Sui Price Prediction: Can Explosive DeFi TVL Surge To $341M Keep SUI Holders Blissful?

Despite the fireworks surrounding the approval of spot Bitcoin ETFs last week, the crypto market entered the new week with a hangover. Initial surges in Bitcoin and most altcoins quickly gave way to profit-taking, leaving many licking their wounds. However, amidst the bear clouds, a handful of altcoins like Sui (SUI), Binance Coin (BNB), Chainlink (LINK), and Aptos have remained surprisingly resilient, even flashing green.

For Sui, this bullish defiance could offer promising opportunities. Increased investor interest could see the path of least resistance shift upward, ushering in a new phase of price discovery.

Recommended: Crypto Price Prediction For January 14: ETH, XTZ, SUI

Sui Price Prediction As Bulls Gear Up For New ATH

After surging in double-digits despite the calm crypto market on Monday, Sui price trades at $1.39. The uptick in the price has been drastic in 2024, with the token rallying by 80% since January 1.

Sui currently sits above the most crucial bull market indicators starting with the 200-day Exponential Moving Average (EMA) (in purple), the 50-day EMA (in red), and the 20-day EMA (in blue).

The position of the Relative Strength Index (RSI) in the overbought region at 77 shows that buyers have the upper hand and are likely to push for a daily close above the immediate $1.4 resistance.

A buy signal from the Moving Average Convergence Divergence (MACD) indicator which was recently reconfirmed backs the ongoing rally. Therefore, demand for SUI tokens could continue as long as the blue MACD line holds above the red signal line and on condition that the momentum indicator is moving in an upward direction.

Should Sui price fail to hold S/R at $1.4, consolidation will likely follow. The most sturdy short-term support lies at $1.2 but if overwhelmed, investors may have to push their expectations for a near-term springboard to $1 and $0.8 if push comes to shove.

Based on the four-hour chart, Sui is not immune from the current market doldrums. With two bearish candles forming below $1.4, bulls must act first to arrest the situation before it worsens. Otherwise, the projected retracement to $1.2 is likely to gain traction.

While the MACD exhibited a strong bullish theory on the daily chart, it is leading toward the bearish camp on the four-hour chart. If sellers exploit this new weakness, SUI might settle for consolidation between $1,2 and $1.4 ahead of the next potentially massive breakout targeting highs above $2.

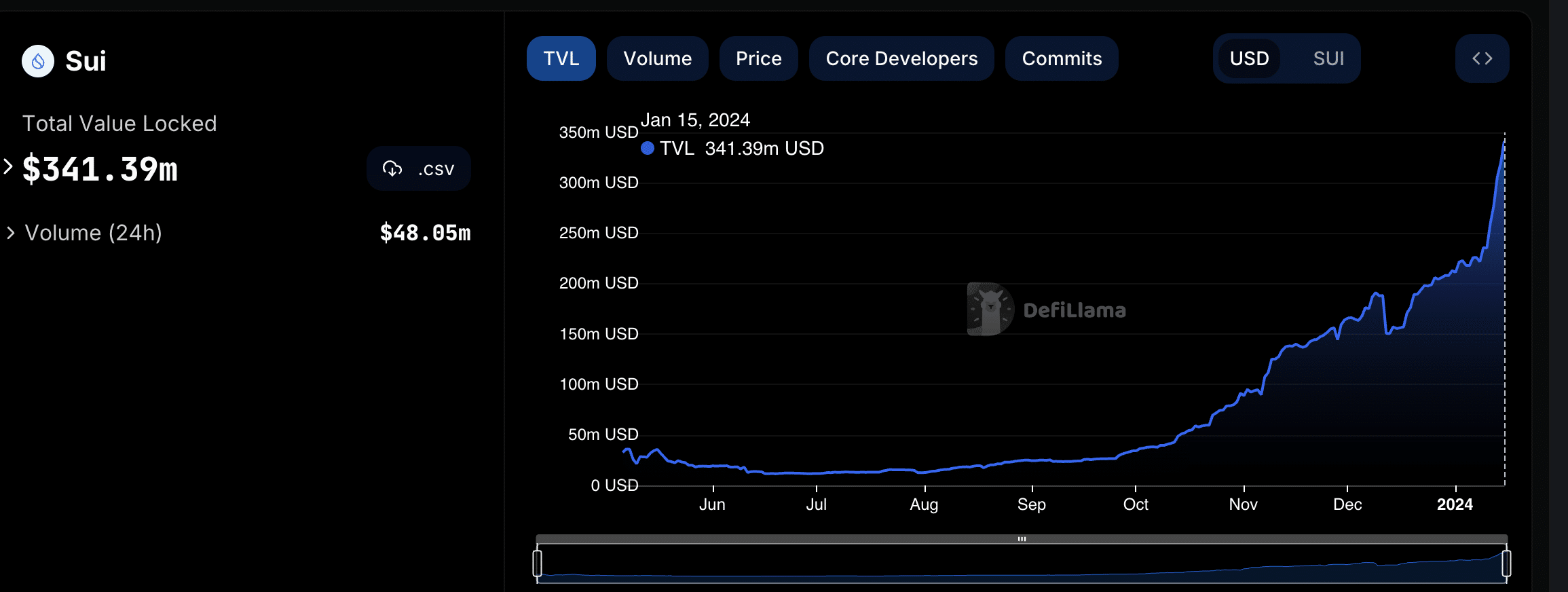

Sui’s DeFi TVL Rises To $341 Million

Sui’s decentralized finance (DeFi) outlook has changed significantly over the last six months, with the ecosystem’s total value locked (TVL) soaring to $341 million from approximately $12.7 million, according to blockchain data by Defi Llama.

The consistent increase in the TVL suggests holders of SUI are positively prosecuting the token to hit higher price levels in 2024. With Bitcoin ETF out of the way, investors are now focused on the potential bull run following the Bitcoin halving sometime in April. As supply shrinks on exchanges, Sui price could rally exponentially.

Related Articles

- Bitcoin ETFs Receive Cold Shoulder from Investor Kevin O’Leary

- Ethereum Price Prediction: Will Ascending Triangle Momentum Propel ETH to $3,400?

- Top Altcoins to Buy January 14: SOL, TON, AR

- XRP Sees Largest Realized Loss Since 2022, History Points to Bullish Price Run: Report

- US Strike on Iran Possible Within Hours: Crypto Market on High Alert

- MetaSpace Will Take Its Top Web3 Gamers to Free Dubai Trip

- XRP Seller Susquehanna Confirms Long-Term Commitment to Bitcoin ETF and GBTC

- Vitalik Buterin Offloads $3.67M in ETH Amid Ethereum Price Decline

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?

- Pi Network Price Prediction: How High Can Pi Coin Go?

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards