Solana Price Set for Upside as SOL Hits Record 99% Tokenized Stock Share

Highlights

- Solana price surge expected with breakout above $150 resistance zone.

- Solana is enhanced by tokenized stock dominance in decentralized finance.

- The market sentiment is not very clear, risk is around at $130.

Solana price has seen a 10% increase over the past week, fueled by a positive market trend. As it approaches the $143-$145 resistance zone, technical signals indicate rising momentum, hinting at a potential breakout. Furthermore, the record 99% tokenized stock share highlights an increasing interest in Solana, reinforcing its long-term prospects.

The price action is improving despite its past difficulties in recovering. The future of Solana is promising as investor confidence increases.

Solana Surges Ahead in Tokenized Stock Trading Volume

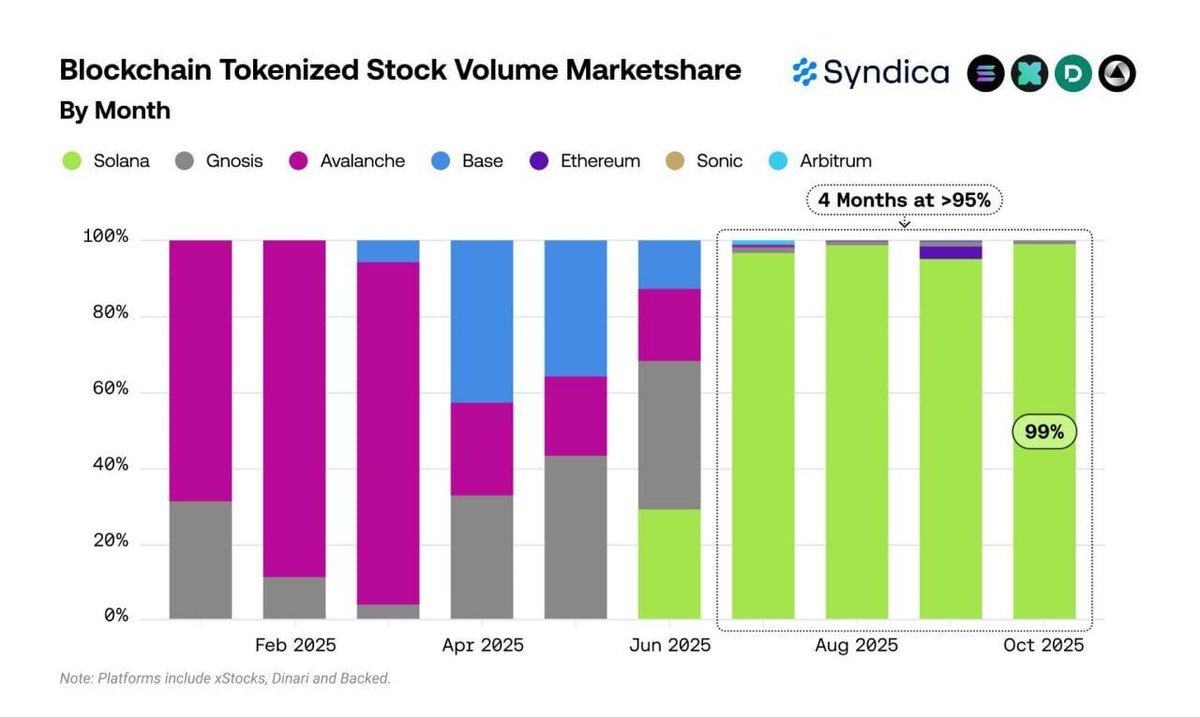

Over four months, from July to October 2025, Solana has dominated the tokenized stock market, with a trading volume of more than 95% each month. In October alone, the market share was phenomenal, with Solana taking 99% of the market share.

This change is an important change in the blockchain landscape because Solana is beating early-year leaders such as Avalanche. Its low charge and high throughput have solidly made it the blockchain of choice in tokenizing real-world assets (RWAs), which is gaining momentum on such platforms as xStocks and Dinari.

With tokenized assets projected to hit a mind-blowing 16 trillion by 2030. The current lead that Solana holds would put it in the vanguard of the convergence between traditional finance (TradFi) and decentralized finance (DeFi).

Will Solana Price Break the $150 Barrier?

The SOL price hovered at $141 as of November 28, 2025, as the market sentiment shifted.

On the 4-hour chart, technical analysis shows that SOL is experiencing resistance at the level of less than 150 since the price has been unable to move positively.

The crypto markets rebounded a bit, and most of the digital assets recovered. Bitcoin price stands at around $91,000, with Ethereum price hovering above $3,000, which gives a possible upward trend.

The other altcoins, such as ADA, Dogecoin, and the price of XRP, have shown a small price growth, which indicates a wider market recovery.

The MACD line falls below the signal line, which implies bearish movement. The MACD histogram also has red bars, which indicate that there is yet some selling pressure on the market. This may result to further price weakness in case the trend prevails.

Also, the Chaikin Money Flow (CMF) indicator, which shows the flow of money in and out of the asset, is at about 0.06. A breakout above $150 could lead to a price surge, while a drop below $130 could indicate further downside risk.

Frequently Asked Questions (FAQs)

1. Why is Solana's price trending upwards?

2. How dominant is Solana in tokenized stock trading?

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- Crypto Market Rises as U.S. and Iran Reach Key Agreement On Nuclear Talks

- Trump Tariffs: U.S. Raises Global Tariff Rate To 15% Following Supreme Court Ruling

- Bitwise CIO Names BTC, ETH, SOL, and LINK as ‘Mount Rushmore’ of Crypto Amid Market Weakness

- Prediction Market News: Kalshi Faces New Lawsuit Amid State Regulatory Crackdown

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise