Tezos Price Analysis: XTZ Fell 23% This Week; What’s Next?

Tezos price analysis indicates a corrective pullback. XTZ price has been in the short-term uptrend till August 17. After forming a double top near $2.06, the pair retraced lower and fell 23%.

As of press time, XTZ/USD is trading at $1.06, up 1.74% for the day. The 24-hour trading volume of the coin fell more than 36% to $38,417,085 according to CoinMarketCap.

- Tezos price managed to trade higher with minute gains.

- However, the price fell more than 23% in the week.

- A daily candlestick below $1.60 will bring more losses.

Tezos price trades with caution

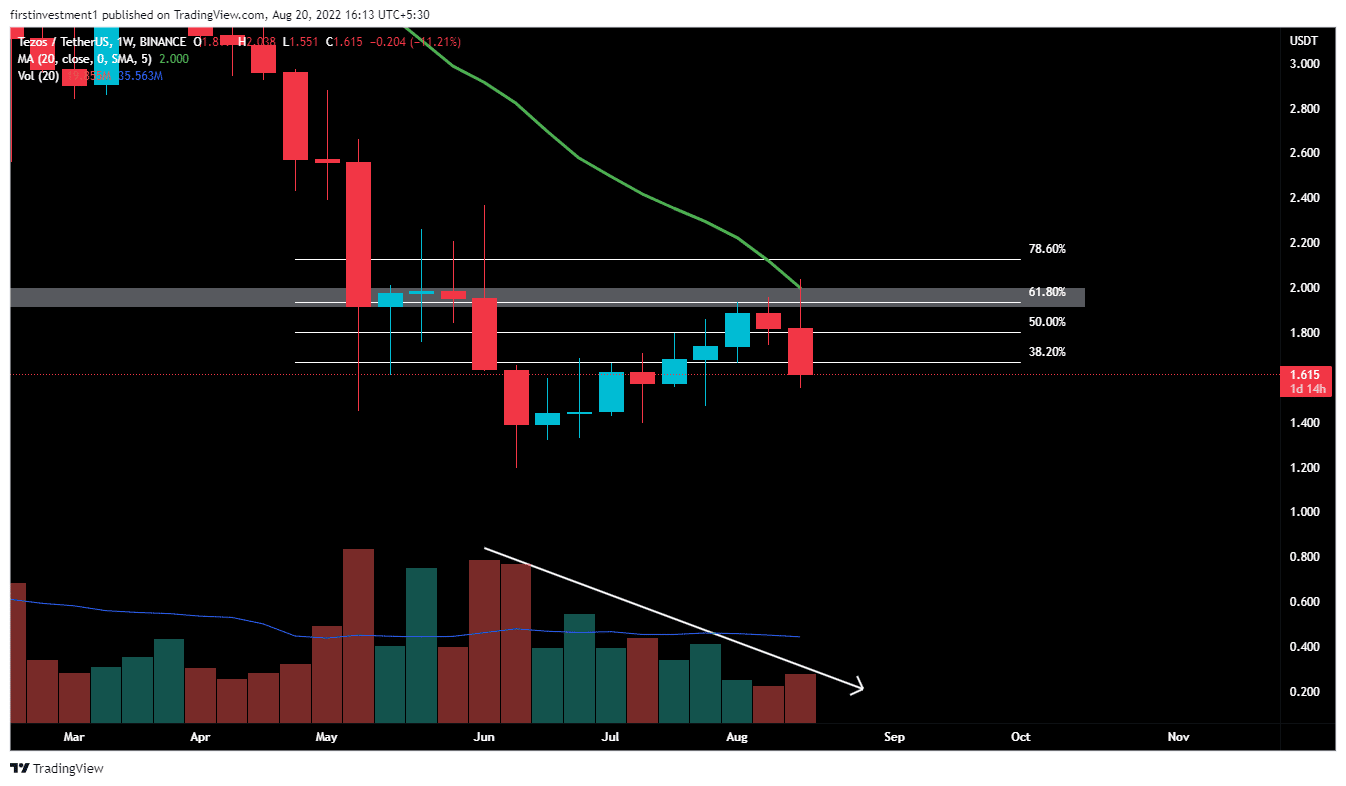

On the weekly chart, after testing the low of $2.10, the price had made a high of $9.2. The price recorded an upside of more than 350%.

However, on May 16, 2022, the price broke the support of nearly two years of $2.0 and gave a closing below this level on the weekly chart, & then started to fall toward $1.22.

This week, the price tested the $2.0 level once again, but couldn’t sustain the gains. The bull faces heavy selling pressure near the level, which was once acting as a support.

The price is taking resistance of the 20-day exponential moving average. Along with a 61.8% Fibonacci retracement, which will act as immediate resistance for this week.

Now, if the price on the weekly chart, closes below $1.50, then there is a high probability of the price going up to its recent swing low, which is between $1.2 to $1.4.

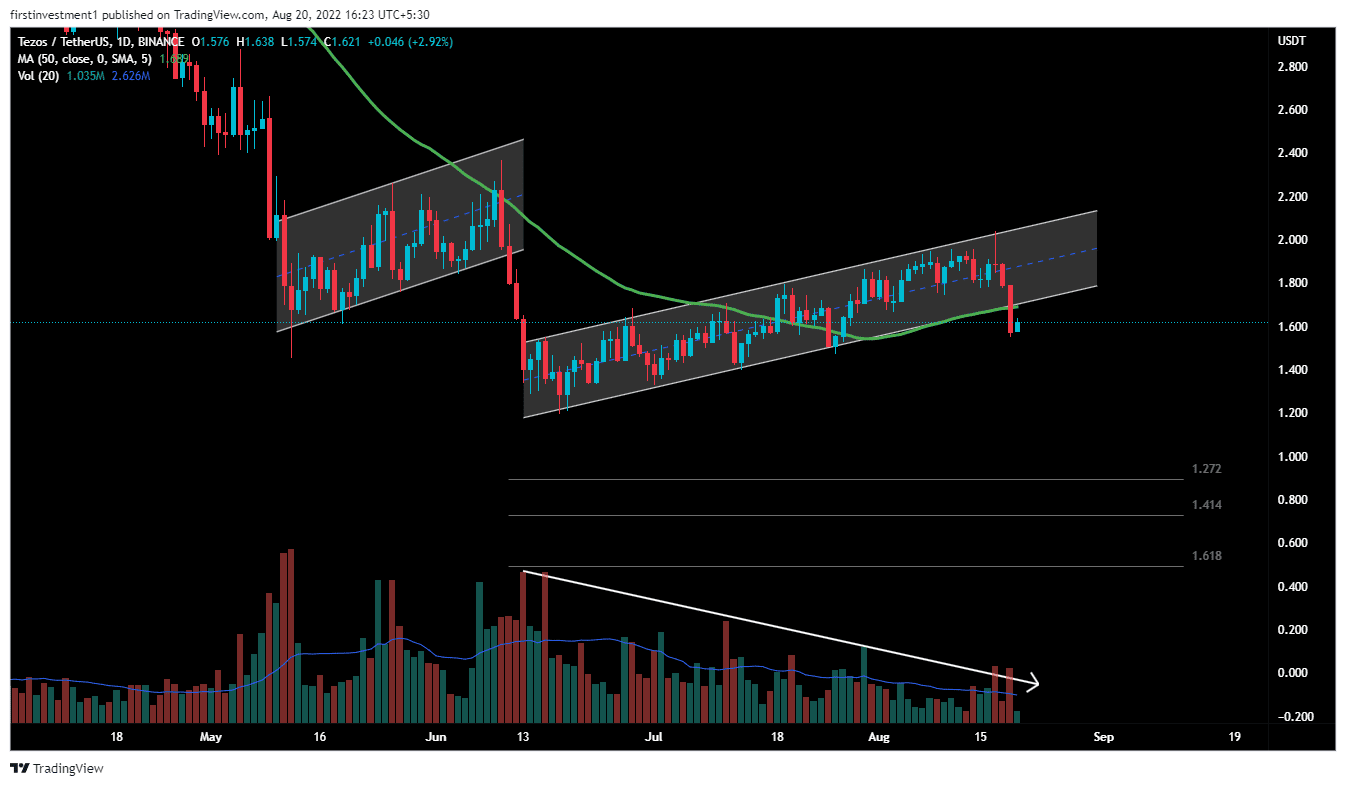

On the daily chart, the XTZ recently gave a breakdown of a bearish “Flag & pole” pattern, indicating weakness around the overall look, along with a clear break of the 50-day exponential moving average.

XTZ’s price broke the pattern’s support level and gave a bearish breakdown. The volumes were declining, with the rising price of an XTZ, which implies a worry for the bulls. When the market is rising while volume is declining, big money is not the one buying, more likely slowly exiting positions.

Also read: https://Crypto Market Plummets, Will The Hawkish Fed Create New Lows

According to this pattern, The expected fall in XTZ price could fall up to $1.33. To find targets for Flag Pattern, the Fibonacci Extension indicator is used, which gives us more than 70% accurate targets.

The nearest support is the swing low, which is $1.51, whereas the nearest resistance could be found at $1.70. There is a higher probability of the price breaking the support level. “Sell on rising” opportunity is the best course of plan we can go with.

On the other hand, a sustained buying pressure above the $1.72 level could invalidate the bearish outlook. And the price can move toward $1.90.

XTZ looks bearish on all time frames. Below $1.55 closing on the daily time frame, we can put a trade on the sell side.

- Prediction Market News: Kalshi Faces New Lawsuit Amid State Regulatory Crackdown

- Will Bitcoin Crash To $58k or Rally to $75k After Hot PCE Inflation Data?

- Ripple’s RLUSD Gets Institutional Boost as SEC Eases Stablecoin Rules for Broker-Dealers

- Crypto Market Weekly Recap: BTC Waver on Macro & Quantum Jitters, CLARITY Act Deadline Fuels Hope, Sui ETFs Go Live Feb 16-20

- Robert Kiyosaki Adds To Bitcoin Position Despite Market Decline

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral