it may test the next support level at $100.

In the past 24-hours, the global crypto market cap has fallen to $2.62 T, reflecting an 8% drop. Bitcoin, leading crypto, along with other top coins like ETH, XRP, and DOGE, is also facing a decrease as market-wide declines continue.

Presently BTC trades below its $80k support level as this situation keeps the bearish trend active. The price decline occurs primarily because of worldwide economic instability and worries about future trade conflicts related to Trump.

To sum up, the Solana price faces significant downward pressure as macro trends shift. If the current trend continues, the SOL price could test the $70 support level, presenting further challenges for the coin.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

Frequently Asked Questions (FAQs)

1. Why is Solana Price Down?

2. How does the Supertrend indicator signal a bearish trend?

3. Could Solana's price fall to $70?

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Gold vs. Bitcoin: Can Gold Outperform BTC Amid US–Iran Conflict?

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs